CLR, HES, NBL, and WMB Slash Nearly $6.6 Billion in 2016 Plans

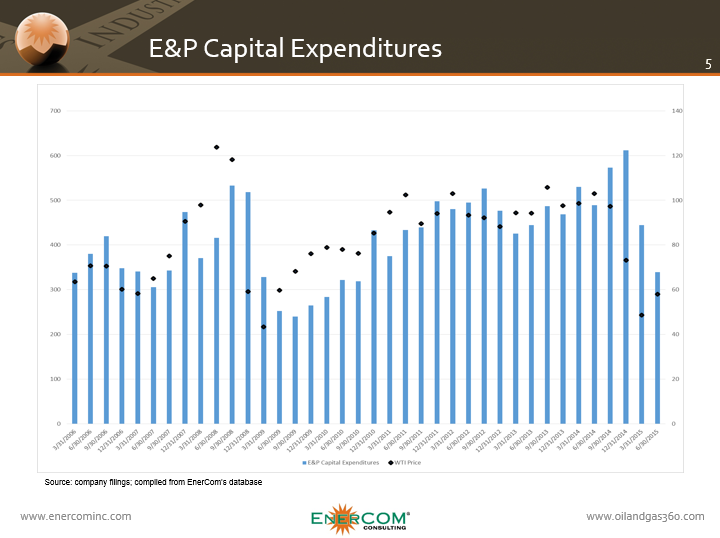

Lower year-over-year spending in 2016 was a foregone conclusion for many in the exploration and production space, but the amount of expenditure cuts is noteworthy, no matter how you slice it.

Plans for 2016 are trickling out ahead of Q4’15 earnings season, and some of the biggest names in the business continue to pull back on operational activity. Hess Corp. (ticker: HES, www.hess.com) announced its 2016 budget of $2.4 billion is 40% below its 2015 spending levels and 20% below its initial 2016 plans.

The announcement comes one day after Williams (ticker: WMB, www.williams.com), in association with Williams Partners (ticker: WPZ), dropped its year-over-year spending levels in 2016 to $2 billion – a 32% reduction amounting to about $1 billion.

The announcement comes one day after Williams (ticker: WMB, www.williams.com), in association with Williams Partners (ticker: WPZ), dropped its year-over-year spending levels in 2016 to $2 billion – a 32% reduction amounting to about $1 billion.

It’s worth noting that both Hess and Williams actually outlined the extent of their spending cuts in the first paragraph of the releases. The verbiage is against the grain of other players in the industry, as most in prior announcements did not provide great detail on the amount of spending reductions.

Continental Resources (ticker: CLR, www.clr.com) and Noble Energy (ticker: NBL, www.nobleenergyinc.com) also announced significant cuts after the market closed on January 26, 2016, unofficially marking the opening of the 2016 guidance announcement floodgates.

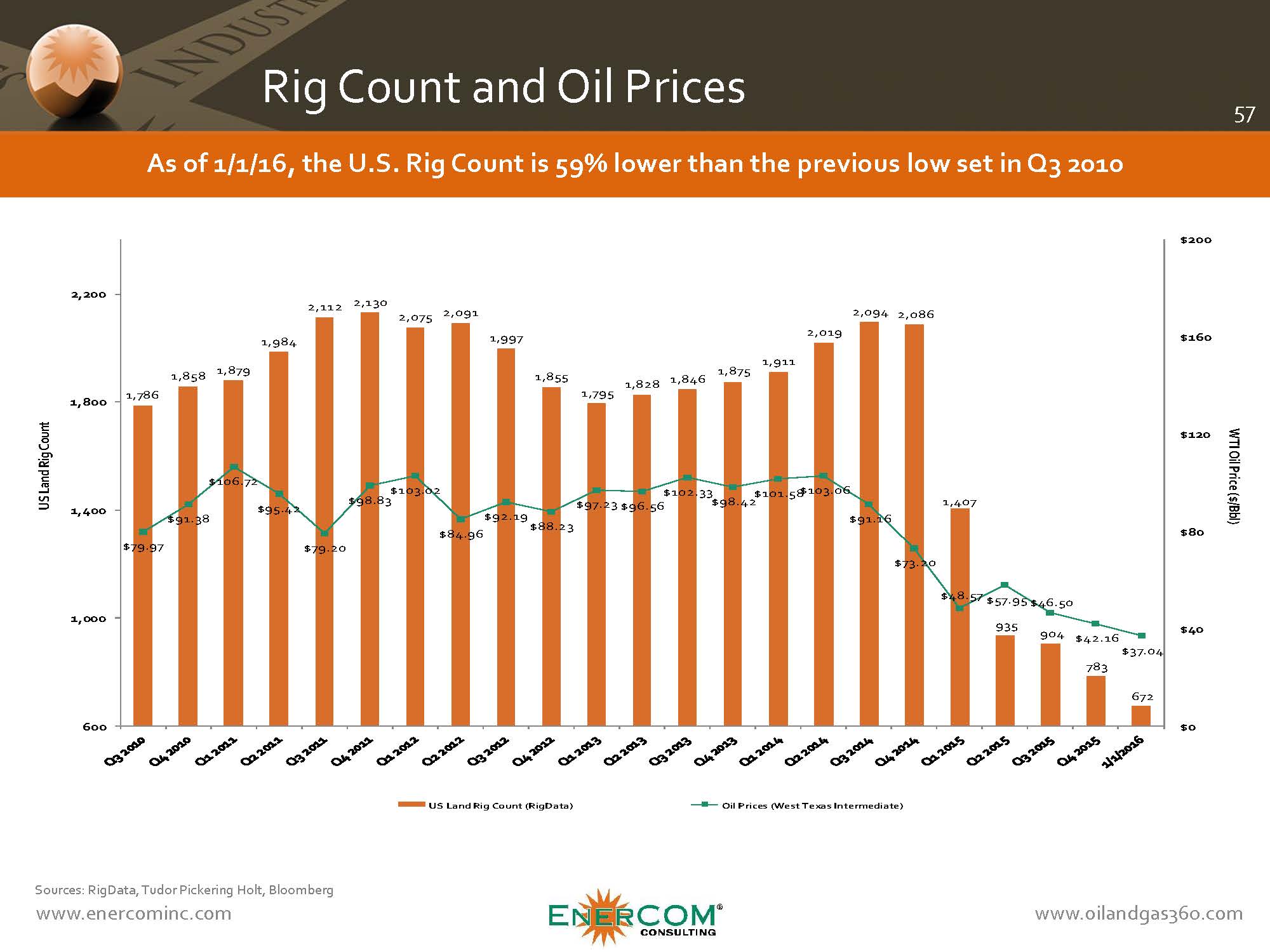

SLB: This is an Anticipated Outcome

In its Q4’15 conference call, management from Schlumberger said the headwinds from 2015 will persist throughout the new year. “The market also for oilfield services in the coming quarters will remain challenging as the pressure on activity and service pricing is set to continue,” said Paal Kibsgaard, Chairman and Chief Executive Officer of Schlumberger. “It also means that 2016 E&P levels will fall for a second successive year and that any significant recovery in our activity levels will be a 2017 event.”

SLB estimates its 2016 spending levels will likely be flat on a year-over-year basis, but Kibsgaard mentioned that E&P annual budgets were “exhausted well before the halfway point for the fourth quarter (of 2015).” A repeat of the previous year, with supply remaining consistent on limited activity, could create an even greater conundrum for the industry in 2017.

SLB estimates its 2016 spending levels will likely be flat on a year-over-year basis, but Kibsgaard mentioned that E&P annual budgets were “exhausted well before the halfway point for the fourth quarter (of 2015).” A repeat of the previous year, with supply remaining consistent on limited activity, could create an even greater conundrum for the industry in 2017.

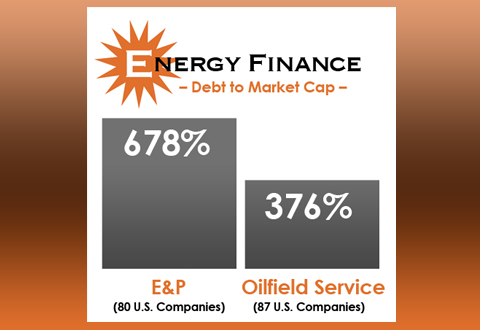

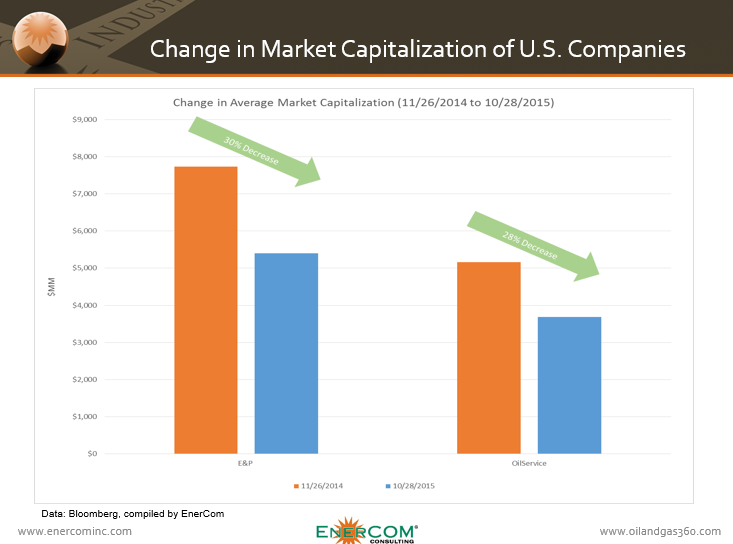

Average spending cuts in 2015, compared to the prior year, were about 35% among E&P and oilservice companies, according to information compiled by EnerCom, Inc.

Hess Spending Snapshot

Although the large-cap E&P trimmed an additional $600 million from its 2016 plans, the company maintained its yearly production average of 330 to 350 MBOEPD. Its Bakken volumes also remained unchanged at estimates of 95 to 105 MBOEPD, and activity levels are slated to run two rigs and bring online 80 new wells in the region for estimated costs of $425 million. In a note covering the news, Capital One Securities said the announcement would be an “interesting litmus test for the sector in terms of how HES reacts today… We believe the budget cut will be welcome, but the question will be “did HES cut enough?” given that it still implies a very wide outspend of cash flow.”

Shares of HES were virtually flat in response to the news – one day after the stock sank to its lowest point in more than 10 years. The NYSE Arca Oil Index, on the other hand, ended the day up roughly 3.7% as WTI and Brent spot prices increased more than 5%.

Based on the table below compiled from previous Hess guidance, the drastic drop in unconventional activity greatly outpaces cuts elsewhere. Part of the cut stems from the establishment of Hess Infrastructure Partners in July 2015, as Hess’ 2016 spending guidance excludes a $340 million budget for the Partnership that will be funded at the joint venture level.

Pro forma spending amounts considering the Partnership, the capital directed at unconventionals and production is roughly 78% lower than 2015, piggybacking on a 24% cut from 2014. By contrast, developments and exploration expenditures have remained relatively steady in the last three years.

Hess YOY Capital Spend by Region ($MM) |

|||

| 2014 | 2015 | 2016 | |

| Unconventionals | $2,850 | $2,100 | $470^ |

| *Bakken Shale | $2,200 | $1,800 | $425 |

| *Utica Shale | $550 | $290 | $45 |

| Production | $1,475 | $1,200 | $610 |

| Developments | $925 | $1,000 | $820 |

| Exploration | $550 | $400 | $500 |

| TOTAL | $5,800 | $4,700 | $2,400^ |

| *Included in unconventional section ^Excludes $360 million associated with infrastructure costs |

|||

Continental Adjustments

Continental Resources, the figurative poster child of the shale boom (backed by the outspoken Harold Hamm), made the largest cut, percentage-wise, of any of the companies this week. Similar to Hess, CLR, also operates extensively in the Bakken and has cut its rig count in half (to four). Its 2016 budget of $920 million is just one-third of its 2015 program, which guided for $2.7 billion in expenditures.

The majority of 2016 plans are directed at operating within cash flow, and the majority of its drilled Bakken wells will not be completed until a price rebound. “This high quality DUC inventory represents a significant asset for the Company as prices recover,” said Jack Stark, President and Chief Operating Officer of CLR, in the company’s prepared remarks.

The majority of 2016 plans are directed at operating within cash flow, and the majority of its drilled Bakken wells will not be completed until a price rebound. “This high quality DUC inventory represents a significant asset for the Company as prices recover,” said Jack Stark, President and Chief Operating Officer of CLR, in the company’s prepared remarks.

Continental is as exposed at anybody to the price of crude, as it holds no hedges.

Noble Energy, Too

Noble Energy aims at spending $1.5 billion in 2016, down from $3.0 billion in 2015. Expenditures were not the only thing to get halved: NBL’s quarterly dividend was cut to $0.10/unit from $0.18/unit. Kenneth M. Fisher, Noble’s Executive Vice President and CFO, said the decisions are “part of a comprehensive effort to spend within cash flow and manage the Company’s balance sheet.”

NBL management believes the dividend adjustment, along with a recent debt refinancing, adds an additional $200 million in liquidity to Noble’s balance sheet.

Midstream is No Exception: Williams Spending Snapshot

Williams and Williams Partners is in a bit of a flux, as the entity was purchased by Energy Transfer Equity (ticker: ETE, www.energytransfer.com) in September 2015 for $37.7 billion. Upon its consummation, ETE will be the third largest energy franchise in North America and one of the five largest energy companies in the world.

But WMB and WPZ, for the time being, is embarking on 2016 with $2 billion in growth capital. An estimated $1.3 billion is directed for expansions of Transco, a pipeline network that sprawls more than 10,000 miles across the northeast United States to the Gulf Coast. Previously, Williams laid out a three year growth expenditure plan, intending to spend roughly $3.5 billion in 2015, followed by midpoints of $2.9 billion in both 2016 and 2017. Adjustments to the 2017 plan have not yet been announced.

As far as near-term funding, Williams is taking a different approach than Hess: the midstream major plans to meet all 2016 equity needs by monetizing more than $1 billion means in assets, and does not intend to issue either equity or debt throughout 2016. Transco, on the other hand, raised more than $1 billion in senior notes last week to repay indebtedness and fund expenditures. Along with Transco, Williams intends on placing $4.8 billion of transmission projects into service by the end of 2017.

As far as near-term funding, Williams is taking a different approach than Hess: the midstream major plans to meet all 2016 equity needs by monetizing more than $1 billion means in assets, and does not intend to issue either equity or debt throughout 2016. Transco, on the other hand, raised more than $1 billion in senior notes last week to repay indebtedness and fund expenditures. Along with Transco, Williams intends on placing $4.8 billion of transmission projects into service by the end of 2017.

Survey: Expect more Reductions

In a survey of industry executives in December, Oil & Gas 360® asked E&P and Oilservice company decision makers along with the investing and financial community to anticipate levels of spending by E&Ps in 2016.

A clear majority by respondents in every industry category predicted that E&P CapEx would be reduced by 10% to 30% in 2016. 18% of all respondents said companies would establish the bare minimum (maintenance only, no new drilling or field development).

OilService executives were more bearish; 37% said that they believed E&Ps would establish bare minimum CapEx with no new drilling in 2016.

Keep an eye on Oil & Gas 360®’s Industry Calendar to stay on top of earnings season, and be sure to sign up for Closing Bell for daily updates on the latest developments in the energy industry.