Increased drilling efficiencies keep Concho Resources’ assets profitable

It wasn’t that long ago that oil reached above $50 per barrel. Then the recovery faltered as production reentered the market after the unplanned supply interruptions in Nigeria and Canada had started prices on the upswing. With the price settling in near $40 per barrel, producers are coming to grips with the new normal, but Concho Resources (ticker: CXO) looks to be well prepared for the $40 price environment.

When asked about how the company’s asset portfolio looked at today’s price-point, Concho Chairman and CEO Tim Leach said the company has several decades’ worth of inventory to drill at the pace it’s currently going.

Concho currently holds approximately 250,000 net acres in the Northern Delaware Basin, 125,000 net acres in the Southern Delaware Basin, 110,000 net acres in the Midland Basin, and 100,000 acres in the New Mexico Shelf.

Commenting on high-return assets, Leach said “I think you could actually raise the bar above 20% (IRR) and still have multi-decades type of inventory at this year’s pace.” Previously, Concho said it believed around 30% of its assets showed 20% IRRs or better at $40 oil, but Leach said during the conference call that “if it was 30% before, that number is higher [now], somewhere between 30% and 50%.”

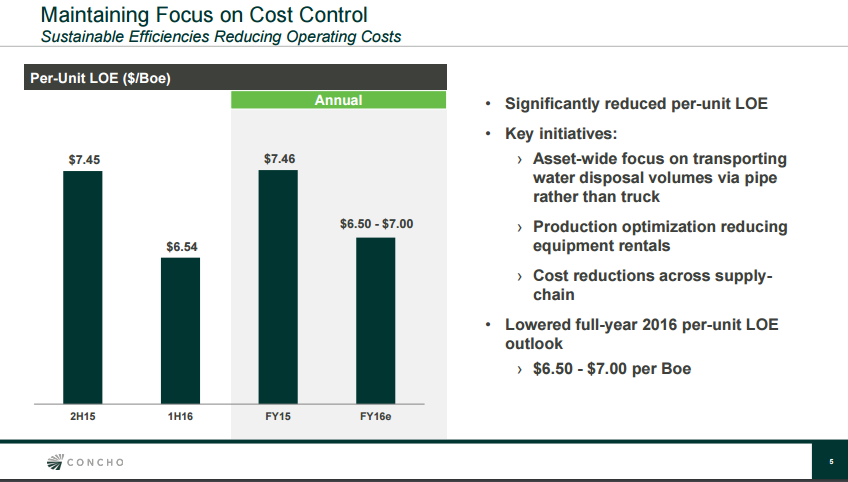

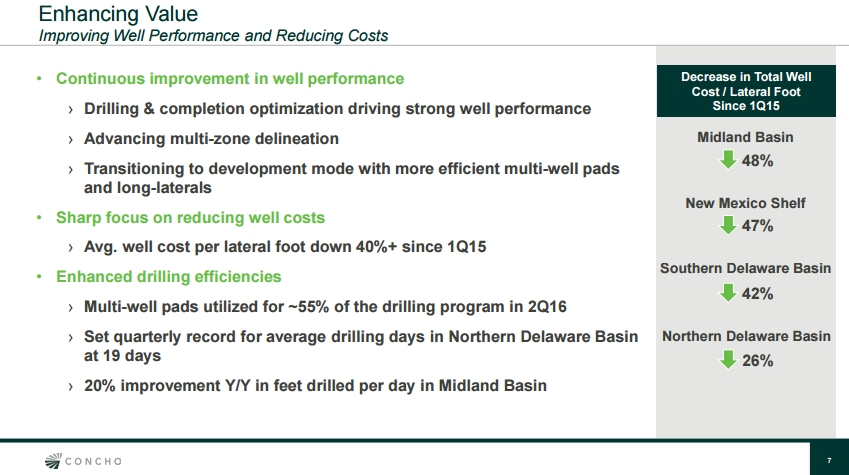

These improved numbers were thanks in large part to improved operating efficiency, Concho’s management said. In the company’s second quarter filing, the company reported production growth guidance for the full year at 0%-2%, up from 0% while simultaneously lowering operating costs. G&A was down $0.15 at its midpoint, while LOE was down $0.75 at its midpoint, both on a per BOE basis.

Most of those savings were coming from efficiencies, and not lower service costs, Leach added. “We still have continued to experience lower cost from the service industry. The rig count hit a bottom in the Permian Basin of I think 130 or 140 rigs, and now it’s up to 190. So, we’ve seen some increasing activity out here.

“But at the same time, the Permian Basin’s kind of where everybody wants to be. So, there’s been equipment and people moving in here from other basins. So, I think we’ve got plenty of spare capacity in all respects. And so, I don’t think we feel any cost pressure on the upside, and there may still be some room to move lower.”

Drilling where everyone wants to be

“The Southern Delaware Basin is very early as far as getting enough information on wells to delineate all the productive zones,” said Leach. “And so, I think there’s still a tremendous amount of work to be done there. And so, we like the Delaware Basin, and the top tier areas of the Delaware Basin continue to grow.

“And the Midland Basin … there’s lots of companies with lots of data, and it’s probably further along the industry’s understanding of what works and what doesn’t work and where the Wolfcamp works best, where the Spraberry works best. But, in general, I think for both the Midland Basin and the Delaware Basin, it’s still the early innings.”

During the company’s conference call Leach said Concho currently has 16 rigs operating across its assets. In the company’s investor presentation, the slides indicate that there are currently four rigs in the Northern Delaware Basin, four in the Southern Delaware Basin, six in the Midland Basin, and two drilling in the New Mexico Shelf.

“I think the enhancements we’ve seen in the Midland Basin, namely water delivery system—the ability to drill long laterals—have allowed that asset to compete with the Delaware,” said Concho CFO Jack Harper.

“Going forward, when I look at the allocation this year, it’s about 25% to the Midland Basin. That’s a pretty good proxy going forward. As Tim said, we’re looking for a balance between the Midland Basin, the Southern Delaware and the Northern Delaware.”

Analyst Commentary

Capital One

Very positive with strong quarterly results, declining costs, and production guide-up. EPS 26c vs 6c/3c Street/COS. 2Q CFPS $4.34 vs $2.62/$2.45 Street/COS. The beat vs COS was driven by higher production and lower OPEX (unit costs -10% q/q). Production increased 4% q/q and was 2%/3% above Street/COS and 2% above the upper end of mgmt’s 138 – 142 Mboe/d guidance range. Oil production was 1% below Street and 2% above COS. 2Q CAPEX was 13%/8% below Street/COS and YTD represents ~44% of the FY16 budget.

UBS

CXO raised its 2016 production guidance from flat YoY (or ~143 MBoed) to flat to +2% YoY (or 143-146 MBoed), with the mid-point roughly in line with consensus of ~144 MBoed but just above prior UBSe of ~143 MBoed. 2Q16 production was ~5.2 MBoed above the mid-point of CXO's guidance range accounting for nearly all of the upward revision to FY16 volume guidance. The company also provided 3Q16 production guidance of 144-148 MBoed, with the mid-point up slightly QoQ and in line with consensus but just above prior UBSe of ~144 MBoed. However, CXO's 1H16 actual volumes and 3Q16 and FY16 guidance implies production should steadily grow in 2H16, leaving volumes on an upward trajectory heading into 2017 (we forecast 4Q16 volumes to be up ~4% YoY). CXO expects a significant improvement in capital productivity this year as it plans to extend average lateral lengths to 7,000 feet in 2016 (from 5,200 feet in 2015) and increase the percentage of operated wells on pads to +50% in 2016 (from 15% in 2015). Meanwhile, CXO reiterated expectations for its oil mix this year to be 60-64%, but below last year's ~66%. We modestly raised our 2016 production forecast from 143 MBoed to 146 MBoed.

KLR

We are increasing our CXO target price $15 to $153 per share due to almost

15% lower operating expense and approximately 5% lower capital intensity. Our

’16 production growth forecast of ~2% is at the high end of company guidance

(0%-2% growth). Our ’17 production growth forecast of ~10% is in line with

guidance (at least 10% growth). This year, the company is increasing the average

lateral length of wells drilled ~35% to ~7,000’ and plans to drill approximately

55% of operated wells on multi-well pads.