Industry made it abundantly clear they are interested in Alaska’s oil and gas–onshore and offshore: Eni, ConocoPhillips, Armstrong, Anadarko

On Wednesday, the Bureau of Land Management (BLM) and the Alaska Division of Oil and Gas each held a lease sale in Anchorage, putting state and federal leases up for auction. Officials associated with the lease sale said they were surprised by the high number of bids they received. The revenue associated with both of the lease sales is sizeable, according to reports by the Arctic Energy Center.

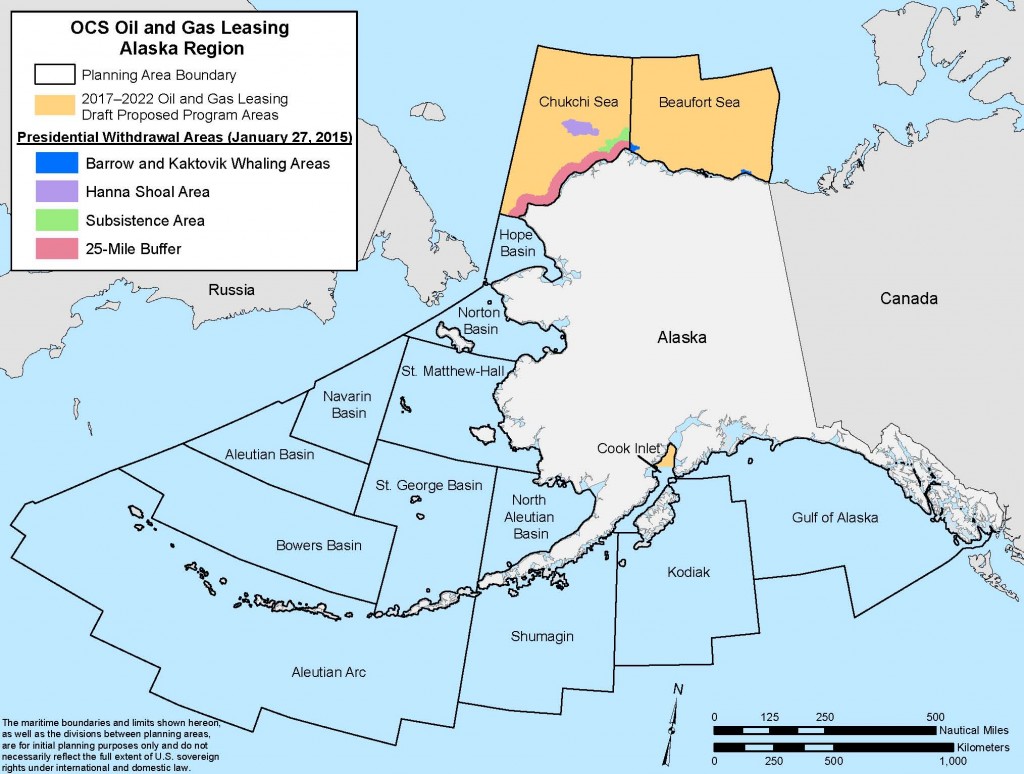

At the Alaska Division of Oil and Gas sale, over 633,000 acres of Beaufort Sea and North Slope tracts were sold for $17.8 million. BLM received $18.8 million from the NPR-A lease sale it conducted, and the state of Alaska will receive $9.4 million of that.

At the BLM sale, the agency received 92 bids for 67 lease tracts – the most it has received since 2010. The revenue windfall from the state sales is a welcome boost for Alaska, which has been hit hard by the low price environment. The division did not receive any bids for lease tracts in the North Slope Foothills.

Great news for the state: Walker

Governor Bill Walker said in a press release, “This is great news—for the state and the industry. As Alaska grapples with a $3.5 billion deficit, these $17.8 million oil and gas lease sales are the first stage to getting much-needed production in our state.”

Chantal Walsh, Oil and Gas Division Director commented on the investment attractiveness of the state. “Today’s lease sale results are very encouraging and demonstrate that the state of Alaska remains highly attractive to companies and investors interested in exploring and developing untapped hydrocarbon resources.

“Despite low oil prices, it’s clear that oil and gas companies see Alaska’s OCS region as a sound investment. Familiar names like Armstrong, Eni, and ConocoPhillips made a strong showing at the lease sale, but new players like Houston-based Burgundy Xploration also made moves to grab North Slope tracts,” according to sources at the sale.

“The industry has made it abundantly clear that they are interested in Alaska’s onshore and offshore energy opportunities,” the Arctic Energy Center said in a statement.

Five industry groups sought the federal leases, E&E News reported. The most successful bidder was ConocoPhillips Alaska Inc. in combination with Anadarko E&P Onshore LLC, which submitted 65 bids, winning all of them.

This year, Armstrong Energy spent the most for a single state bid, paying $111 per acre for one North Slope tract, E&E reported. The Denver-based independent is currently exploring for resources on lands located east of Alaska’s oil-rich Prudhoe Bay and Kuparuk River units.

The Alaska agency said six industry groups submitted bids in the North Slope sale, with Burgundy Xploration offering to buy the most lands. Other bidder groups included Accumulate Energy Alaska in partnership with Burgundy, Alliance Exploration, ConocoPhillips Alaska, and Caracol Petroleum together with TP North Slope Development. Three companies bid for Beaufort Sea offshore lands: Narwal, Eni Petroleum US and a group identified as Alaska LLC.

On the North Slope, the division received 402 bids on 384 tracts totaling 599,880 acres, making it the second largest sale by acreage since area wide oil and gas leasing began in 1998. Winning bids on the North Slope totaled $16,900,490, according to the governor’s office.

The division received $870,431 for eight bids on seven tracts totaling 33,460 acres in the Beaufort Sea.

“The number of competitive bids the state received shows Alaska is good for business and a stable place to invest,” said John Hendrix, the Governor’s Chief Oil and Gas Advisor.

The results are considered interim until the Alaska Division of Oil and Gas determines that the winning bidders are qualified and the bids valid. Following bid adjudication, the preliminary results will be posted at the DNR website.