Alaska hopes to make $400 million more per year after buying TransCanada’s share of the project

Last week Alaska Governor Bill Walker said that the decision to purchase TransCanada’s share of the project was the “number-one get-well card” for Alaska’s $3.5 billion budget deficit.

“Today is a historic day,” said Walker. “By gaining an equal seat at the negotiating table, we are taking control of our destiny and making significant progress in our effort to deliver Alaska gas to the global market.”

The State of Alaska announced that it will officially buy TransCanada’s (ticker: TRP) share of the Alaska LNG (AKLNG) project for approximately $64.6 million, according to a release from the office of Alaska Governor Bill Walker. The decision required the backing of the Alaskan legislator, which authorized an appropriation allowing the state to purchase TransCanada’s 25% share of the project.

In June 2014, Alaska’s Department of Natural Resources and TransCanada signed the Precedent Agreement, which authorized TransCanada to pay upfront capital costs and hold the state’s 25% share of ownership in AKLNG’s midstream components—the gas treatment plant and pipeline. The price tag on today’s announcement reflects TRP’s upfront capital costs, plus 7% interest.

Holdups are out of the way

The approval for the appropriation was held up for some time by the Alaska legislature, with concerns about who would run the state’s interest in Alaska LNG prompting some officials to put the brakes on the decision.

“I’ve been asking for months now, who is coordinating the efforts of all the state departments, and I haven’t got that answer yet…there is no one person in the administration now who you can go to get the majority of your questions answered,” said House Speaker Mike Chenault earlier this month.

Governor Walker said he was regularly in touch with the other partners of the project, and said that he would handle Alaska’s interest in the LNG project.

Governor Walker said he was regularly in touch with the other partners of the project, and said that he would handle Alaska’s interest in the LNG project.

Walker’s administration believes the state would benefit to the tune of $400 million more a year following the buyout of TransCanada’s interest in the project.

Alaska’s “gigaproject” cures what ails

Alaska LNG has been described as a “gigaproject” by those involved, with an estimate price tag of $45 to $65 billion. The project has stayed on track despite the plummet in prices since November of last year, largely because of its size. Alaska LNG is being developed by a partnership including energy majors BP (ticker: BP), ExxonMobil (ticker: XOM) and ConocoPhillips (ticker: COP).

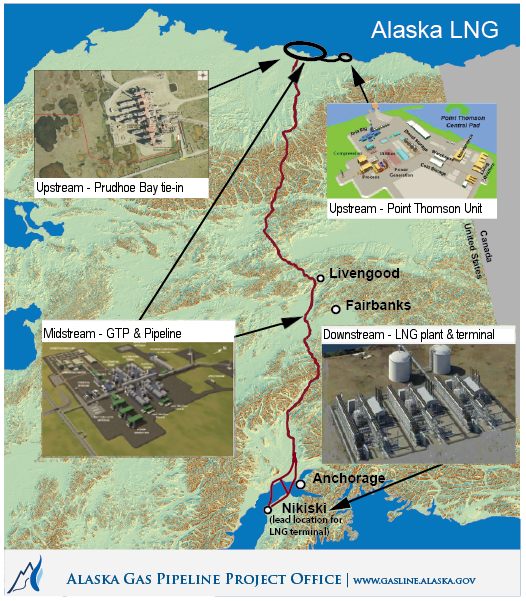

The project is still in the initial phases of determining whether or not to move ahead with construction, but if completed, the Alaska LNG project will include a three-train, 6 million tons per annum (approximately 246 Bcf per annum) LNG plant and a gas treatment plant with expected capacity of 3.7 Bcf/d, connected by an 800 mile, 42” pipeline with a minimum of five domestic gas off-takes along the pipeline route.

The Alaska LNG project partners are expected to meet December 4 to discuss a work plan and budget for the LNG project in 2016. Governor Walker also hopes to have assurances from the partners that they would not be able to block the project from advancing if they withdrew ahead of the meeting.

Offshore becoming less viable

Alaska’s push to keep the AKLNG project moving forward comes as several international oil majors leave the state’s waters. Many companies, including the three majors holding the remaining 75% of AKLNG’s interest, have deferred exploration in Alaska’s Arctic offshore, with others canceling operations altogether.

On November 17, Norway-based Statoil (ticker: STO) announced that it plans to shut its office in Anchorage and walk away from 16 operated and 50 non-operated leases in the Chukchi Sea. STO said the leases were “no longer considered competitive within Statoil’s global portfolio.”

Statoil’s decision came less than two months after Royal Dutch Shell (ticker: RDS.B) announced that it would end its offshore operations in Alaska following disappointing results from the company’s Burger J exploration well. In its press release, Shell said it made its decision to leave the Alaskan Arctic because of the disappointing well results, “the high costs associated with the project, and the challenging and unpredictable federal regulatory environment in offshore Alaska.”