Alberta’s royalty review panel has decided not to make changes until after the end of 2016

The Alberta provincial government released a statement last week announcing that it had formed a panel to conduct a review of the oil and gas industry’s royalties. The panel, which will be chaired by ATB Financial President and CEO Dave Mowat, will not make any changes to royalties until after the end of December 2016, according to a release from the Alberta government.

Along with Mowat, the royalty review board will consist of energy economist Peter Tertzakian, former Alberta deputy minister of finance Annette Trimbee, and Mayor of Beaverlodge Leona Hanson. The panel’s mandate is to identify ways to optimize returns to Albertans as owners of resources, industry investment, diversification opportunities, such as value-added processing, and the responsible development of Alberta’s resources.

Royalty review should help restore confidence

Recently elected Alberta Premier Rachel Notley ran in part on a campaign to review the royalty structure in Alberta to ensure that the people of the province were receiving a fair share of revenue. Along with changes in the corporate tax structure, one of the first moves made by Notley since being elected was to announce that the New Democratic Party (NDP) would announce how it would proceed on its royalty review by the end of the summer.

Notely said the government does not want to trigger a recession by implementing new policies or budget cuts, and that her party will listen if the panel finds that raising royalty rates would have adverse effects. With oil prices at multi-year lows, increased royalties could place a great deal of pressure on Canadian oil companies which are already struggling, but the review could be a chance to restore investor confidence in the industry, said the Canadian Association of Petroleum Producers (CAPP).

“Many Albertans are feeling the severe impact of low oil and natural gas prices that have resulted in one of the most dramatic economic downturns in a generation,” said CAPP President and CEO Tim McMillian. “That’s why the royalty review should focus on how to re-establish Alberta as a province that is competitive with other jurisdictions. The more competitive we are the more we can protect and grow jobs, investment and government revenues in Alberta.”

CAPP proposes that the government should:

- Pursue policies that make Alberta competitive to attract and retain capital investment;

- Support development of more ways to transport oil and natural gas to customers in existing and world markets, and to access world prices; and

- Encourage investment in the development of high-efficiency, innovative technology.

“While our industry did not ask for a review, now that we have one we believe it should be completed in a timely manner,” McMillian said. “A timely, open and transparent review of how to make Alberta more competitive could help to reduce market uncertainty and allow oil and natural gas companies to plan for the future.”

Now’s the time for a review – Mowat

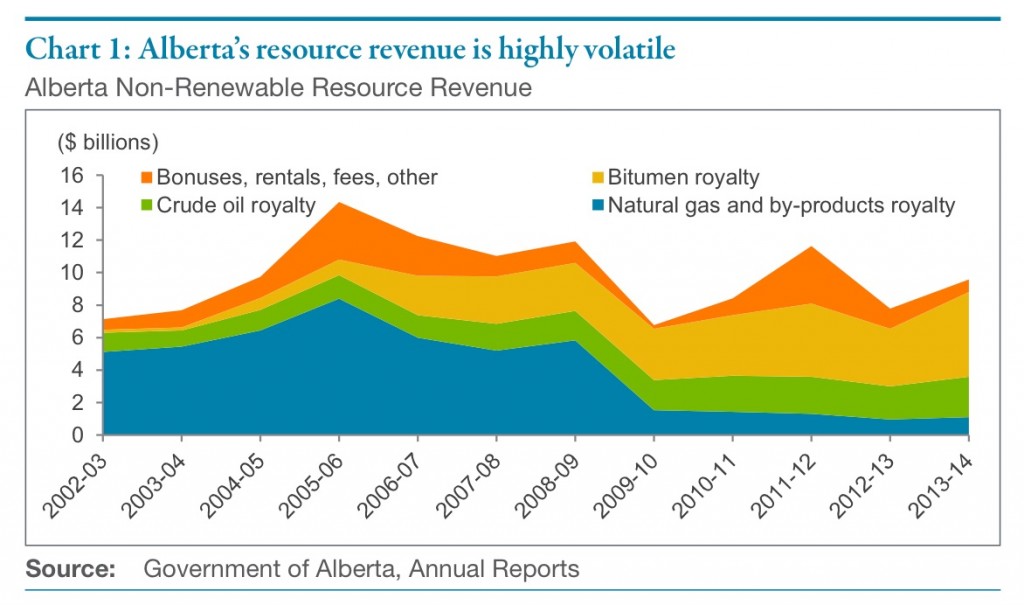

When asked about the current economic recession, the panel’s chair, Dave Mowat, said now is the right time to be conducting a review, given that companies know there will not be any changes before 2017. “One of the things we want, any insights we have about a framework for the future is, it has got to work as well at $30 a barrel as it does at $100 a barrel,” said Mowat.

Any new royalty system must protect the energy industry during down times, when oil prices are low, and make companies pay full value when prices are higher, said Alberta Energy Minister Marg McCuaig-Boyd.

Where does the royalty money go?

Any extra money raised from a change in royalties will be invested in the province’s Heritage Savings and Trust Fund, which now stands at about $18 billion, according to McCuaig-Boyd.

As detailed in its annual report, the Heritage Fund was created in 1976 and 30% of Alberta’s non‑renewable resource revenues were deposited into it initially. “As Alberta experienced tough economic times in the early 1980s, this percentage was reduced to 15 per cent in 1982 and deposits were halted in 1987. The Alberta government resumed depositing money into the Heritage Fund in 2005. The government allocated $3.9 billion from budget surpluses into the Fund from 2005 through 2008. Also, with the elimination of the Province’s accumulated debt in 2005, legislation required a portion of investment income be retained for the purpose of inflation‑proofing the Fund.”

The province’s Heritage Savings and Trust Fund generated a 12.5 per cent return and earned more than $1.6 billion in 2014-15. “Net income was higher than expected, due mainly to stronger-than-expected performance in the equity markets and a weakening Canadian dollar, which bolstered the return on the Fund’s international investments,” the fund’s annual report said.

The Heritage Fund’s legislation requires that it retain a portion of its income as protection against inflation. The remaining income is transferred to the Province’s General Revenue Fund. “In 2014-15, the Heritage Fund earned net income of $1,678 million in income, $210 million of which was retained in the fund for inflation proofing and $1,468 million was transferred to the General Revenue Fund,” according to the fund’s annual report.