American Eagle Energy Corporation (ticker: AMZG) is a Williston Basin focused E&P company engaged in the exploration and production of petroleum and natural gas in North America. The company operated under the name Eternal Energy Corp. until December 2011 when it changed its name to American Eagle Energy Corporation upon its acquisition of American Eagle Energy Inc.

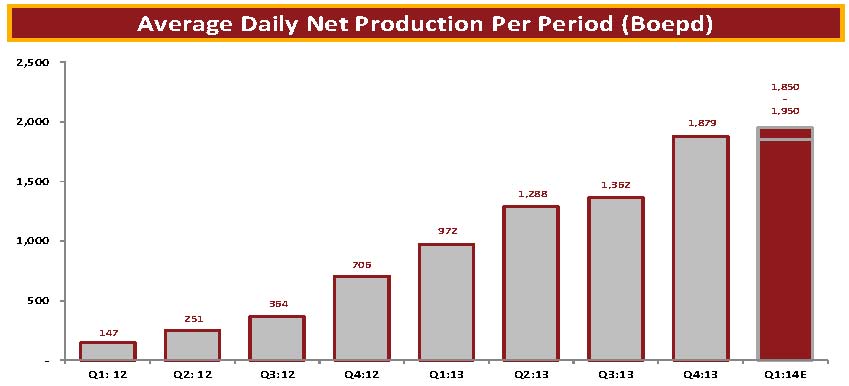

American Eagle announced average net Q4’13 production of roughly 1,879 BOEPD. Quarterly production increased 38% compared to Q3’13 numbers and exceeded the company’s guidance mark of 1,800 BOEPD, Seven gross operated wells (2.85 net) were drilled in Q4’13 through its two rig program.

The company recently presented at EnerCom’s The Oil & Services Conference™ 12 on February 19, 2014. Click here for a list of questions asked at AMZG’s breakout session.

[jwplayer mediaid=”210944″]

Q4’13 Operations Review

The company will target wells located entirely in the Bakken and Three Forks formations in 2014. Longer laterals targeting the Three Forks are expected to hold estimated ultimate recoveries (EURs) of 449 MBOE, good for a PV-10 value of $7.9 million at an estimated average well cost of $6.4 million. Four gross wells (0.32 net) in its Spyglass project area were brought online in Q4’13, with three targeting the Middle Bakken and one targeting the Three Forks formation. The Middle Bakken wells, two of which were field extensions, averaged lateral lengths of 5,900 feet and produced an average 30-day IP rate of 163 BOEPD. The single Three Forks well was drilled to 9,851’ and produced a 30-day IP rate of 399 BOEPD.

Year-end proved reserves reached 13.6 MMBOE (88% oil) for a pre-tax PV-10 value of $308 million, which is 135% higher than year-end 2012 totals.

Q1’14 Production Already Underway

Source: AMZG March 2014 Presentation

At the time of its earnings release on March 4, 2014, American Eagle Energy reported the drilling of four gross operated wells and the completion of six gross operated wells for the current quarter of Q1’14. The six operated wells returned average IP rates of 341 BOEPD. Four of the wells exploited the Three Forks and returned average IP rates of 372 BOEPD.

The company currently has eight gross operated wells awaiting completion, with five in the Bakken and three in the Three Forks. Six additional gross wells are already completed, leading AMZG to estimate a total of nine gross operated wells will be brought online in Q1’14 alone. The company believes net volume production for the quarter will average between 1,850 BOEPD and 1,950 BOEPD.

Increased knowledge of the acreage is leading to reduced well costs. Previous costs of $6.8 million to $6.2 million per well has dropped to $6.4 million to $5.7 million per well. AMZG believes it can lower well costs by another 10% to 15% during fiscal 2014, meaning well expenditures would drop to roughly $5.6 million to $4.8 million apiece.

Spyglass Details

Source: AMZG March 2014 Presentation

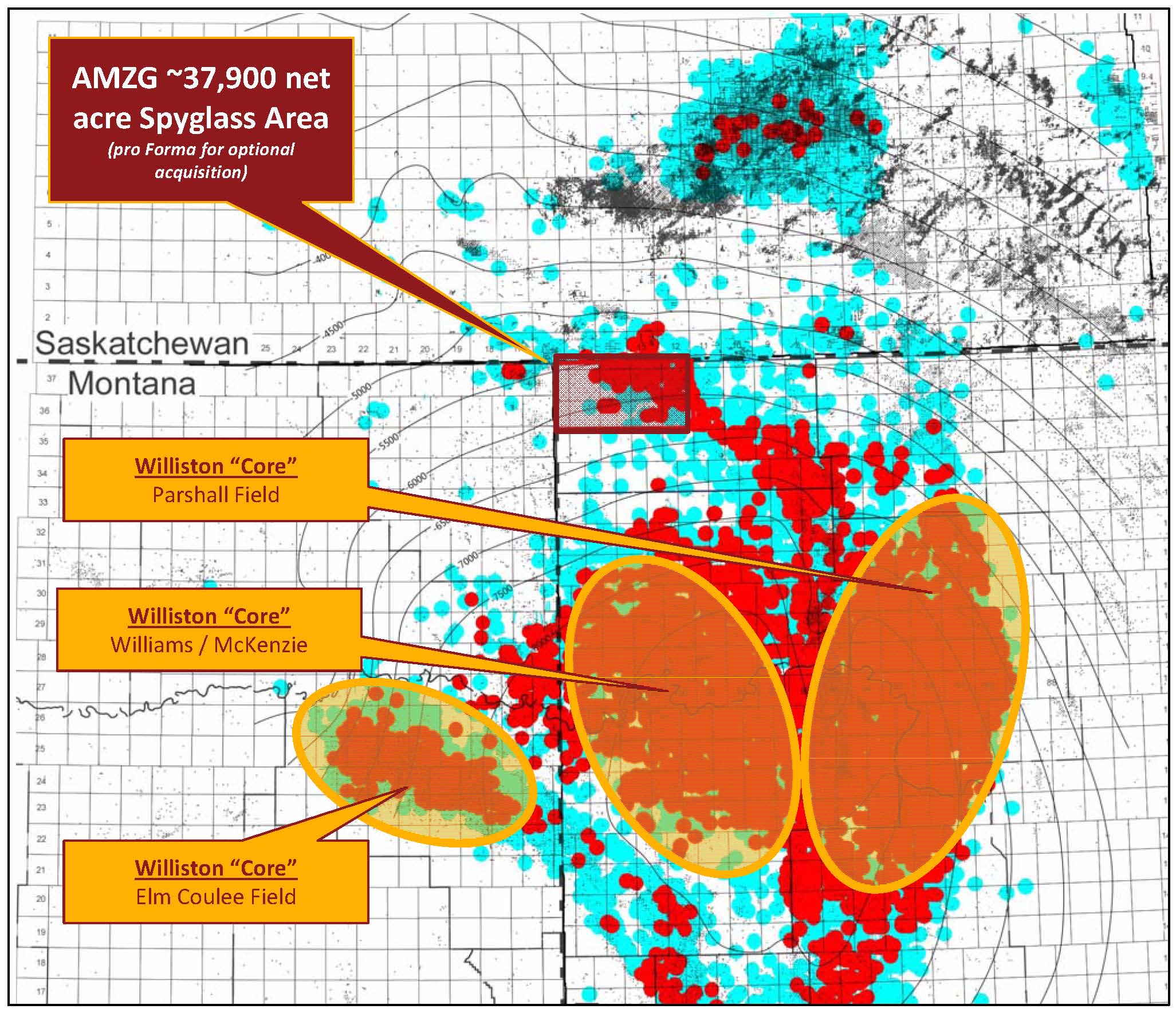

The company currently has 28 net producing operating wells to date, with 22 in the Spyglass project. The company has acquired 29,600 gross acres (44% working interest) in the Spyglass dating back to its purchase in 2013. AMZG is currently operating under a joint venture in which its partner fronts operating costs in exchange for 100% production rates until the partner has recouped 112% of its target. Once the target is achieved, AMZG receives 30% of the well bore interest. The JV project has allowed AMZG to expand its footprint and de-risk its acreage.

The company has been exercising acreage add-ons as part of the JV agreement. One final acreage option is in place to be accepted by March 31, 2014. If accepted, AMZG will add 8,250 net acres and roughly 450 BOEPD for a purchase price of $47 million. Total proved reserves of 2.3 MMBOE in the area would carry a PV-10 value of $55 million. Pro forma for the option, American Eagle would increase its Spyglass acreage to roughly 50,000 acres (approximately 37,900 net) with a 55% working interest.

With a primary focus on the Spyglass, AMZG will drill 21 gross wells (10 net) in 2014. The gross-to-net ratio, which will be nearly 50%, is a considerable increase over the working interest of 41% in Q4’13 and 31% in Q3’13. The drilling of 21 gross wells is three more than the initial guidance of18 gross wells, as described in AMZG’s Q3’13 release. Despite the increase in well count, operating expenditures are expected to remain consistent at $65 million for fiscal 2014.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. As of the report date, neither EnerCom nor any of its employees has a financial interest in any equity or debt of any company mentioned in this report.