Anadarko increases its sales volume guidance 8 MMBOE as the company streamlines assets

Anadarko Petroleum Company (ticker: APC) announced its third-quarter results today, placing an emphasis on investing in assets the company feels offer it the best returns: the Delaware Basin, the DJ Basin and the deepwater Gulf of Mexico (GOM).

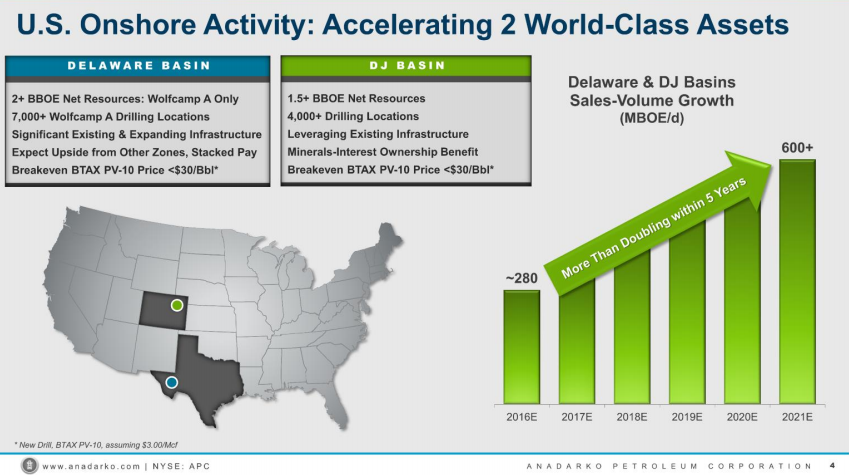

“The three Ds” as the assets were referred to during the company’s conference call, will allow Anadarko to deliver 10%-12% compound annual oil growth rate over the next five years, the company said in its press release Tuesday.

APC will step-up its efforts to divest assets outside of the three Ds, but it does still plan to hold on to some of its international assets if the potential payoff from them seems worthwhile.

“It’s very important that we continue to take opportunities where we think it’s a good risk to our rate of return opportunity to simply look for places where we may be able to have option value in the future,” said John Colglazier, Anadarko’s senior vice president of investor relations and communications. “Columbia could be just that. Mozambique could continue to be just that. It’s not requiring much capital; neither one are that capital-intensive at this point, but it gives us option value for the future.”

The Delaware, DJ and deepwater GOM will be the primary source of growth for the company in the near-term, however. Anadarko anticipates sales volumes to increase 8 MMBOE from the midpoint of its initial expectations, after adjusting for the increased divestiture program. APC plans to finish the year with more than $2.5 billion of cash on hand, which it will deploy in its three growth assets, management said during the conference call.

The company has been able to add two rigs to both the Delaware and DJ thanks to lower drilling costs, Anadarko reported. In the Delaware, APC plans to “rapidly evaluate new stack pay potential across [its] almost 600,000 gross acres,” and in the DJ, Anadarko plans to drill 90 more wells, complete 50 additional wells, and produce an additional 5 MMBOE above expectations, the company said.

Anadarko looks to double deepwater production with recently acquired Freeport-McMoRan assets

Following Anadarko’s $2 billion acquisition of Freeport-McMoRan’s (ticker: FCX) GOM assets in September, APC has high expectations for its deepwater assets, with management saying that the company plans to double production from its GOM assets.

“Lucius continues to outperform, achieving a daily record of over 100,000-plus barrels of oil per day. This along with new production from our development wells at K2 and Caesar/Tonga increased our year-over-year oil volumes in the Gulf of Mexico by 10,000 barrels per day to 65,000 barrels per day,” said Anadarko Chairman, President and CEO Al Walker.

“And as we announced last month, upon closing the acquisition of Freeport McMoRan’s of Gulf of Mexico assets, we expect to double production in the Gulf of Mexico to about 160,000 BOE per day, 85% of which is comprised of oil. We will plan to use a portion of the $4 billion of cash that we will have at quarter end to fund our acquisition and redeem the remaining $750 million of senior notes due September 2017. As noted, in last night’s news release, we also expect to receive an excess of $1 billion of proceeds from the pending divestiture of our Carthage assets in East Texas.”

KLR Group pegged the value of the divestiture around $1.5 billion in a note today, giving the deal a “reasonable” rate multiple of about 4.4x. The associated production with the assets is approximately 340 MMcfe/d (26% liquids).

In reporting its 3Q results, the company reported a net loss attributable to common stockholders of $830 million, or $1.61 per share (diluted). The net loss includes certain items typically excluded by the investment community in published estimates, which in the aggregate decreased net income by $371 million or $0.72 per share (diluted) on an after-tax basis, the company said in its press release. Net cash provided by operating activities in the third quarter of 2016 was $785 million.

Anadarko’s Q3 press release, conference call webcast and presentation are linked here.