MarkWest Energy: Sold. “For Pennies on the Dollar.” Unitholders Say “No” on Management Bonus Payments

MarkWest Energy Partners (ticker: MWE) distributed a news release announcing that unitholders approved the merger with MPLX (ticker: MPLX), an MLP created by Marathon Petroleum (ticker: MPC). From the MarkWest news release: “Based on the voting results, approximately 80 percent of the units voted at the special meeting were in favor of the merger agreement.”

That math is misleading…

To clarify: 195.2 million units were in the market to vote on the merger agreement. Reading the MWE Form 8-K, 122.6 million voted “Yes”. That calculates to only 57.6% of total units voted “Yes.” This is not an “overwhelming majority” as Marathon Petroleum’s Gary Heminger was quoted to say in the news release.

Of the 122.6 million “Yes” votes, Tortoise Capital voted “Yes” with its 12.6 million units and Kayne Anderson Capital voted “Yes” with its 11.4 million units. You will recall that these two funds signed confidentiality agreements with MPLX and then subsequently agreed to the new cash terms from Marathon and pledged their units for the merger. From page 20 of the November 17, 2015, proxy: “During the morning of November 16, 2015, each of Kayne Anderson and Tortoise executed confidentiality agreements with MPLX and subsequently engaged in discussions with Mr. Heminger regarding a potential further increase in the cash portion of the Common Merger Consideration. That afternoon, MPC offered to increase the cash portion of the Common Merger Consideration to a fixed amount of $6.20 per MWE Common Unit, and both Kayne Anderson and Tortoise agreed to enter into voting agreements to vote in favor of the Merger Proposal, subject to approvals by the MWE GP Board and the MPC Board.”

It Adds Up to a Bad Deal

As announced before the market opened on July 13, the original agreement was for an exchange of 1.09 MPLX units for each MWE unit, plus $3.37 of cash. The total calculated enterprise value of MWE with the announced deal was $20.0 billion.

After the December 1, 2015 announcement, using closing prices for each company, MPLX purchased MarkWest for $14.1 billion, 29% below the implied upside valuation with the July 13 announcement. The MWE management and board of directors failed to negotiate a hard price per unit with Marathon to benefit its unitholders. Because the 1.09 exchange ratio was not fixed (or at least had a trading collar), MWE management and directors approved a deal that penalized unitholders by $5.8 billion. Doh!

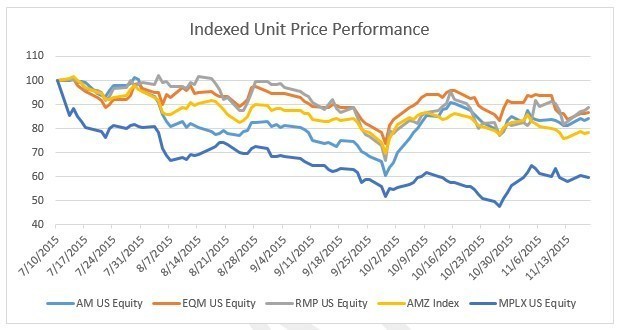

Let’s look at the transaction another way. At market close on Tuesday, December 1, 2015, the value per unit of MWE was $46.00. When the NYSE closed on July 10, 2015, one trading day before the July 13 merger announcement, MWE’s units closed at $59.75 per unit. This represents a 23% destruction of unit price value from announcement to proxy approval. Some analysts have said (read, Institutional Shareholder Services, or ISS) that the Alerian MLP Index was negatively impacted during the same period, and that it would stand to reason that MWE and MPLX’s units would follow the trend. John Fox, a co-founder of MarkWest, and the man who hired the current chairman, Frank Semple, released a statement on November 19 that pointed out the error in the ISS research, saying: “I believe ISS’s assumption is incorrect. Below is a chart that indexes the share price performance of three Marcellus-focused midstream companies – Antero Midstream Partners LP, EQT Midstream Partners, LP and Rice Midstream Partners – against the unit price performance of MPLX LP (NYSE: MPLX), and the Alerian MLP Index, over the July 10, 2015 to November 18, 2015 time period.

“The three Marcellus focused midstream companies fell an average of 13.4% over the time period compared to a 40.4% decline for the units of MPLX which is a result of the announced deal dragging down the units of MarkWest.

“The Marcellus and Utica regions, key operating areas for MarkWest, yield superior returns for operations compared to other basins in United States.”

Here’s some after-the-proxy-vote math: MWE has realized $1.2 billion in valuation loss since the deal was announced.

- MWE Open price on December 1, 2015: $47.99

- MWE price at close, before after hours trading, December 3, 2015: $41.53

- Difference: $6.46/unit

- Units Outstanding: 195,230,469

- It’s over, but the value destruction continues: $1.2 billion, or $636 million more than the $625 million transaction breakup fee.

John Fox – I’m Voting No on the MWE / MPLX Merger

John Fox, co-founder and former Chairman, President and CEO of MarkWest was a dissenting voter of the merger. He first made public his opinion on the deal in a letter to current MarkWest chairman Frank Semple on November 4, 2015, outlining three reasons why he was against the merger:

- “SIGNIFICANT REDUCTION IN DISTRIBUTIONS. Subsequent to the closing of the proposed merger, and made public by the referenced companies, the annual distributions to MarkWest unitholders will be cut by 46%. Further, the companies have publicly announced their estimated intent to return to pre-merger distribution amounts in three to five years post-merger, and the cash portion of the merger consideration is not adequate compensation to the MarkWest unitholders for this huge reduction in distributions, especially when viewed in connection with the huge drop in market price for both MarkWest and MPLX units.

- IDRs TAKE MONEY FROM UNITHOLDERS AND LIMIT FUTURE GROWTH. MarkWest unitholders are currently invested in an entity with no Incentive Distribution Right (IDR) obligations. Post-merger, cash available for distribution to unitholders is significantly reduced by obligations to make IDR payments to Marathon Petroleum, as owner of the MPLX GP and its IDRs. Gary Heminger, president of Marathon while presenting at the Barclays’ CEO Power Conference on Sept. 9, 2015, made it abundantly clear of his company’s intended use of MPLX: “We’ll use the MLP (MPLX) to grow the value inside MPC through the IDRs that come back into MPC.” During the period from 2016-2019, Marathon Petroleum, as owner of MPLX GP, is projected to realize an estimated benefit of nearly $2 billion in cash from IDRs that would otherwise accrue to the limited partners of MarkWest were it to remain a stand-alone entity! The post-merger surviving entity will, as a result of this IDR burden, allocate cash away from its organic growth platform and unitholders to enrich Marathon, the owner of the GP of MPLX. In fact, the large inventory of “drop down EBITDA” available from Marathon will, in large part, go directly back to Marathon in the form of IDRs, creating an enormous growth head wind at MPLX. I believe this will lead to additional valuation compression as Wall Street demands higher yield for slower growth.

- MARKWEST IS MUCH BETTER OFF AS A STANDALONE COMPANY. Beyond the obvious avoidance of a draconian distribution cut and the enormous IDR burden, a standalone MarkWest has a tremendous growth platform as expressed in management’s June 3, 2015 analyst day presentation. Not only is MarkWest the 2nd largest gas processor in the United States, MarkWest is the largest gas processor in the prolific Marcellus/Utica gas field, processing approximately 60% of the total rich-gas production from this field. This is the largest gas basin in the United States and one of the largest in the world, and is expected to have many years of growth ahead. Through acreage dedications and its pipeline backbone, MarkWest has a large proprietary footprint already built. My question is: Why would you give away for, pennies on the dollar, this marvelous company you have built and all its future growth potential?”

Six days later, on November 10, 2015, Marathon Petroleum upped the cash consideration of the merger agreement by $1.84 per unit.

Fox distributed a news release on November 12, 2015, dismissing the sweetener, saying: “In my view, the $1.84 per unit cash increase announced from Marathon Petroleum does not materially change the fundamentals of the deal,” Fox said. “The revised $52.93 per unit implied deal terms based on MPLX’s closing price on November 10 is still 33% below the initial implied deal terms outlined in July.”

One week later, Marathon made a “best and final” offer of $6.20 of cash per unit, and with the newer and higher cash sweetener announced it had secured a “Yes” vote from MWE’s two large unitholders – Kayne Anderson Capital Advisors, L.P. and Tortoise Capital Advisors, L.L.C.

While Marathon Petroleum twice increased the taxable cash portion of the merger agreement, cash is fungible. But it’s how you apply the cash that really matters.

- It can be used to compensate MarkWest unitholders for distribution payments they would have received had they remained a standalone company. According to Fox, as of November 4, 2015, unitholders of the combined entity will receive $4.51 per unit less in aggregate distributions from 2016-2019 (page 7 of John Fox presentation.) Quoting from MarkWest’s October 29, 2015 proxy statement: “MarkWest and MPLX indicate that the $3.37 per unit cash portion of the merger consideration is intended to compensate MarkWest unitholders for this reduced distribution.”

- Then what about the cash associated with the Incentive Distribution Rights that MWE unitholders will now have to watch being distributed to Marathon? Fox said Marathon Petroleum: “is projected to realize an estimated benefit of $2.0 billion in cash from IDRS that would otherwise accrue to the limited partners of MarkWest were it to remain a stand-alone entity!”

- But wait…if the $6.20 is making up for the reduced distributions, and in part for the IDRs, are MarkWest unitholders receiving anything for the $579.8 million of value destruction that occurred since the deal was approved with 57.6% of the vote?

In this “David and Goliath” story, Fox did not ultimately prevent the merger from closing but he did provide a strong voice for unitholders that ultimately forced Marathon to pay more than $566 million more than its initial offer in cash payments to unitholders. That small victory was overshadowed by the fundamental flaws with the deal structure. What fundamental flaws?

In a November 20, 2015, news release from Fox, Brian O’Neill, the other MarkWest co-founder, offered his reasoning behind voting against the deal, saying: “I want to add that the unit offering exchange of 1.09 MPLX units per MWE units is an unacceptable offer price. Without a collar on the equity component, I believe the deal was structured poorly from the beginning.

“MWE has spent more than $10 billion in capital expenditures over the previous five years, which means MPLX and its owner, Marathon Petroleum, are merely refunding MWE’s unitholders and leaving a small premium for their efforts. Furthermore, I am against the $50 million plus consideration to current officers of MWE. Given the absolute value decline of MPLX units since the deal announcement in July, my recommendation is for this transaction to be voted down.”

The December 1 closing price for MWE unitholders was $46.00. This means that with each Marathon announcement subsequent to the original July 13 terms, the deal worsened. Fox said on November 20, 2015: “The vision Brian and I had for MarkWest when co-founding this company did not involve building one of the most admirable natural gas processing franchises in the industry just to sell-out at the bottom of the market! MarkWest is the #2 gas processor in the United States and the largest processor in the liquids-rich Marcellus and Utica Shales. We’re handing it over to Marathon Petroleum for pennies on the dollar.”

Unitholders Say “No” on Management Bonus Payments

There was a second proposed proxy item for MWE unitholders to cast a “Yes” or “No” vote. MarkWest management and its board of directors asked its unitholders to “to approve, on an advisory, non-binding basis, the Merger-related compensation payments that may become payable to MWE’s named executive officers in connection with the Merger.” Six highly compensated executive officers were identified in Form DEFA14A dated November 17, 2015, to receive a combined $54.9 million in cash and equity. Approximately 126.0 million “No” votes were cast for this proxy item, or 64.5% of the 195.2 million units.

This was a non-binding “advisory” vote for the proxy. We expect institutional and retail investors of MarkWest, Marathon and MPLX will be reading the read the fine print of each company’s income statements and cash flow statements to see if the $54.9 million is paid to the management team that sold a well-run, well-capitalized and well-positioned company at the bottom of the market.

In the end, MWE management didn’t get a bonus payment, its board of directors approved a transaction that unitholders realized real valuation destruction of $5.8 billion, and one of the great energy stories of the 21st century, a company that was built from scratch to become the second largest processor of natural gas in America was sold, as John Fox said, “for pennies on the dollar.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.