When and where will the dust settle?

Brent crude traded at $86.50 Tuesday morning, at the same time WTI was trading at $84.25. By midday they were both down, to $86.00 and $82.66, respectively. By afternoon, Brent was off $3.25 at $85.64, and WTI closed down $3.08 at $82.66. Where will oil prices end up and where will they leave the U.S. shale producers?

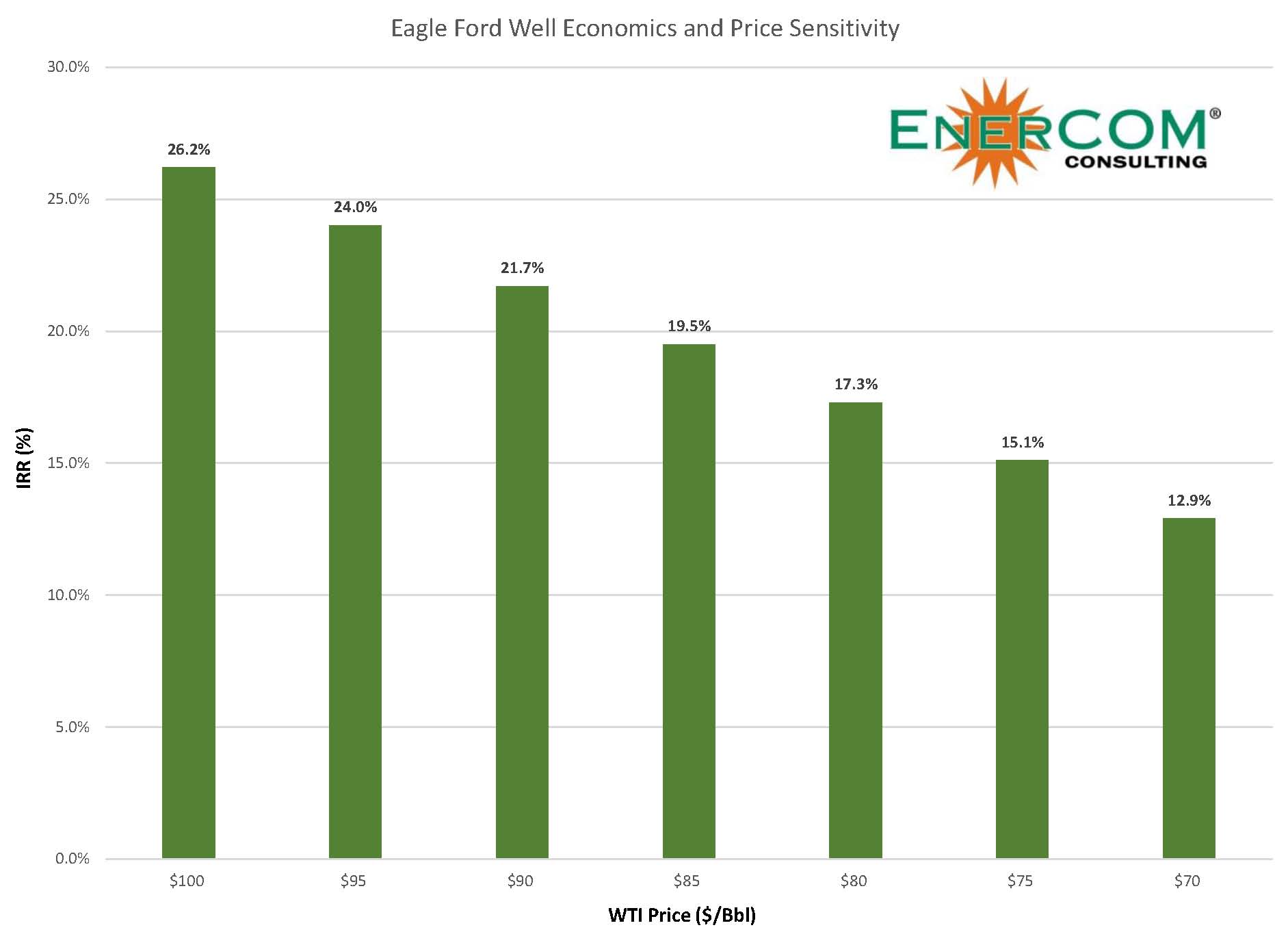

Many energy research teams have weighed in during the past few days. Baird said in a note that “all in, economics of core oil plays (Eagle Ford, Bakken and Permian) are still robust with WTI at $85/barrel.”

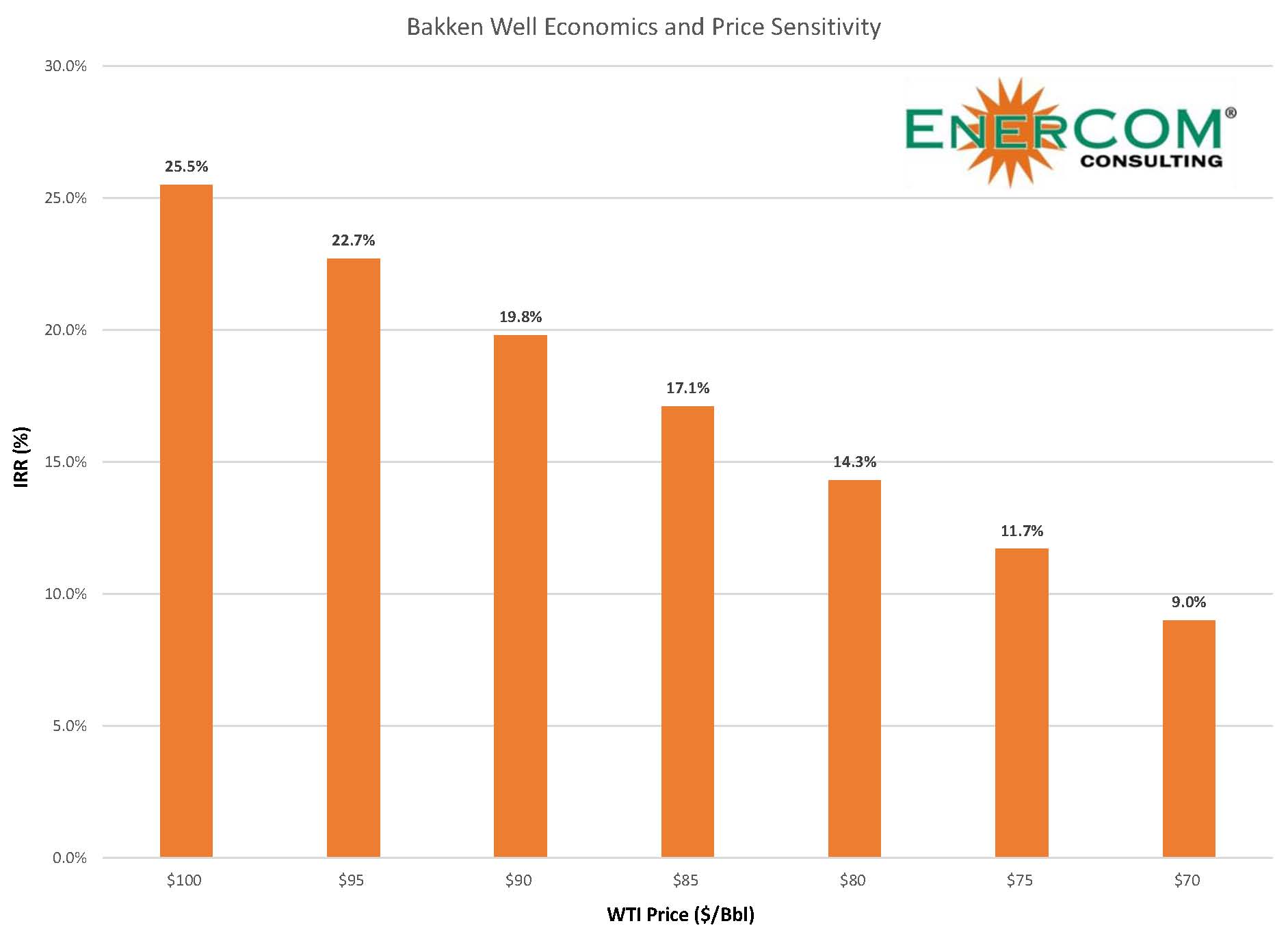

EnerCom’s energy analysts looked at two key U.S. oil basins—the Eagle Ford and the Bakken. The accompanying charts illustrate how deteriorating oil prices affect well economics according to the EnerCom model.

EnerCom’s energy analysts looked at two key U.S. oil basins—the Eagle Ford and the Bakken. The accompanying charts illustrate how deteriorating oil prices affect well economics according to the EnerCom model.

Yesterday, energy analysts at Raymond James released a note entitled “Energy Stat: What Is Driving Oil Lower and When Will the Pain End?”

“After topping out at over $106/barrel in mid-June, U.S. oil prices (WTI) have been on a downward spiral, falling over 20% in just the last 100 days. We have detailed many times over the past couple of years our belief that oil prices are facing severe fundamental headwinds given that core global oil supply growth is twice as fast as core oil demand. Until recently, this bearish stance has been dead wrong (from an oil price perspective) as significant unanticipated Middle East supply interruptions have allowed oil prices to hold stubbornly above $100. Now that U.S. oil prices are well below $100, is our bearish view finally being vindicated by the market? The short answer is — yes and no. Yes, there is increased chatter about the fact that U.S. oil supply is growing too fast and global demand growth remains anemic. However, we think that much of the recent downturn was a psychological sell-off triggered more by a rising U.S. dollar than the markets realization that oil fundamentals flat out suck.”

“In recent days several members of the Organization of the Petroleum Exporting Countries — Saudi Arabia, Kuwait, Iraq, Iran and the United Arab Emirates — have cut prices to European and Asian buyers as competition for global market share has grown fierce,” the New York Times reported. “Demand for petroleum products is declining worldwide, particularly in Europe, just as the global market is flooded with oil. Many energy experts say the world market, which consumes about 90 million barrels a day, has one million barrels more than it needs, although that could easily change if the Islamic State, also known as ISIS, attacked Baghdad and threatened the southern Iraqi oil fields, or if militias suddenly renewed their blockades of oil ports in Libya. Imports from OPEC countries have been cut in half since 2008, forcing countries like Saudi Arabia and Nigeria to compete with one another in Asia, cutting their prices starting last week,” the Times said.

“In recent days several members of the Organization of the Petroleum Exporting Countries — Saudi Arabia, Kuwait, Iraq, Iran and the United Arab Emirates — have cut prices to European and Asian buyers as competition for global market share has grown fierce,” the New York Times reported. “Demand for petroleum products is declining worldwide, particularly in Europe, just as the global market is flooded with oil. Many energy experts say the world market, which consumes about 90 million barrels a day, has one million barrels more than it needs, although that could easily change if the Islamic State, also known as ISIS, attacked Baghdad and threatened the southern Iraqi oil fields, or if militias suddenly renewed their blockades of oil ports in Libya. Imports from OPEC countries have been cut in half since 2008, forcing countries like Saudi Arabia and Nigeria to compete with one another in Asia, cutting their prices starting last week,” the Times said.

With Q3 conference calls on the near horizon, oil companies will face a wave of questions about their drilling and development plans in light of free-falling commodities prices. Kinder Morgan (ticker: KMP), Baker Hughes (ticker: BHI) and Schlumberger (ticker: SLB) are scheduled to report this week. Oil & Gas 360®’s calendar of earnings calls may be accessed here.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.