Utica Accounts for 25 of Antero’s 31 Drilled Wells in Q3’15; Up to 50 Deferred Completions Figure in 2016 Guidance

Management of Antero Resources (ticker: AR) believes the company can achieve year-over-year growth of 25% to 30% in 2016, based on preliminary targets released in an operations update on October 13, 2015. The significant jump is planned on top of the company’s production record in Q3’15, averaging 1,506 MMcfe/d – above its full year guidance of 1,400 MMcfe/d, which estimated 40% growth compared to 2014.

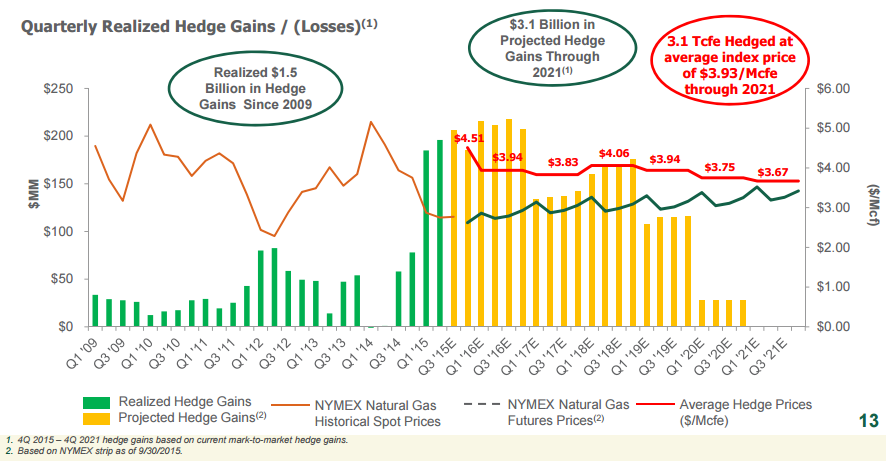

In the company release, Paul Rady, Chairman and Chief Executive Officer of Antero Resources, said, “We feel confident in our preliminary 2016 growth targets given our large inventory of drilled but uncompleted wells, as well as our industry-leading hedge book which locks in virtually all targeted 2016 production at an average all-in hedged price of $3.94 per MMBtu.”

Antero Operations Update

The company is currently running nine rigs in the Appalachian basin, with four in the Utica and five in the Marcellus. The Utica, however, received the bulk of operations in Q3’15, hosting 25 of the 31 drilled and completed wells. The disparity is expected to level off in Q4’15, with the Marcellus and Utica receiving 11 and 12 new completed wells, respectively.

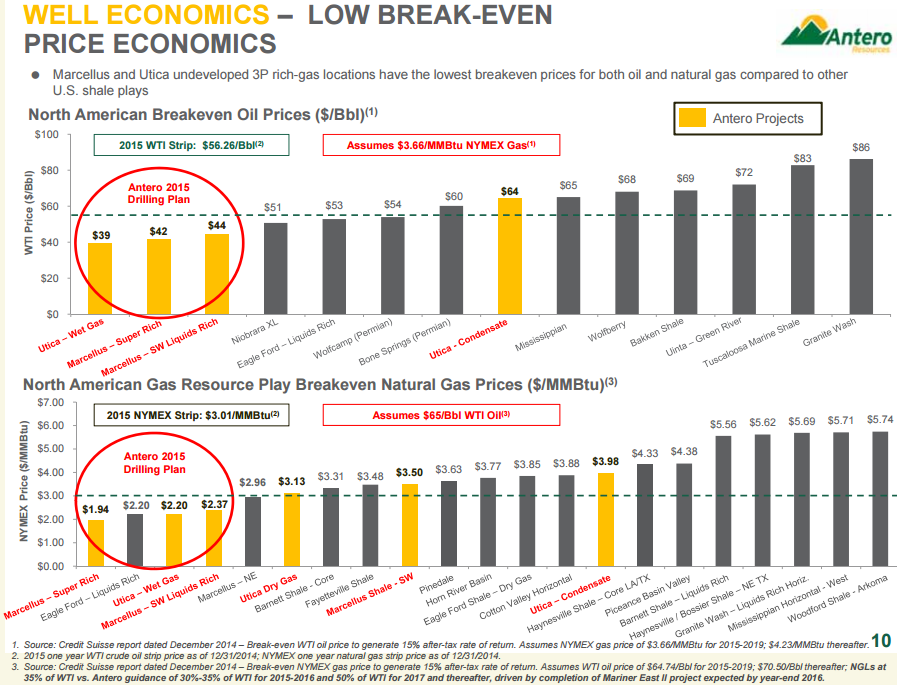

The company expects as many as 2,400 “high grade” horizontal locations remain in its inventory, along with 5,331 undrilled proved probable and possible locations, offering considerable room to run. EnerCom’s E&P Weekly Benchmarking Report estimates 70% of Antero’s acreage is proved undeveloped, which is meaningfully higher than the median of 45% from 87 peer companies tracked.

About 50 wells are expected to be deferred into 2016, adding to the expected ramp-up in guidance.

Hedge Benefits

Antero was able to lock in virtually all of its 2016 production at $3.94 MMBtu (100% of target midpoint) with an expected 85% of volumes headed to favorable markets. This compares to 2015, with 94% of production hedged at $4.43/MMBtu (94% of guidance) with 71% of volumes expected to reach favorable markets.

The company reports gains of $1.5 billion since 2009, including gains in the last 26 of 27 quarters. An additional $3.1 billion in hedging gains are expected by year-end 2021. Well costs have also declined by 16% to 18% from operational efficiencies and well cost savings, and a pipeline project is on schedule for Q4’15 completion. The company also secured a 10-year agreement to provide 70 MMcf/d to the Freeport LNG project in Texas, which is expected online by the end of 2018.

The added benefits will further contribute to three-year finding and development costs that are the lowest of all companies in EnerCom’s Benchmarking Report, weighing in at just $0.66/Mcfe. The industry median, including oil companies, is $3.26/Mcfe. Antero’s asset intensity, defined as the percentage of every EBITDA dollar required to maintain flat production rates, is second only to CONSOL Energy (ticker: CNX) at 29%.

Balance Sheet Update

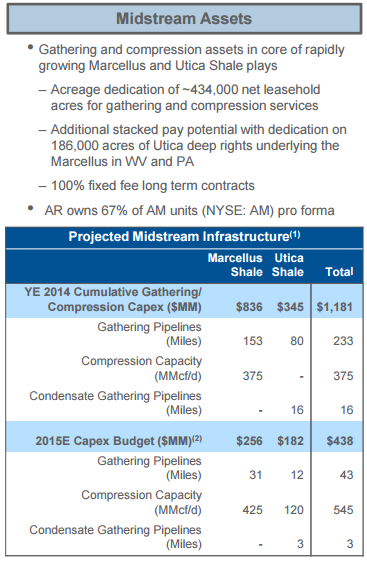

Antero padded its liquidity with the recent drop down of its water business to Antero Midstream in September for total consideration of $1.05 billion, consisting of $794 million in cash (less any assumed debt) and nearly 11 million issued common units. Pro forma, Antero will own 66.5% of Antero Midstream. The parent company will also receive two potential earn-out payments at year-end 2019 and 2020 if certain targets are met.

Antero Midstream gains a 20-year contract with exclusive rights to provide fresh water and disposal services at all of AR’s operations in Ohio and West Virginia. Fixed fees range from $3.64 to $3.69 per barrel. A wastewater treatment facility is also expected to be in service by Q4’17, in which AR will pay a fixed fee of $4.00 per barrel for a similar 20-year contract.

Upon closing of the mentioned drop down, AR holds $3.0 billion in liquidity with $3.9 billion in debt. The company has not yet redetermined its borrowing base, which is currently set at $4.0 billion. In the Antero’s Q2’15 conference call, management said it does not anticipate a borrowing base reduction based on its ability to replace reserves and its favorable hedges.

Upon closing of the mentioned drop down, AR holds $3.0 billion in liquidity with $3.9 billion in debt. The company has not yet redetermined its borrowing base, which is currently set at $4.0 billion. In the Antero’s Q2’15 conference call, management said it does not anticipate a borrowing base reduction based on its ability to replace reserves and its favorable hedges.

Antero Midstream Increases Distributions

Antero Midstream (ticker: AM), meanwhile, increased its quarterly distribution for the third straight time since its Initial Public Offering in November 2014. Its new payout of $0.205 per unit is 8% higher sequentially.

The dividend payout likely stems from higher than expected EBITDA and cash flow guidance, with both being boosted by approximately $10 million in an Antero Midstream update on October 13, 2015. AM management believes the organization will benefit from the parent company’s volumes increase, forecasting a distribution growth target of 28% to 30% through 2017.

The two companies are scheduled to release their respective Q3’15 earnings on October 28, 2015, with conference calls occurring the following day.