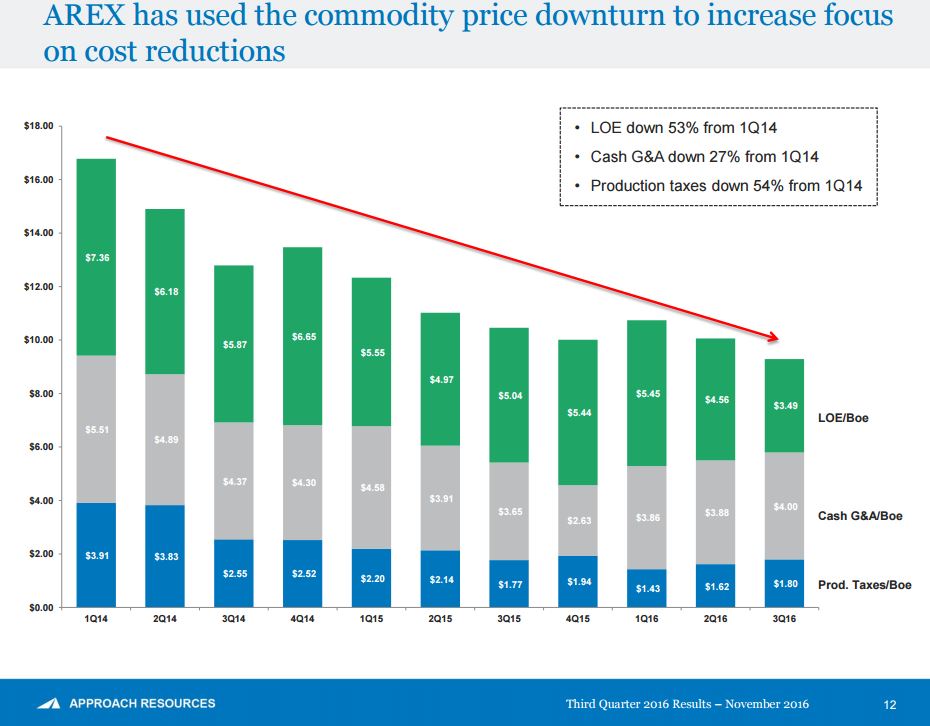

Approach Q3: Sets record low quarterly LOE at $3.49 per Boe

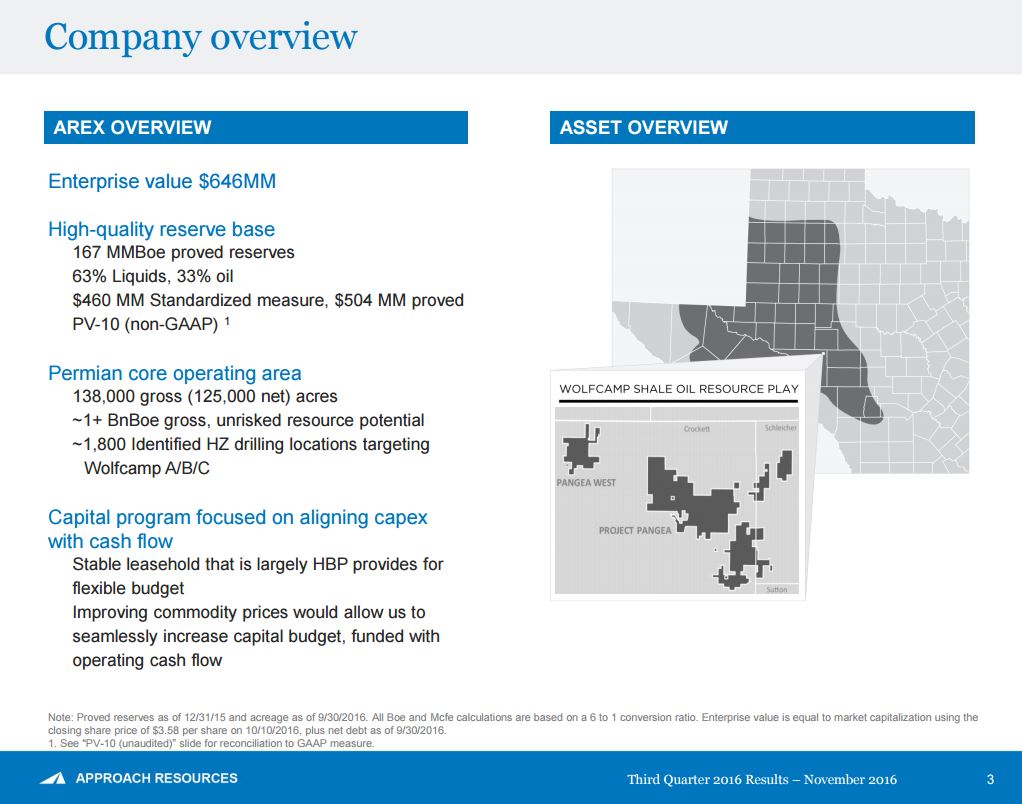

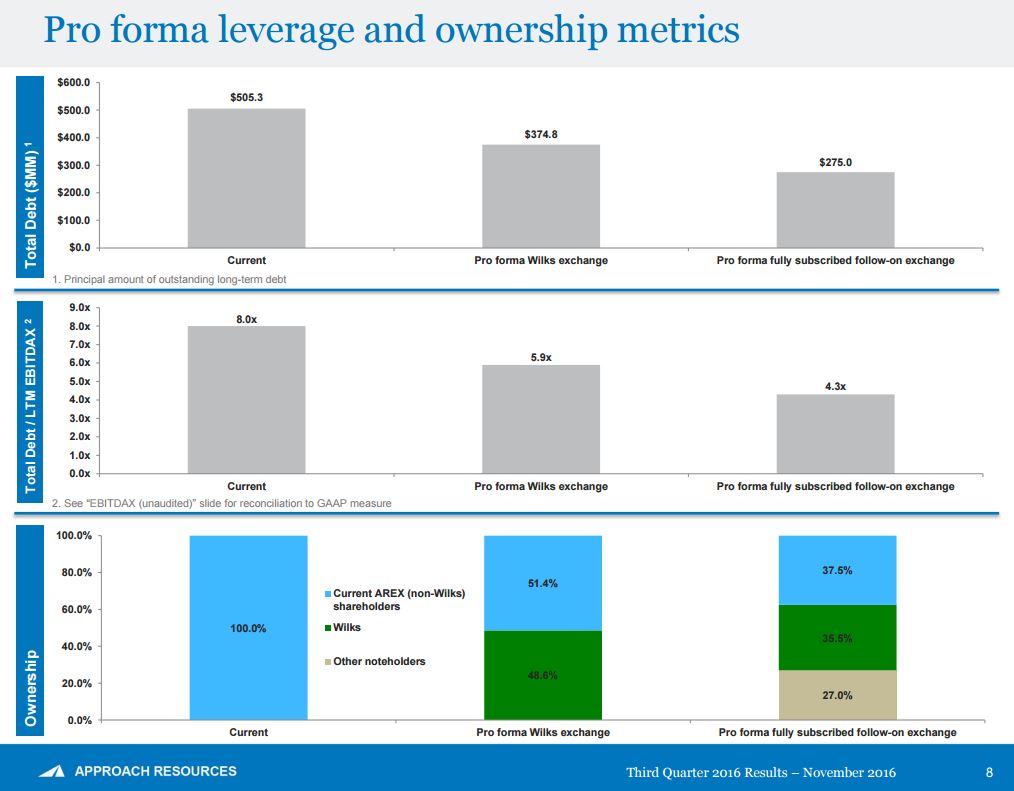

On Nov. 2, Permian operator Approach Resources (ticker: AREX) published several announcements including its Q3 2016 results and a privately-negotiated exchange of $130 million of 7.00% senior notes due 2021, followed by an exchange offer for the remaining $100 Million of 7.00% senior notes due 2021.

3Q Highlights

- Production was 12.1 MBOEPD, exceeding prior guidance for the quarter

- Record low quarterly lease operating expense (LOE) was $3.49 per Boe

- Third quarter well costs were below $3.5 million

- Average initial production (IP) for three wells completed during the quarter was 813 Boe/d (58% oil and 81% liquids), including one short lateral well normalized to a 7,500’ lateral

- Net loss was $9.1 million, or $0.22 per diluted share, and adjusted net loss (non-GAAP) was $9.6 million, or $0.23 per diluted share

- Revenues totaled $23.7 million and EBITDAX (non-GAAP) was $14.1 million

- Renegotiated long-term crude oil marketing arrangement that will result in lower oil differentials beginning in fourth quarter 2016

During third quarter 2016, Approach reported completing three horizontal wells, one well in the Wolfcamp A bench and two wells in the Wolfcamp C bench. The average IP rate was 813 BOEPD (58% oil and 81% liquids), including one short lateral well normalized to a 7,500’ lateral. At September 30, 2016, we had four horizontal wells waiting on completion.

Capital expenditures incurred during third quarter 2016 totaled $5.5 million, consisting of $6.4 million for completion activities and $0.2 million for infrastructure projects and equipment, partially offset by a legal settlement with a service provider of $1.1 million.

“We plan to drill two wells in fourth quarter 2016 but do not plan to bring any new wells on-line,” the company reported. “We expect fourth quarter production to average 11.6 MBOPD.”

Approach said that in October it had renegotiated its long-term crude oil marketing arrangement, which it expects “will result in a reduced realized oil differential going forward, while retaining the flexibility to price our oil either at Midland or Cushing benchmark-based prices. Assuming Midland-based pricing, the new marketing arrangement will reduce our overall crude oil price differential to approximately $2.25 per barrel relative to spot Midland price.”

Liquidity

At September 30, 2016, Approach reported a $1 billion revolving credit facility in place, with a borrowing base and lender commitment amount of $325 million. “Our liquidity and long-term debt-to-capital ratio were approximately $52.4 million and 46.6%, respectively,” the company reported.

Long Term Strategy

During today’s Q3 conference call, Approach CEO Ross Craft brought investors up to speed on his views that the company’s long term strategy is paying off.

Ross Craft: “Our industry’s history is one of boom and bust. Companies have faltered trying to outsmart and outpace the market. Approach has been a recognized Permian producer since 2004. We’ve had our share of exciting times; however, our stamina has come from taking the long view and understanding that pace, balance and discipline are the keys to managing our business.

“Our play book is relatively simple: make judicious business decisions, consistently drive down costs through synergies of scale, concentration of acreage and operating efficiencies, and the benefit from doing all of this – all of these things well. The strategy is durable because it is independent of commodity prices.

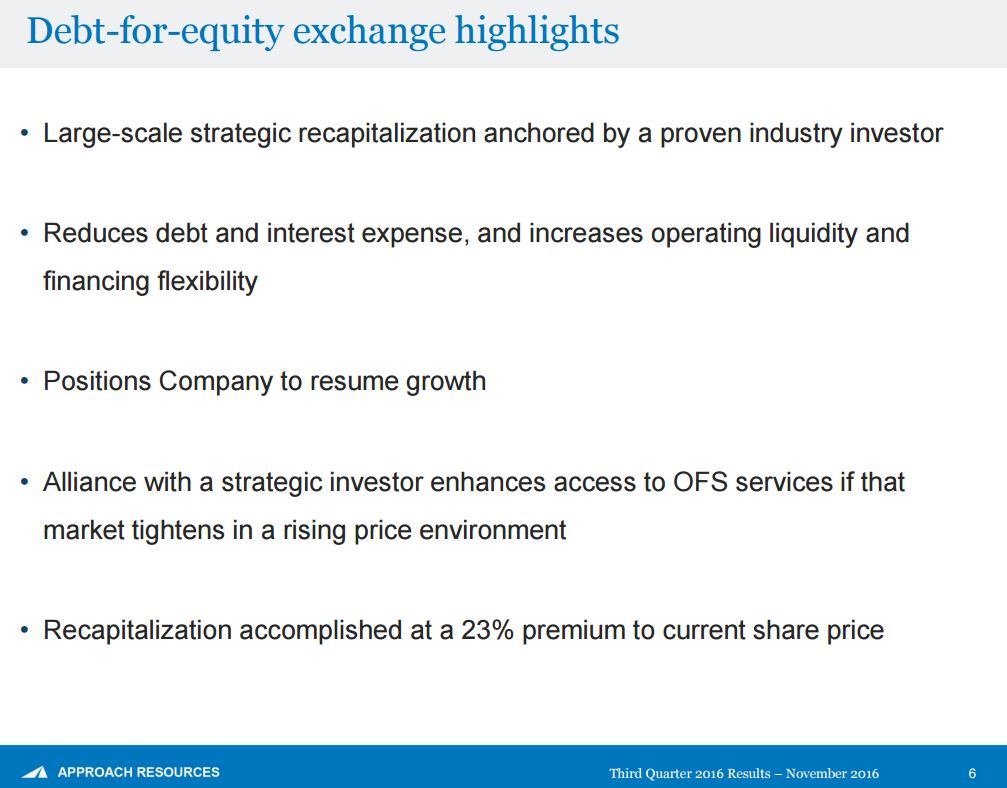

“Yesterday, we announced that Approach has entered into a large-scale debt for equity exchange agreement with a proven industry operator and investor.”

Transformative: long-term debt reduction of $230 million possible

The transactions are transformative for Approach, and if approved by our stockholders and fully completed, will reduce the company’s long-term debt by up to $230.3 million and save the company up to $16.1 million in annual cash interest payments and up to $70 million in cash interest payments over the life of the senior notes. We believe that this transaction is critical to unlocking shareholder value in the company as it right-sizes the balance sheet for the current commodity price environment, improves growth potential and enhances strategic flexibility for financing and M&A activities. In addition, the transaction, if completed, will reduce our leverage to bring us closer in line with the new 2016 OCC revised leverage guidance for E&P companies.

3Q Call Q&A

Analysts asked for clarifications on the debt exchange transactions in the call’s Q&A:

Q: Just had a quick question on what happens after both those transactions, if they go through successfully. Do you guys use those cost savings to kind of ramp up activity and accelerate? Or how should we think about that?

AREX: Yes, the plan right now is to take the – obviously the interest savings is the big component of this exchange. Obviously the key would be, assuming commodity prices are supporting increasing our drilling activity, would be to roll it back into the CapEx or the company so we start this machine back up.

Q: On the new oil contract, can you talk about any details on that? Are there any limits or exceptions, or is that going to cover your entire production going forward?

AREX: There are no formal allocations in terms of volume, so it’s whatever volumes we produce we’ll be able to send down that contract.

Q: What’s going to happen if the bond holders, the remaining bond holders, do not agree to exchange into equity? What is the plan?

AREX: They’d all just – the old ones would stay in place. And that’s okay. I mean, we’re fine with that outcome.

Q: And do you have a threshold? Is there anything in the documents that 85% would need to exchange for the tender to be valid, or even…

AREX: No. There are no thresholds in any of these transactions.

Q: So whoever exchanges is going to own equity, and whoever wants to remain as a sub is going to remain on the balance sheet?

AREX: That’s right.

Q: Is there anything that you could offer them, like an exchange into a second lien or anything like that, or no? You won’t necessarily change the terms for them?

AREX: No, we’re not offering them second lien or any other incentives.

Q: And you expect the older transactions, the first one and then the follow-up exchange you said, to close in the first quarter of next year?

AREX: That’s correct.

In his closing comments on the call, Ross Craft emphasized the importance of adding the Wilks as a partnership in relation to the privately negotiated exchange of senior notes for equity. “We think it’s going to be a very attractive business venture for our shareholders.”

“It’s a comprehensive de-leveraging program like we’ve described. It’s far better than any other type of de-leveraging you can look at. Asset sales, obviously, are not what we like to do. We think this is going to be received well. Obviously, it’s in the hands of the shareholders at this point. And we look forward to talking to all the shareholders and describing the pros behind this,” Craft said.

Partnership with the Wilks

Wilks Brothers, LLC is the investment arm of the Wilks Family Office, based in Cisco, Texas. The company has made and holds significant public and private market investments across multiple sectors including real estate, energy lifecycle and E&P. In 2002, the family founded FracTech, a hydraulic fracturing and oil field services firm, and grew the firm into the largest independent pressure pumping provider in North America before selling its stake in 2011.

Matt Wilks and Morgan D. Neff, Portfolio Managers in the Wilks Family Office, said in a statement: “For over 20 years, the Wilks have demonstrated a commitment to working collaboratively in their investments to the benefit of all related parties. We are extremely excited about the opportunity to partner with the stockholders and management of Approach. With excellent assets, management and a transformed balance sheet, we are confident in the opportunities for growth and value expansion for Approach.”

“We are excited to align ourselves with a strategic investor that has the depth of knowledge and experience in the oil field services industry of the Wilks Family Office. We look forward to working with the Wilks on developing ways to enhance our access to competitive offerings of completion, drilling and other services in anticipation of tightness in oil field services during an improving commodity price environment that will drive growth in both of our businesses,” Craft said in a statement.

Links to Approach Resources’ Q3 news release, the debt-for-equity exchange release and presentation are provided.