The West Virginia Department of Commerce will allow hydraulic fracturing under the Ohio River, according to reports from local media outlets. The state had previously leased out about 474 acres of land in Marshall and Wetzel counties and retains a 20% royalty of the produced resources. Statoil (ticker: STO) has already finalized a deal with an average cost of about $9,000 per acre. Other producers, including Noble Energy (ticker: NBL) and Gastar (ticker: GST), are in the process of finalizing drilling contracts.

Statoil holds a prominent position in the United States’ greatest producing gas play, with 512,000 net acres spread across three states. Its average vertical well depths are roughly 8,000 feet, while the average depth of the Ohio River is about 24 feet. The Department of Commerce had said leases were awarded to bidders on a mile-by-mile basis and were “based upon the Director’s determination the bidder will operate responsibly and develop the prospect that protects the interest of the State of West Virginia.”

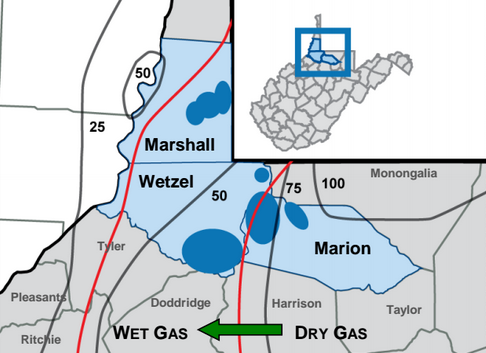

The Ohio River and its surrounding areas are also prospective for the Utica Shale, which is a deeper and more liquids-based formation than the Marcellus. Its Marshall and Wetzel counties are home to numerous producers who have flocked to the play, including micro-caps like Trans Energy (ticker: TENG), a Marcellus pure-play with approximately 45,000 gross acres in the area.

Drilling under rivers, while relatively uncommon, does exist. Operators have been drilling below the Susquehanna River in Pennsylvania for roughly five years and are monitored by the Susquehanna River Basin Commission, which has a fact sheet detailing the process and its requirements. The sheet reads: “Potable water is about 850 ft below ground surface. Shale gas formations are vertically separated from freshwater aquifers by at least 2,000 ft of sandstones and shales of moderate to low permeability.”

West Virginia Commerce Secretary Keith Burdette admitted state budgets are very tight and said the royalties could “create what could be a substantial revenue stream.” Pennsylvania received $10.5 million up-front in March 2014 and in 2010 from Chesapeake (ticker: CHK) to operate under the Susquehanna River, not including royalties.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.