“Production from the North Slope of Alaska and the North Sea of Europe, burgeoning oil regions 20 years ago, is in decline. Unrest in Venezuela and Nigeria threatens the flow of oil. The Middle East remains the mother lode of crude, but war and instability underscore the perils of depending on that region.”

The points above came from an archived feature story by National Geographic called “The End of Cheap Oil.” That was the magazine’s cover story in June 2004. Amazingly, these statements hold the same meaning as if the feature were to be published today. The monthly spot price when National Geographic published the article was just $37.05/barrel. The closest WTI has come to returning to that level occurred in November 2015, when average prices ended at $41.65/barrel.

The article (written by Tim Appenzeller, an award winning science journalist) uniquely describes the scene of a Gulf of Mexico operation, outlining the technical challenges and extreme caution associated with extracting the world’s most relied-upon resource. Appenzeller touches on harsh lessons learned from the 1973 oil embargo, reminding readers that the U.S. will have to find other ways to reduce its need to foreign oil. He adds, “The best hope for slowing the U.S. rise in dependence on imported oil lies far out at sea.”

The article (written by Tim Appenzeller, an award winning science journalist) uniquely describes the scene of a Gulf of Mexico operation, outlining the technical challenges and extreme caution associated with extracting the world’s most relied-upon resource. Appenzeller touches on harsh lessons learned from the 1973 oil embargo, reminding readers that the U.S. will have to find other ways to reduce its need to foreign oil. He adds, “The best hope for slowing the U.S. rise in dependence on imported oil lies far out at sea.”

Strangely enough, United States offshore production was actually lower in 2014 than it was in 2004. Considerable blame can be placed on the Macondo disaster, which essentially halted further offshore projects. President Obama imposed a drilling ban on the majority of offshore areas that will extend through 2017.

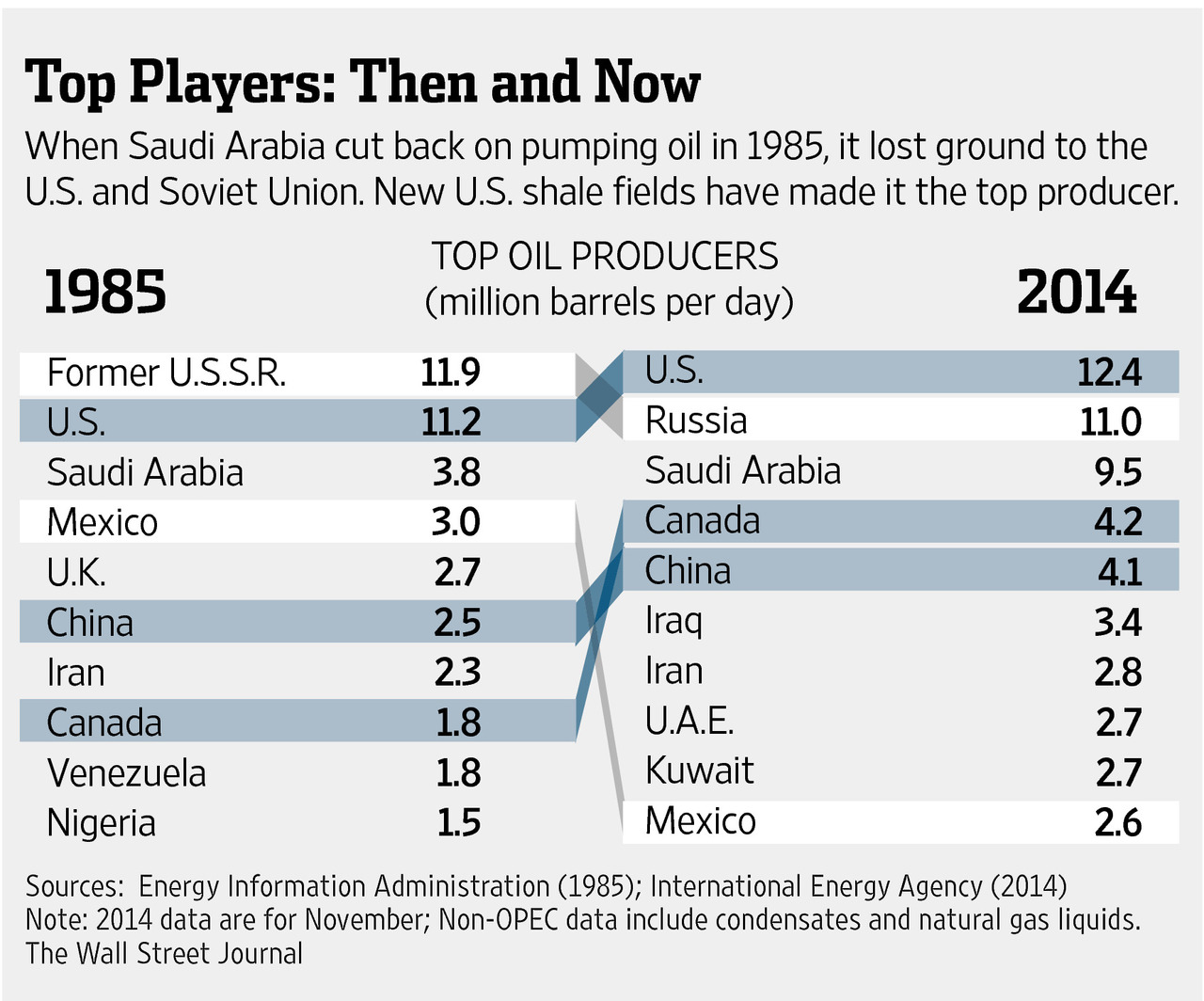

At first glance, it would appear that the U.S. would be starving for oil. Innovations in the industry, however, have boosted United States output to its highest level in roughly three decades. Production from the Gulf of Mexico has remained in the 1,400 MBOPD range since the late 1990s, and in 2004, accounted for 27% of domestic volumes. The Gulf’s output was similar in 2014, except it garnered only 16% of the share of United States volumes. Oil production from Colorado, North Dakota and Texas, meanwhile, has increased by 320%, 1178% and 195%, respectively.

The crude oil surge catapulted the U.S. to the role of the world’s greatest oil producer, surpassing the mainstays on the production market. The 2004 National Geographic story predicted: “The real challenge to the Middle East’s oil dominance comes from elsewhere in the old Soviet Union: the boggy, cold forest of western Siberia. Once the bulwark of the Soviet oil industry, Siberia declined in the early 1990s as its wells and infrastructure fell into disrepair. Many analysts believed Siberia’s oil was played out. Now it’s making a comeback.”

Sound familiar?

Not in 2004. The phrase “hydraulic fracturing” appears just once in the 5,000+ word feature. “Efficiency,” a very popular word in today’s market, does not appear at all. And Appenzeller predicted: “The real threat to the world economy 20 years from now may not be the policies of the Middle East. It may be a global shortage of conventional oil.”

The above cannot be denied, but the amount of unconventional oil derived from United States oil plays would likely shock even the most ardent oil optimists. Today, some of the industry’s leading oilservice providers believe we are still in the early innings of what has become known as the Shale Boom. The resiliency of U.S. producers have stood up to OPEC’s refusal to cut production, resulting in a modern-day survival of the fittest among crude producers. The battle for market share has energy watchdogs like the Energy Information Administration and the International Energy Agency expecting crude prices to stay below $80 through the end of the decade.

The above cannot be denied, but the amount of unconventional oil derived from United States oil plays would likely shock even the most ardent oil optimists. Today, some of the industry’s leading oilservice providers believe we are still in the early innings of what has become known as the Shale Boom. The resiliency of U.S. producers have stood up to OPEC’s refusal to cut production, resulting in a modern-day survival of the fittest among crude producers. The battle for market share has energy watchdogs like the Energy Information Administration and the International Energy Agency expecting crude prices to stay below $80 through the end of the decade.

Cheap oil may not exist forever, but it is unlikely to fade any time soon.