Basic Energy Services emerges from bankruptcy with $125 million in new capital, and erases $775 million in debt

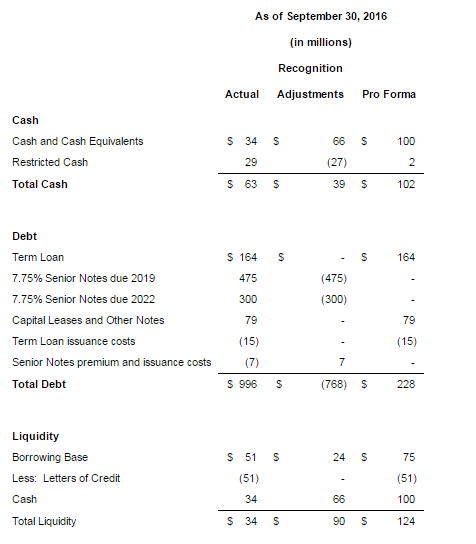

Fort Worth-based Basic Energy Services (ticker: BAS) announced this month that the company has successfully completed its prepackaged restructuring. The company will exit Chapter 11 with $125 million in new capital, and with its debt level reduced by $775 million, according to the company’s press release.

Through the prepacked plan, Basic equitized over $800 million of unsecured debt, including accrued interest, eliminated over $60 million in annual cash interest, and raised the $125 million in new capital.

“Today marks the completion of a restructuring and recapitalization that allows the company to move forward with a solid financial foundation from which we expect to continue to strengthen our business and grow,” said Basic CEO Roe Patterson. “We now have the financial flexibility to continue to provide our customers with industry-leading expertise and safe, efficient services.”

Pro forma capital structure

Board of directors

The company also announced today a newly constituted Board of Directors, effective in conjunction with the company’s emergence from chapter 11:

- T.M. “Roe” Patterson – Mr. Patterson has 21 years of related industry experience. He was named our President and Chief Executive Officer and appointed as a Director in September 2013. From 2006 to September 2013, Mr. Patterson worked for Basic in positions of increasing responsibility. Prior to joining Basic, he was President of TMP Companies, Inc. He was a Contracts/Sales Manager at Patterson Drilling Company from 1996 to 2000.

- Timothy H. Day – Mr. Day is currently a private investor and director of several private companies. Prior to this, Mr. Day joined First Reserve in 2000 as a Vice President, served as Managing Director since 2007 and Co-Head of Buyout since 2012 until December 2015. Mr. Day currently serves as a director on the board of Diamond S Shipping, TNT Crane & Rigging and TPC Group. Mr. Day previously served as a Director of PBF Energy Inc. and Crestwood Midstream Partners LP. Mr. Day has been named Chairman of the Board of the company.

- John Jackson – Mr. Jackson has served as Chief Executive Officer of Spartan Energy Partners since March 2010. Prior to that, from January 2008 through October 2009, Mr. Jackson was the Chairman and CEO of Price Gregory Services, Inc. Mr. Jackson currently sits on the board of directors of Seitel, Inc., Main Street Capital Corp. and Cone Midstream. He has previously served on the board of directors of Select Energy Services (2012 to 2015), RSH Energy (2013 to 2014), Encore Energy Partners (2009 to 2011) and Exterran Holdings, Inc. (2007 to 2009).

- James D. Kern – Mr. Kern has served as Managing Partner of Majestic Ventures 1 LLC, a consulting and investment partnership focused on early stage growth companies since May 2014. In addition, Mr. Kern has served on the board of directors of PlaySight Interactive Ltd. since May 2014. From 2010 to mid-2014, Mr. Kern was a Managing Director at Nomura Securities, serving as Head of Global Finance FIG and Specialty Finance Investment Banking for the Americas.

- Samuel E. Langford – Since January 2015, Mr. Langford has performed services as a consultant regarding upstream energy investments, strategies and management. Previously, Mr. Langford was employed by Newfield Exploration Co. as Senior Corporate Advisor-Corporate Office. In addition to Newfield, Mr. Langford has worked with Cockrell Oil & Gas, British Gas Exploration America, Tenneco Oil Company, Tenneco Inc and Exxon USA in various technical and managerial positions. TESO

- Julio Quintana – Mr. Quintana served as the President and Chief Executive Officer of Tesco Corporation, from 2005 until his retirement in January 2015 and was a member of the Tesco board from September 2004 to May 2015. Mr. Quintana brings 36 years of experience in various aspects of the oil and gas exploration and production industry. He is currently member of the board of Directors of SM Energy and Newmont Mining. Mr. Quintana has also been a board member of Pipeline Pressure Isolation LLC, a private company, since April 2016.

The Prepackaged Plan provides that the initial Board of Directors will have a total of seven members. As of the Effective Date, six of the seven member of the Board of Directors have been designated. The company anticipates that the remaining member of the Board of Directors will be designated shortly after the Effective Date.