“Active” 2014 Program Positions Bellatrix for the Future

Bellatrix Exploration (ticker: BXE), a Calgary-based E&P with operations in Alberta, British Columbia and Saskatchewan, built on its increased reserves by announcing a net profit of $163.1 million ($0.89 per share) in its full-year 2014 results, announced on March 12, 2015. Nearly one-third of the profit was achieved in the fourth quarter, which generated $54.8 million ($0.29 per share). According to the release, BXE’s previous five years has resulted in compound annual growth of 23% in production, 32% in reserves, 27% in funds flow from operations and 71% in net earnings.

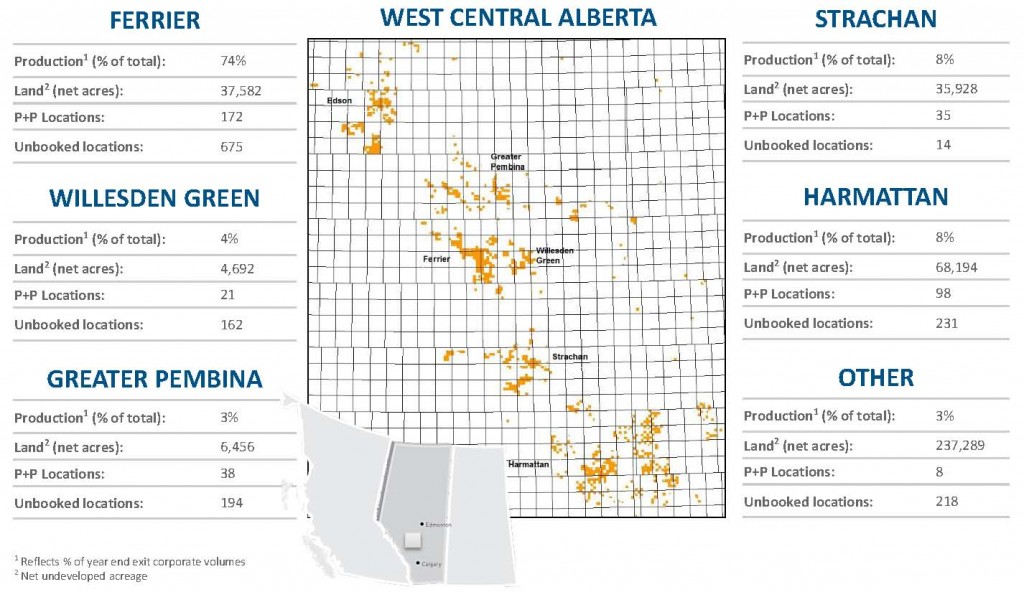

The company previously announced this week that proved reserves for 2014 increased by 30% year-over-year to 161 MMBOE, while its proved developed producing reserves increased by 37% to 74 MMBOE. Its 683,647 net acres hold a net present value of $1.4 billion.

The Growth Stage is Set

BXE management called 2014 the most active year in its history as the Canadian producer invested $504.5 million (80% more than 2013) in exploration and development projects. Included in the projects was its Alder Flats gas processing plant (100% operatorship), which will provide BXE an additional 220 MMcf/d of takeaway capacity. The first of two phases is on schedule to come online in July 2015 and will provide 110 MMcf/d of capacity. Other infrastructure buildouts include the installation of 51 miles (82 kilometers) of pipeline, two oil batteries and a gas compression system with capacity of 144 MMcf/d. Total takeaway capacity will be 60,000 BOEPD upon completion of Phase I of the Alder Flats plant.

An additional $176 million was spent on acquisitions, including the $151 million purchase of tuck-in properties in Alberta. The acquisition, completed in Q4’14, consisted of 2,920 BOEPD of volume and 19.9 MMBOE of proved reserves. In a conference call following the release, company management mentioned it is exploring the sale of non-core assets but is carefully evaluating its options.

“As a management group, we don’t want to do anything in the short-term that will affect long-term profitability of the company,” said Raymond Smith, Chief Executive Officer of Bellatrix. “We want to time our opportunities to best-fit the timing of maintaining a strong balance sheet throughout the year.”

Drilling Program Outlook

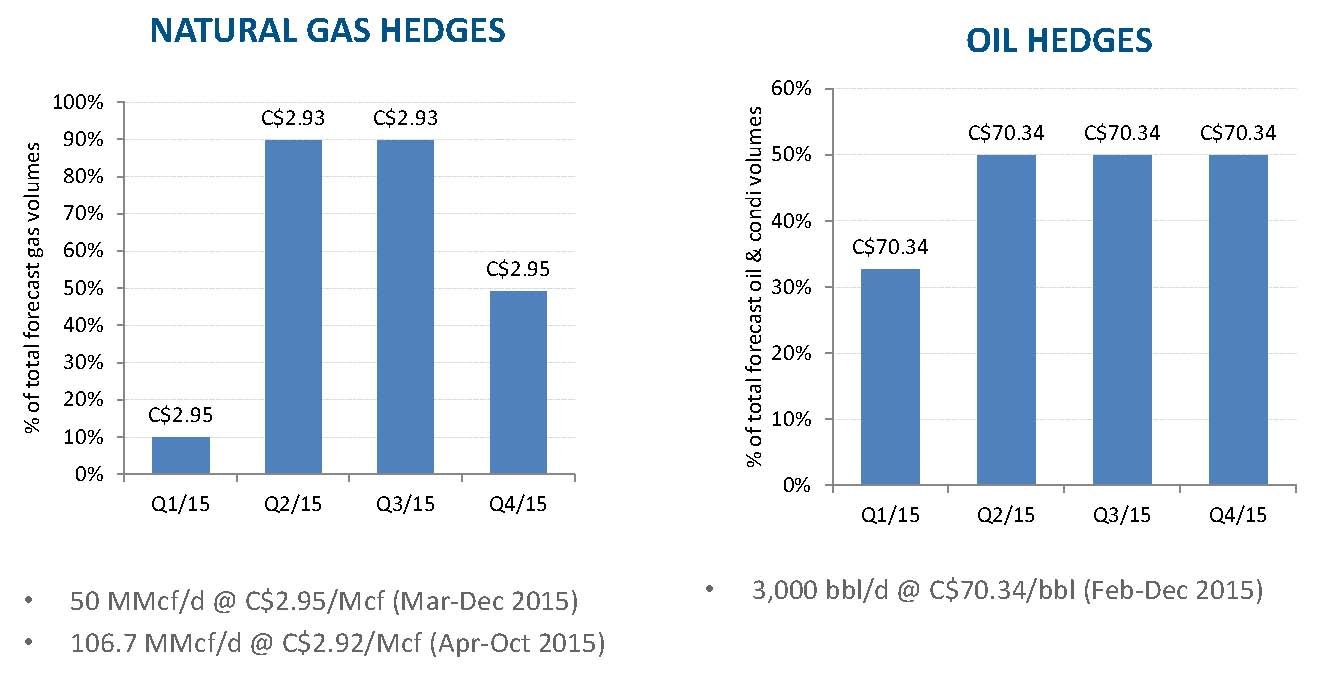

BXE averaged a company-best 38,065 BOEPD (67% natural gas) in 2014 – a 74% increase compared to 2013. The production surge comes from 110 gross wells (59.1 net) drilled in fiscal 2014 with a 100% success rate. In its reserves report, BXE attributed 2014’s operating profit to higher than realized natural gas prices. Approximately 90% of its gas volumes are hedged at C$2.93 in Q2’15 and Q3’15, providing the company a stable source of income in the short term. “The company’s differentiated joint venture strategy proves additional insulation from weak commodity prices,” said Smith, who expects gas prices to approach the C$4.00 threshold by Q4’15.

Average production for Q4’14 was 42,959 BOEPD, and volumes for 2015 are projected in the range of 43,000 to 44,000 BOEPD. In the call, Smith said the company has shut in an additional 8,000 BOEPD of production that is available to offset the decline rates. The consistent flow is expected despite a considerable pullback on expenditures, with 2015’s capital program guided at $200 million (approximately 60% below 2014). Its drilling inventory is forecasted to span more than ten years.

Average production for Q4’14 was 42,959 BOEPD, and volumes for 2015 are projected in the range of 43,000 to 44,000 BOEPD. In the call, Smith said the company has shut in an additional 8,000 BOEPD of production that is available to offset the decline rates. The consistent flow is expected despite a considerable pullback on expenditures, with 2015’s capital program guided at $200 million (approximately 60% below 2014). Its drilling inventory is forecasted to span more than ten years.

BXE’s joint venture partners are buying into the future development. A total of $500 million has been dedicated by Grafton and Canadian Non-Operated Resources Corp, with the latter agreeing to commit $250 million at the end of Q3’14. BXE expects to access $85 million in 2015 from its partners.

Capital Position

As mentioned in Oil & Gas 360®’s reserves update on Bellatrix earlier this week, the company has effectively positioned itself as a low-cost producer as evidenced in EnerCom’s Weekly Report for the period ended March 6, 2015. Based on its Q3’14 results, BXE’s asset intensity (defined as the percentage of every EBITDA dollar required to maintain production) is only 23%, ranking sixth overall out of its 50 Canadian peers, which averages an asset intensity of 79%. On a trailing three-year basis, its finding and development costs are just $5.48/BOE – the third lowest in the group, which averages $21.40/BOE. Production replacement of 643% ranks fifth overall, compared to the group average of 393%.

BXE remains within its covenants after its ambitious 2014 capital program. Its debt to EBITDA ratios have been increased by the bank through Q2’16 in response to the downswing in commodity prices. Its borrowing base also increased to $725 million, of which $175.2 million is undrawn. Total debt at year-end 2014 was $637.7 million, and its net asset value was $1.7 billion.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.