Blackbird Energy announces 913% increase in 1P reserves

Blackbird Energy (ticker: BBI) released a reserves report Monday which announced the company’s proved reserves (1P) increased 913% to 30,526 MBOE (46% NGLs), according to the company’s press release. The net present value of the company’s 1P reserves discounted 10% (NPV10) was $204 million based on an independent reserves evaluation, a 1,356% increase from the company’s previous 1P NPV10 value using the reserves evaluator’s forecasted price deck and the company’s forecasted costs.

The Calgary-based company also announced its proved plus probable (2P) reserves increased by 814% in terms of volume to 59,169 MBOE (46% NGLs) and 1,002% in terms of value to $455 million using forecasted prices and costs.

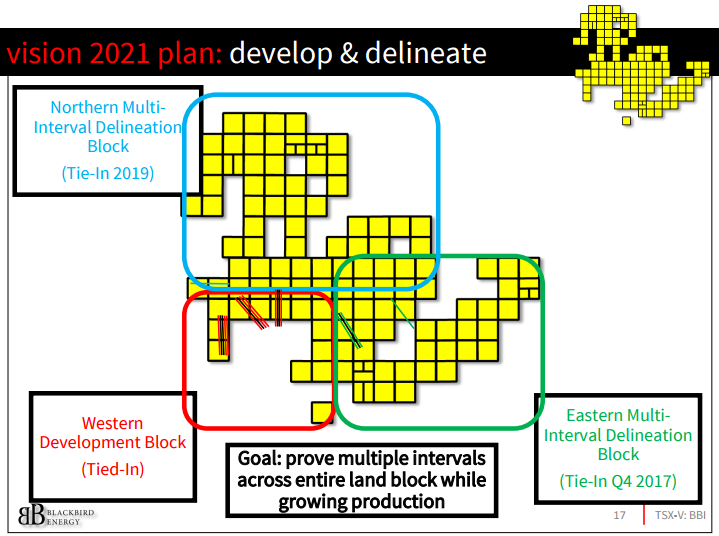

On a 1P basis, BBI has now booked 8 Pipestone / Elmworth Montney net sections, representing 7.9% of Blackbird’s acreage. On a 2P basis, the company has now booked 12 net sections, representing 11.9% of the company’s total acreage. The company’s 1P and 2P reserves are booked in two Montney intervals, but the company believes there are two more intervals giving the play a total thickness of 660 feet.

Blackbird Energy currently holds a position of 100.9 net sections (116 gross) in the Pipestone / Elmworth liquids-rich corridor. The company plans to drill eight development wells this year to build up production, and four exploration wells to prove additional intervals on its eastern acreage north of the Wapiti River.

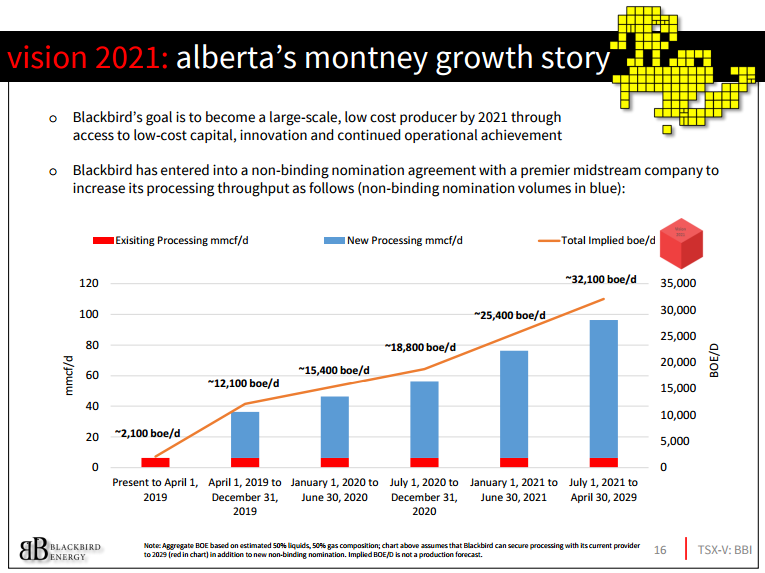

Blackbird targeting 32.1 MBOEPD of production in 2021

Earlier this month, Blackbird announced the company closed a public offering for 112.5 million common shares for $0.55, 29.6 million shares issued on a “CEE flow-through” basis at $0.64 per share and 6.8 million shares issued on a “CDE flow-through” basis at $0.59 per share, for aggregate gross proceeds of $84.8 million, according to the company. The capital will be the catalyst for the company’s growth moving forward.

“We’ve crushed D&C costs, we’ve implemented innovations with Stage Completions, and now we have the capital to work toward this goal,” Blackbird CEO Garth Braun told Oil & Gas 360®. “We believe the resource is there, now we’re working on takeaway and processing capacity to get us there.”