Public sentiment about hydraulic fracture stimulation (fracing) and other aspects of oil and gas exploration and production in Colorado has generated a lot of sentiment in recent months. A variety of Colorado municipalities want to institute local rules, ballot initiatives have been proposed, signatures are being collected, Congressman Jared Polis and Governor John Hickenlooper have weighed in, some local bans on hydraulic fracture stimulation have passed and one (Loveland, Colo.) was recently overturned in a public referendum.

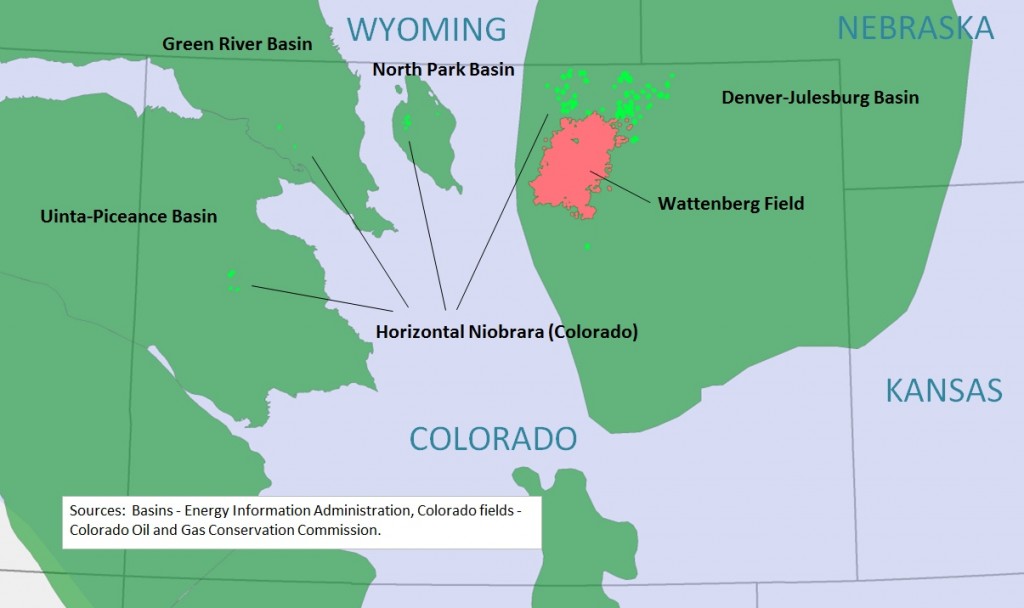

The area under the microscope is northern Colorado’s Denver-Julesburg (D-J) Basin. The D-J Basin is home to the Wattenburg Field, one of the largest natural gas deposits in the U.S., and the Niobrara shale play. “The Niobrara … has emerged as one of the country’s most significant shale plays, covering 8,000 square miles in the D-J Basin with an estimated 4 to 10 billion BOE of recoverable resource,” Stifel Nicolaus and Company said in a recent research note.

“The four largest companies operating in the basin based on production — Noble (ticker: NBL), Anadarko Petroleum (ticker: APC), Encana (ticker: ECA) and PDC Energy (ticker: PDCE) — say they have identified nearly 15,000 potential drilling locations. Most of those sites are in the basin’s Wattenberg Field, which is centered in Weld County. While the field covers parts of Boulder, Broomfield, Adams and Larimer counties, 95% of the permits issued in 2013 were in Weld County, according to Colorado Oil and Gas Conservation Commission data,” according to a Denver Post story in October.

Energy producers place a high priority on their D-J Basin operations and the Niobrara within it. In its December 2013 analyst presentation, Noble Energy referred to their D-J properties as “a premier asset with ‘limitless’ possibilities.” In its Q1’14 earnings release the company said, “Due to continued strong performance in the extended reach lateral program, the Company is now targeting over 90 extended reach lateral wells in 2014, up 65% from its original plans.”

Source: EIA & COGGC

Are New Regulations over the Horizon?

Stifel published a research note dated June 26, 2014 summarizing a conference call it hosted last week with Rick Ridder, spokesman for Coloradans for Safe and Clean Energy (CSCE), regarding various proposals to change drilling rules in Colorado.

Oil & Gas 360® asked Mike Scialla, managing director and energy analyst at Stifel Nicolaus and Company, for his views on Colorado’s growing list of proposed drilling initiatives, petitions and changes to regulations that have generated conversation and action in recent months.

The debate primarily centers around two issues: increased setbacks and local control.

Scialla said it looks like two (No. 88 and No. 89) of 11 proposals now gathering signatures are most likely to go forward. “CSCE will need to file 86,000 signatures with the Colorado Secretary of State by August 4, 2014, in order to place these initiatives in front of voters on the November ballot,” the Stifel research note said.

Initiative No. 88 would require wells to be set back 2,000 feet from an occupied structure—an increase from the current 500 foot setback. Initiative 89 is more environmentally focused. “Initiative 89, the so-called environmental bill of rights, asserts Coloradans have a right to clean air, water and scenic values,” according to the Stifel research note. Neither proposal calls for a ban on fracture stimulation.

The local control initiatives would allow local communities to impose a new layer of restriction such as noise restrictions and the ability to extend buffer zones. Current regulations for oil and gas drilling and production activities are under the jurisdiction of the Colorado Oil and Gas Commission.

“In our call, Mr. Ridder explained that under CSCE’s proposals, county commissions and /or city councils would be allowed to impose rules … ,” the Stifel note said. “We suspect this could result in a myriad of rules and complicate oil and gas development.”

Governor Hickenlooper has publicly expressed his concern that a highly restrictive statewide setback rule, if approved by voters, could potentially eliminate 60% of the potential Niobrara drill sites in Weld County.

A new set of restrictive regulations inhibiting a mineral owner’s ability to develop resources would be likely to deter investment in oil and gas assets in Colorado and dampen future energy development in the state.

To assuage the situation, Governor Hickenlooper has proposed a bill that would allow local governments to impose stricter health and safety standards, call for inspection of oil and gas sites and negotiate with operators regarding setbacks greater than 500 feet. The governor’s bill would grant companies the right to operate, limit moratoriums and appeal local rules in court. The governor’s “compromise bill” appears to have the support of CSCE, Anadarko Petroleum, Noble Energy and Representative Polis, according to the Stifel research note. “Mr. Ridder indicated that CSCE will withdraw its ballot proposals if the governor’s bill is approved,” the Stifel note said.

“I think the setback rule probably changes,” Scialla told Oil & Gas 360® in a telephone call on Friday. “Greater local control sounds good, but I don’t see how it gets implemented. There will probably be a lot of lawsuits around that one.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.