Technological advances in the oil and gas industry have reformed the United States economy, but government policies are preventing the business sector from reaching its full potential.

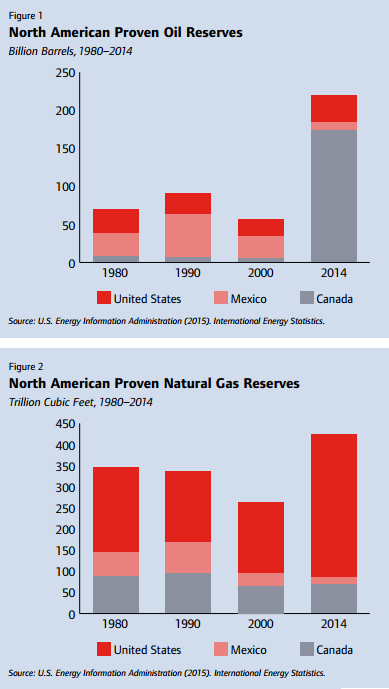

That is the assessment of the Business Roundtable, based on a 31-page report released on November 17, 2015. “Powering Forward; North America’s Energy Resurgence” began by detailing the tremendous leaps accomplished by the continent as a whole, including; U.S. natural gas output increasing by 42% from 2005 to 2014, oil sands production climbing 60% from 2000 to 2014 and Mexico opening up its doors for international investment. The accomplishments were followed by caution, with the group implying the changes are “potentially transformative” and urged that their effects, to date, have not been used to full advantage.

The report says: “Despite this transformation and its potential to generate widespread economic and security benefits, the region’s legal, regulatory and policy frameworks are lagging. Policymakers have been slow to pivot from a world of energy scarcity to one of abundance… More must also be done to remove barriers to responsible energy development and to further integrate the region’s energy system in the pursuit of a common goal: ushering in a new era of energy abundance and security for North America.”

The Case from the BRT

The Case from the BRT

The Business Roundtable accuses the United States of not passing comprehensive energy legislation for more than a decade – well before the effects from the shale boom truly began to take shape. Since then, the industry has expanded so rapidly that infrastructure, permitting and regulatory frameworks have struggled to keep up. Key policy changes include:

- Fortifying and building upon existing infrastructure;

- Streamlining regulatory processes, including permitting and approval turnaround times;

- Increasing access to federal lands; and

- International engagement, which includes removing the crude export ban.

Oil and Gas Goes Beyond Just Oil and Gas

The shale revolution affects more than those involved in hydrocarbon extraction – its emergence has strengthened the region’s economic standing, created a greater stance in international affairs and enhanced overall energy security. That includes more affordable fuel and electricity costs for the American consumer, which can be as much as $1,200 per household based on 2012 estimations from IHS Consulting.

Industries involved with the intricacies of well completion and moving the product to market have also massively benefitted. In February 2014, the chemical industry announced $100 billion in new investments (from nearly 150 projects). Crude by rail shipments are expected to climb again with the recent rejection of the Keystone XL pipeline, even though rail volumes to West Coast refineries, for example, have increased by nearly tenfold since 2012.

$1.2 Trillion in Economic Benefits

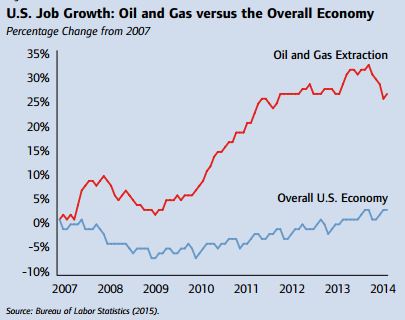

Overall, the oil and gas industry supports about $1.2 trillion in economic benefits, equal to about 7% of the nation’s gross domestic product. Direct employment in the industry skyrocketed by 40% from 2007 to 2012. In Canada, hydrocarbons are the largest source of private sector investment and government revenues from oil sands extraction alone could amount to $1.5 trillion between 2014 and 2028. Mexico, meanwhile, is thirsty for both energy enhancement and expertise after ending its 78-year energy nationalization policy in 2014. Citigroup believes the current reforms can double Mexico’s crude output and provide as many as 2.5 million new jobs by the year 2020.

Don’t Send Our Regional Partners Mixed Messages: Keep the Engine Moving

Integration is the single key needle-mover on the continent’s energy scope, and that includes executing the four main points previously mentioned in the report’s introduction. The Roundtable implied that the government is largely getting in its own way by discouraging investment, implementing unclear permitting policies and maintaining an “outdated” crude export ban.

Integration is the single key needle-mover on the continent’s energy scope, and that includes executing the four main points previously mentioned in the report’s introduction. The Roundtable implied that the government is largely getting in its own way by discouraging investment, implementing unclear permitting policies and maintaining an “outdated” crude export ban.

“Continued U.S. reliance on non-pipeline modes of transportation — coupled with reduced U.S. oil imports — is sending mixed messages to our regional partners,” said the report. “In particular, failure to approve the Keystone XL pipeline has prompted Canada to rethink its export strategy and look toward the Pacific Basin as a potential market for its oil exports.”

At least Canada has option for exports, at the moment. The crude export ban in the United States has added to the supply glut, as oil inventories are at record highs and the price of Brent crude maintains a differential in the $5 neighborhood on West Texas Intermediate. Removing both the crude export ban and the roadblock on the Keystone XL pipeline would be beneficial to the industry while staying within environmental standards, based on studies by the U.S. State Department.

The Business Roundtable believes meaningful adjustments to current energy policies will result in widespread benefits, spreading across much of the economy and paving a road for the future. But addressing those adjustments is the main, definitive point. The Roundtable ended its report by saying, “To take full advantage of the region’s energy promise, policymakers must realign legal, regulatory and policy frameworks with current realities and better integrate energy systems across borders — securing North America’s status as an energy superpower for generations to come.”