Damaged pipeline calls for alternative oil transport solution

An emergency request made by ExxonMobil (ticker: XOM) to use tanker trucks to haul crude oil following the rupture of an oil pipe carrying its crude from offshore has been denied by officials in California. Santa Barbara County’s Planning and Development director rejected Exxon’s emergency permit application, saying it did not meet the requirements for expedited review, reports the Associated Press.

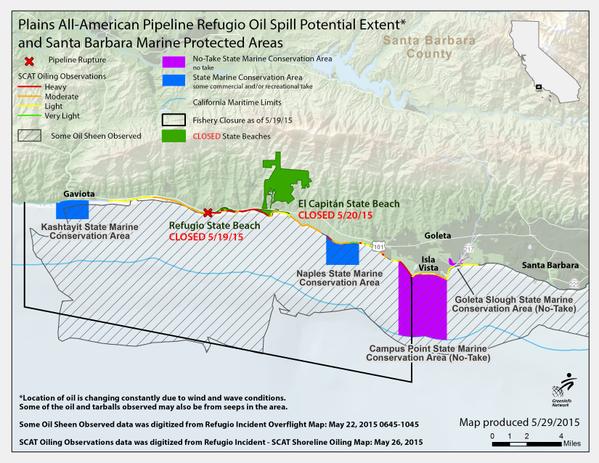

Normally, XOM moves its crude through ten miles of pipe owned by Plains All American (ticker: PAA) from its three offshore rigs to the California coast. Exxon asked California officials to use trucks to transport the crude instead since one of the pipes ruptured on May 19, forcing the company to shut off flows through the line.

Environmental groups praised the Santa Barbara County decision, saying moving the crude by truck was an unsafe solution. “Trucking a million gallons of crude oil a day down winding coastal highways is a recipe for another disaster,” said Kristen Monsell, an attorney for the Center for Biological Diversity.

The Western States Petroleum Association said the decision “reflects an unfortunate lack of understanding of, or sensitivity to, the energy realities California faces,” and said the state would have to import more crude oil to meet its needs.

ExxonMobil spokesman Richard Keil said the company is reviewing other options. The company can reapply through the regular permitting process, the Planning and Development officials said.