Callon Petroleum (ticker: CPE) is engaged in the acquisition, development, exploration and operation of oil and gas properties in the Permian Basin of West Texas.

In a conference call with analysts and investors on May 9, 2014, Fred Callon, Chairman and Chief Executive Officer of Callon Petroleum, said, “This is our first reporting quarter without production contribution from our divested Gulf of Mexico operations, but our trajectory continues upward even without that production that was monetized for $100 million in late 2013. In addition to a projected annual increase in Permian volumes of approximately 135% in 2014, we estimate that our operations can deliver year-over-year annual production growth of over 35% in 2015, assuming no acceleration of our current two rig horizontal program.”

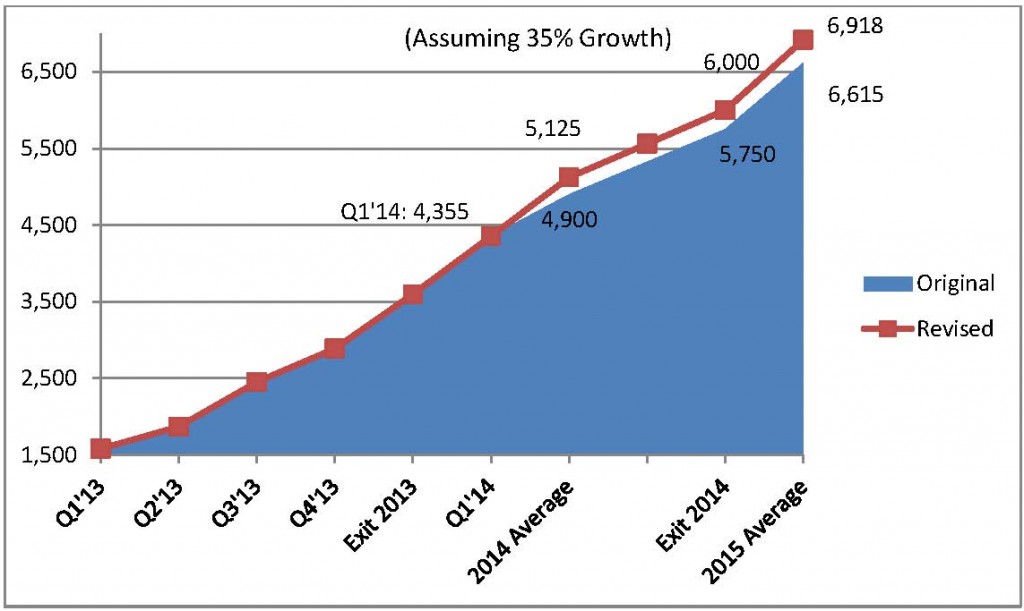

Callon produced 4,355 BOEPD (85% oil) solely from the Permian in Q1’14 – an overall increase of 13% quarter-over-quarter. Permian production from Q4’13 was 2,978 BOEPD, meaning regional operations increased 46% for the time period. The company reported a net loss of $111,000 for the quarter but completed a full-scale positional shift that had been in the works since 2009. Adjusted income was $4.4 million, or $0.11 per share. The company added 1,500 net acres to its position at roughly $5,000 per acre in the quarter.

Callon BOEPD Rates

Uptick in Guidance

Gary Newberry, Vice President of Operations for Callon Petroleum, said: “Our program development operations have fully transitioned into manufacturing mode at our key fields. In addition to capital efficiencies and repeatable production growth, this mode of operation frees up our team to dedicate more time to optimization efforts as well as the evaluation of our opportunities to expand our footprint and gain access to additional acreage so they can turn resource potential into cash flow as part of our program development model.”

The transition, along with well results, prompted Callon to increase its full year 2014 guidance by roughly 7%. New production totals are expected to reach 5,100 BOEPD to 5,400 BOEPD, up from previous estimates of 4,700 BOEPD to 5,100 BOEPD. Oil is expected to consist of 82% to 85% of the stream, which is roughly 20 points higher compared to Q1’13. Operating margins have grown by 40% to $69.15 per BOE as a result of increased oil production. The company expects the majority of production growth to come in Q2’14, with totals expected to rise by roughly 18% to 5,000 BOEPD to 5,250 BOEPD. Assuming Callon hits the 2014 exit rate of 6,000 BOEPD, Permian production will be up 67% on a year-over-year basis. As previously stated, Callon expects compound growth of 35% to carry into 2015.

Drilling Results

Callon drilled 13 gross wells in the quarter and completed nine (9.0 and 8.4 net, respectively). Nine of the wells (eight net) were drilled horizontally and management expects the ratio of horizontals to verticals to increase in the remainder of its 2014 program. The company expects to complete an average of seven wells per quarter as part of its two rig program in 2014. A total of 29 wells are currently on production.

In its Q4’13 release, Callon identified two key initiatives in the Midland; the testing of larger completion designs in the Southern region and developing the Central section horizontally. The Southern Midland Basin (12,700 acres) received the bulk of drilling activity. Nine wells (eight horizontals) were drilled in the quarter and five were completed. Two recent wells produced combined peak rates of 1,821 BOEPD for 30 days and 1,640 BOEPD for 50 days. The results support company expectations of 660 MMBOE of EUR for a 9,000 foot lateral, which would cost $8.5 million per well.

Joe Gatto, Senior Vice President and Chief Financial Officer of Callon Petroleum, said, “As our completion techniques have improved over time, we are seeing higher initial producing pressures in our wells and longer periods under natural flow, which gives us an opportunity to study this issue and the potential impact on longer term well performance.”

The company has traditionally focused on the Upper and Lower Wolfcamp B levels but is exploring potential in the Spraberry and Wolfcamp A. Newberry said: “There’s a lot to do in the Southern Midland certainly a minimum of three de-risked levels, likely now four, with all the work going on in the Lower Spraberry. If we start counting opportunities in the three levels that we know are working on our area, we’ll get like 266 horizontal wells, which is beyond a 10-year inventory of work. If you start counting the Lower Spraberry, which we’re about to prove up ourselves, you get out to about 370 wells.”

Third Rig Possible

Callon has been dedicated to its two rig program. However, increasing well locations and the addition of up to 1,500 acres per quarter has the company considering adding a rig.

Fred Callon said: “I think, when we add the third rig, we are in program development. We want to add a rig in a similar vein and want to capture all the efficiency. We want to alternate between fields so we don’t have a lot of overlapping drilling and completion activities going on at any one time, but there are opportunities within our existing asset base in the coming months to add that third rig.”

Management said capital constraint is not an issue and current guidance rates reflect its two-rig program. The company holds a debt to market cap ratio of 18% – well below the median of 40% in EnerCom’s 88-company E&P database. A SunTrust Robinson Humphrey note on May 14, 2014, said “With a stronger revenue outlook and guidance implying little change in absolute expense levels, essentially all of the top line gains should flow to the bottom line.”

“We certainly have the capacity to add a third and fourth rig with the existing organization we have and we just really need to find those types of opportunities in a smart way. But once we do, I think we’ve demonstrated what we can do with acreage when we get it in our hands, so that’s going to be a continuing effort for us,” said Callon.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom has a long-only position in Callon Petroleum.