New Delaware Basin acreage holds base inventory of 206 net wells and is producing 1.9 MBOEPD; 36% of drilling locations targeting 10,000 foot Wolfcamp laterals

Callon Petroleum Company (ticker: CPE) announced late Tuesday that the company will add 27,552 gross (16,098 net) acres in the Delaware Basin to its assets following the close of a $615 million acquisition from American Resource Development and its subsidiaries (Ameredev).

The acquisition includes 1.9 MBOEPD of flowing production (71% oil), a base inventory of 481 gross (206 net) horizontal drilling locations in the Wolfcamp A and B, and ownership in midstream assets including five salt water disposal wells and over 13 miles of gathering lines and gas lift return lines, Callon said in its press release.

The agreement also includes the potential for Callon to acquire an additional 1,006 net acres in Ward County, if such leasehold acquisitions are consummated prior to closing of the acquisition.

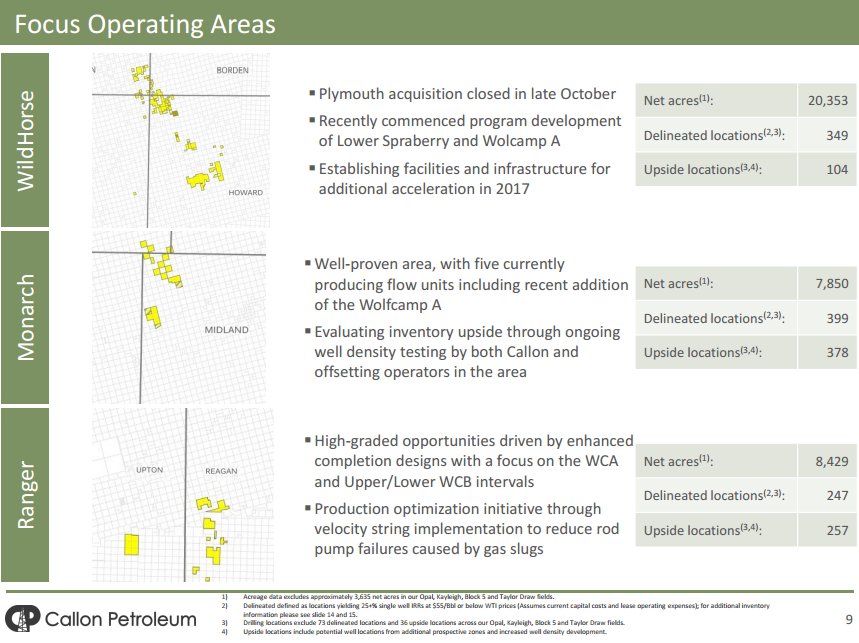

Ameredev currently operates approximately 80% of net surface acreage and has an average working interest in operated properties of approximately 82%. On a pro forma basis, assuming the closing of the acquisition, Callon’s aggregate Permian Basin position will include approximately 55,500 net surface acres concentrated in four core operating areas within both the Midland and Delaware sub-Basins.

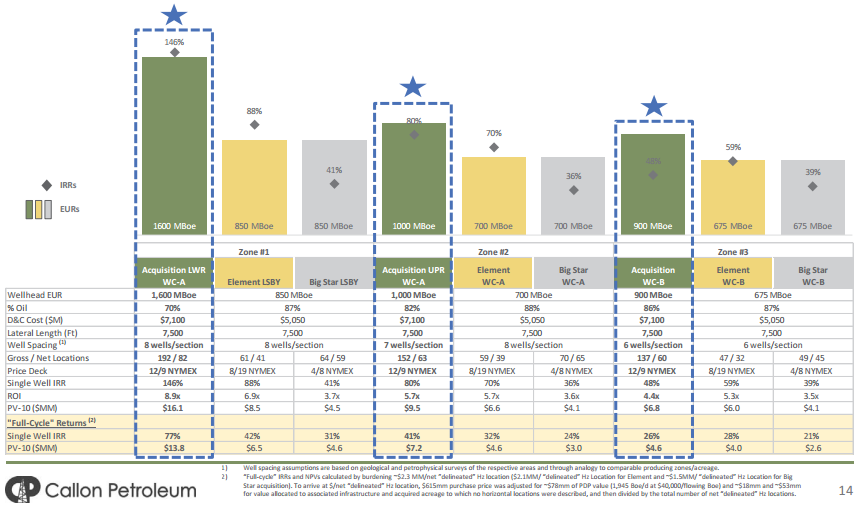

“The position is well-suited for long lateral development and offers the potential for the development of multiple shale and sand intervals in the core of the Southern Delaware Basin’s over-pressured oil window,” said Callon Petroleum Chairman and CEO Fred Callon. The company believes drilling locations in the Wolfcamp A and B will average 7,500 lateral feet, with 36% of the inventory comprised of 10,000 foot laterals.

“We are looking forward to adding a fourth core operating area to our Permian portfolio and are currently planning to deploy an operated horizontal drilling rig to this acreage by mid-2017, in addition to our plans to be running four horizontal rigs in the Midland Basin by the end of 2017,” Callon continued, indicating that the company would deploy a fourth rig roughly three months earlier than previously anticipated.

Almost 90% of new inventory expected to generate 25%+ IRRs at $50 oil

With the acquisition adding roughly 480 delineated locations in the Wolfcamp A and B, Callon now has a delineated inventory of almost 1,600 locations, of which almost 90% are expected to generate 25%+ IRRs at $50 oil, a note from Johnson Rice & Company said Wednesday. Callon estimates that moving forward with its current drilling program, and holding its activity at five rigs after 2017, it now holds more than 20 years of delineated drilling inventory.

Backing out the flowing production and existing infrastructure, valued at $40,000 per flowing BOE and $18 million, respectively, the acreage cost an estimated $32,500 per acre, which is in-line with recent Delaware transactions. Applying the acreage cost to the delineated inventory suggests about $2.5 million of land cost per drilling location.

Given the deeper and over-pressured nature of the acreage, Callon Petroleum anticipates well costs of $7.1 million, higher than the roughly $5 million well cost on the company’s Midland acreage. The cost will be offset by higher EURs, however, with Callon projecting 1.6 MMBOE in the Lower Wolfcamp A, 1.0 MMBOE in the Upper Wolfcamp A and 0.9 MMBOE in the Wolfcamp B assuming 8 locations in each of the Wolfcamp A benches, and 6 locations in the Wolfcamp B.

Acquisition financed with $754.4 million equity offering

In conjunction with yesterday’s press release about the Ameredev acquisition, Callon also announced a common stock offering to fund the deal. The company’s initial offering was for 34 million shares of its common stock with the option to underwriters to purchase an additional 5.1 million shares, which the company quickly upsized to 40 million shares with an option for an additional 6 million shares. At a price of $16.40 per share, the offering with shoe would generate about $754.4 million gross to Callon.

In both the initial offering and the upsized offering, the company said that the proceeds from the deal would be used to fund the Ameredev acquisition, and the balance would be used for corporate purposes. If the deal does not close, Callon said it will use the net proceeds of the offering to fund a portion of its exploration and development activities and for general corporate purposes, which may include leasehold interest and property acquisition, repayment of debt and working capital.