Permian operator Callon Petroleum (ticker: CPE) announced a 20% increase to its borrowing base on October 7, 2015. Its new borrowing base is $300 million – $50 million higher than its previous determination, and no other changes were made to the credit facility.

In a company issued press release, Fred Callon, Chairman and Chief Executive Officer of Callon Petroleum, said, “This increased level of liquidity, combined with our focus of attaining self-funding status under our current drilling program in 2016, provides us with the flexibility required to prudently grow in a volatile environment.”

The company is scheduled to release its Q3’15 results after the close of markets on November 4, 2015, and will discuss results the following morning via conference call.

Permian Operations Update

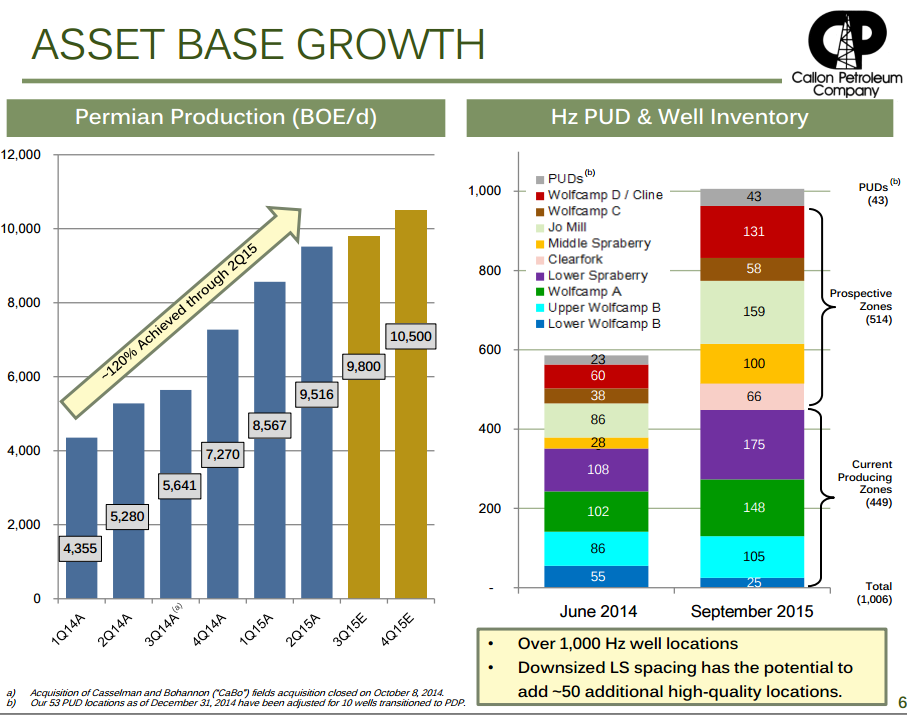

Callon’s Permian footprint spans about 100,136 net acres, and its properties have repeatedly exceeded expectations. The company had a 2015 annual volume midpoint of 8,200 BOEPD in an operations plan released in February, but averaged H1’15 volumes of 9,041 BOEPD with production still trending upward.

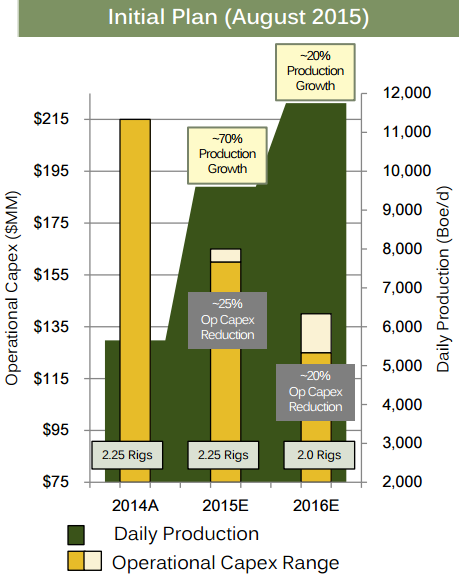

The company is now targeting a production midpoint of 9,600 BOEPD in 2015, representing a year-over-year increase of nearly 70%. The company expects to realize an additional 20% of annual growth in 2016, placing expected midpoint volumes at 11,520 BOEPD, which more than doubles its 2014 annual average of 5,648 BOEPD. The growth profile follows a trendline dating back to last year; its projected Q4’15 volumes will be 120% higher than Q1’14.

For the remainder of 2015, Callon has approximately 66% of oil production swapped at a price of $66.17. In 2016, about 4,000 BOEPD is currently hedged with average downside protection of $56.62, representing about 43% of its oil production if the 80% oil cut is considered.

Moving Toward Cash Flow Neutral

Management expects to be cash flow neutral by H2’16, potentially expanding its opportunities in the Permian.

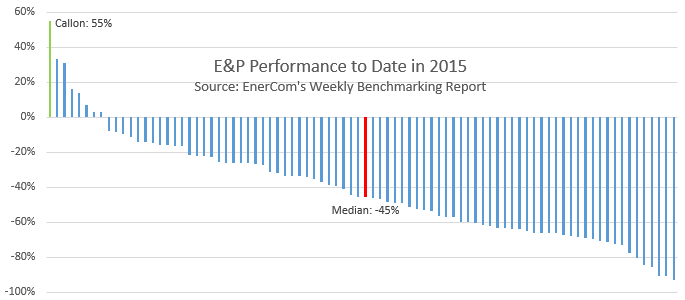

The market has taken notice of Callon’s track record: CPE shares are up 55% year-to-date, making it the top stock performer among its 87 peers in EnerCom’s E&P Weekly Benchmarking Report. Despite the performance to date, Capital One Securities still sees Callon as “one of the cheapest pure-play Permian names that we cover on EV/EBITDA multiples.” In a company update on October 5, 2015, the group explains, “the stock trades at ’16/’17 EV/EBITDA multiples of 8.3x/6.6x, which are meaningful discounts to median multiples of 10.4x/8.4x for our Permian names under coverage.” OAG360 notes CPE maintains an EBITDA margin of 62% – above the industry median of 54%.

Steady Financials

Callon increased its reserves to 32.8 MMBOE in 2014 (120% higher than 2013) and now has more than 1,000 horizontal locations in its inventory, but has managed to build up its asset base without breaking the bank. The company has $225 million available on its borrowing base, pro forma the recent raise, and does not have any debt maturing until 2019.

Any near-term obligations are minimal; essentially all of its properties in the Southern Midland Basin are held by production. Management noted the majority of its 2015 capital plan would be used in the first half of the year. In its Q2’15 results, the company spent about $130 million on operations but reiterated capital expenditure guidance of $175 million for the full fiscal year as is two-rig program continues.

“We can deliver 20% production growth and growth into the teens the following year by living within our means,” said Joe Gatto, Chief Financial Officer of Callon Petroleum, in a recent conference. “We feel that’s a pretty powerful statement.”