Lower Spraberry Type Curves: 900 MBOE

It took four years for Callon Petroleum (ticker: CPE) to transition to the Permian Basin, and since the shift completed last year, the micro-cap E&P is boosting operational activity despite a rather difficult commodity environment. Capital One Securities welcomed the update, saying “CPE’s solid execution continues” in a note dated May 7.

Callon increased its full-year 2015 guidance to 8,800 to 9,300 BOEPD, up roughly 10% from its previous estimate of 8,000 to 8,400 BOEPD. Its capital guidance is expected to come in at $160 to $165 million (the high end of its initial guidance), but the estimate reflects the increased drilling activities and is offset by anticipated cost reductions. Total completed well costs in Q2’15 are expected to be 30% below the 2014 average, which includes a 7,500 foot lateral that management expects to run about $5 million.

The drilling program boost is entirely at Callon’s discretion. Fred Callon, Chief Executive Officer of Callon Petroleum, told OAG360 in a February interview that only three gross wells are obligated to be drilled, and its position of 18,062 net acres is largely held by production. The company was utilizing an artificial lift program which restricts flowback and allows for a more “slow and steady” approach. The method, along with the majority of wells being drilled in the first half of 2015, will allow for consistent production growth and possible exposure to rising oil prices through the end of the year.

Q1’15 Results

The Mississippi-based company reported total volumes of 8,567 BOEPD from more than 60 producing horizontal wells in its Q1’15 release and anticipates sequential production growth of about 4% in Q2’15. Q1’15 production is already 18% higher than Q4’14 totals. The full-year 2015 guidance of 8,800 to 9,100 BOEPD is more than double the Permian volumes Callon was producing in Q1’14. Approximately 5,000 BOEPD are hedged at weighted average prices of $65 to $71 per barrel.

The company reported a net loss of ($12.2 million) in the quarter due to the commodity downturn. On an adjusted EBITDA basis, CPE reported a $26.7 million gain due to an $18.5 million charge in depreciation, depletion and amortization.

“While we can’t do much about the direction of commodity prices, we have made significant strides in reducing the cost portion of our cash margins,” said Joe Gatto , Chief Financial Officer of Callon Petroleum, in a conference call following the release. “Lease operating expenses, including workovers, was $9.03 per BOE for the quarter, representing a quarterly decrease of 20%.”

Type Curves Rising

Management increased its type curves across the board in the latest release, with the Central Midland Basin holding the greatest estimates. The Wolfcamp B and Lower Spraberry formations are slated at 640 MBOE and 900 MBOE (increases of 25% and 15%), respectively, while the upper and lower intervals of the Wolfcamp B in the Southern Midland Basin have curves of 575 MBOE.

“Putting these increased EUR assumptions together with the capital and operating cost reductions, we expect returns across our asset base of 30% to 35% for the Wolfcamp B and 55% for the Lower Spraberry in a $55 per barrel oil,” said Callon in the conference call. Management expects associated payouts to be reached in 24 to 30 months.

Management declined to comment on the progress of three new wells in the Southern Midland region but two nearby wells drilled by Diamondback Energy (ticker: FANG) in the latest quarter were exceeding the 990 MBOE type curve in its early stages of production.

Management declined to comment on the progress of three new wells in the Southern Midland region but two nearby wells drilled by Diamondback Energy (ticker: FANG) in the latest quarter were exceeding the 990 MBOE type curve in its early stages of production.

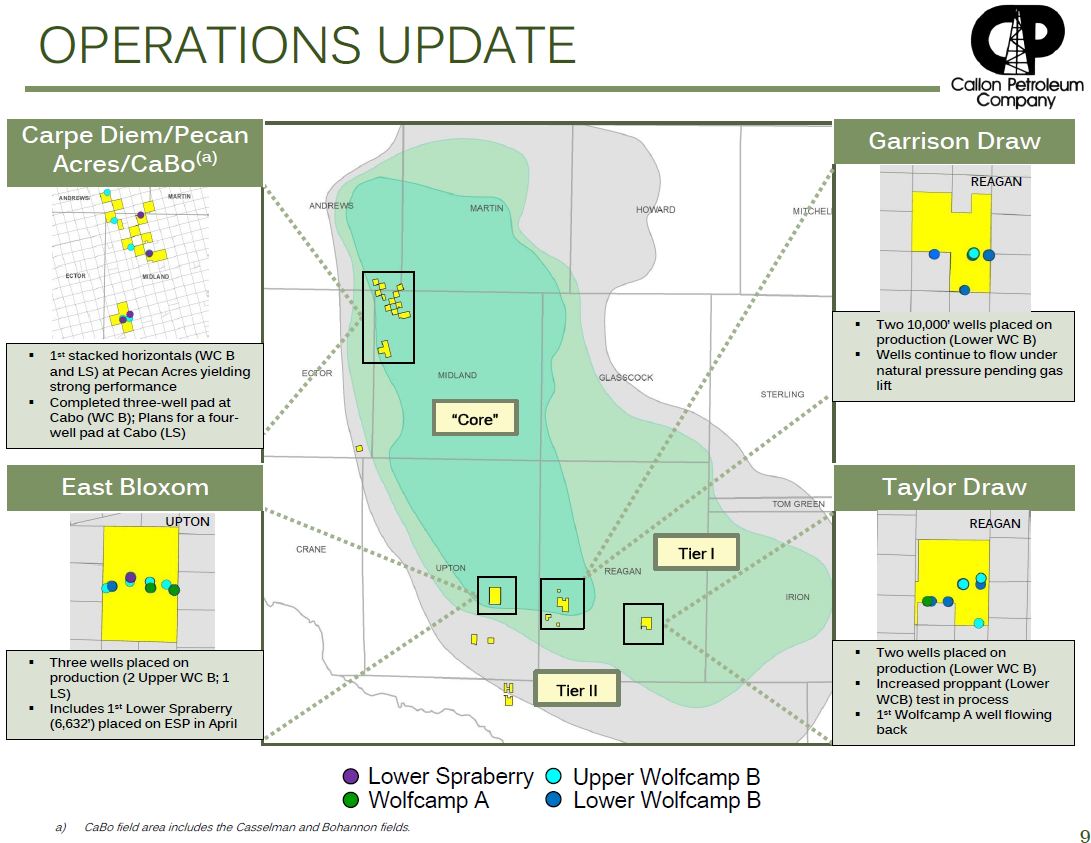

Permian Program

Callon anticipates drilling 26.9 net horizontal Permian wells in 2015 – three more than anticipated, with the guidance increase. The Lower Spraberry formation is expected to receive 9.1 net wells. Q1’15 operations received the lion’s share of 2015 expenditures, with its $65 million in capital representing more than 40% of 2015’s anticipated capital. The investment resulted in 7.8 net drilled wells and 2.5 are currently awaiting completion.

The Lower Spraberry program will garner more of the expenditures moving forward as Callon spreads its operational footprint in the United States’ most prolific oil play. For fiscal 2015, the Wolfcamp and Lower Spraberry formations are in line to receive 17.9 and 9.1 net wells, respectively. In 2016, that split will shift to 6.2 net Wolfcamps and 15.6 net Spraberrys. CPE’s original plans had called for 3.0 net wells to be drilled in 2015, which shows the company’s rising expectations for the Spraberry formation.

Total proved reserves more than doubled on a year-over-year basis to 33 MMBOE, of which 55% are classified as proved developed producing. The newly revised expenditures are approximately 25% below 2014’s capital guidance.

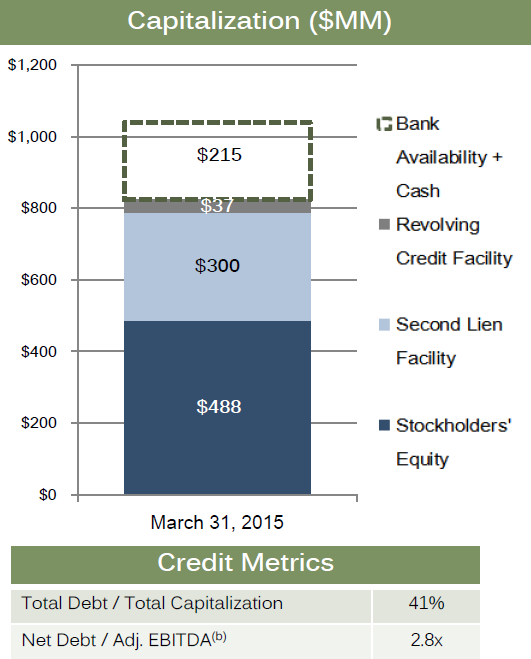

Cash Flow Neutrality Target: Mid-2016

Unlike the majority of its smaller peers, Callon is equipped to navigate the commodity downturn with a solid balance sheet. The company’s $250 million borrowing base was reaffirmed and $65.6 million was added to its cash flow via a common equity offering earlier in the quarter. A total of $215 million of cash and credit availability makes up its current cash on hand.

Callon management remains focused on achieving cash flow neutrality by H2’16, and its quest will be aided by production growth on a two rig program. Management believes Q4’15 volumes can be 30% greater than Q4’14, which would equate to about 9,450 BOEPD. An additional 10% growth is expected in 2016, pushing CPE past the 10,000 BOEPD milestone.

Callon management also mentioned it is still active in the acquisition field and is opportunistic for future possibilities within the year. “We believe we’re near the core of the Midland Basin,” said Fred Callon. “There are opportunities out there that are smaller but we think we’ll be successful in adding to our acreage position sort of with the bolt-on acquisitions that we’ve talked about before.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.