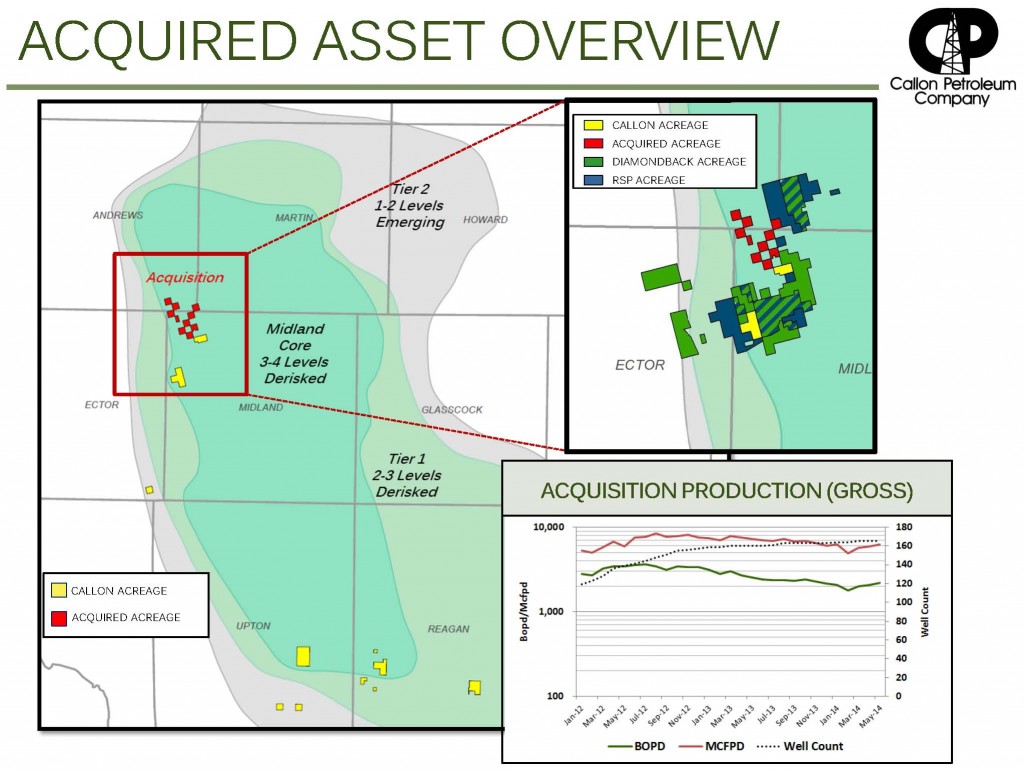

Callon Petroleum Company (ticker: CPE), a Permian Basin pure-play E&P, announced the addition of 6,230 gross acres (3,862 net) in the oil province on September 2, 2014. The properties were purchased for $212.6 million in cash and are near CPE’s existing operations in Carpe Diem and Pecan Acres in Midland County, Texas. The sale is effective May 1, 2014 and the company will assume operatorship upon closing of the transaction, which is expected to occur in early October 2014.

“The fields are located in the core of the industry’s multiple zone development activity, and will add substantially to our existing inventory of potential well locations,” said Fred Callon, Chairman and Chief Executive Officer on a conference call following the release. “This is a perfect complement to our existing activities and we believe we purchased these at an attractive valuation due to the seven prospective benches.”

Click here for Callon’s presentation covering the acquisition. Click here for a webcast, complete with questions and answers from industry investors and analysts.

Acreage Breakdown

The acquired acreage produced at an average 1,465 BOEPD (68% oil) from 165 mature vertical wells during Q2’14, the “vast majority of which were drilled prior to 2013,” said Gary Newberry, Callon’s Senior Vice President of Operations. Net proved developed producing reserves, based on Callon estimates, are 4 MMBOE, and a 3D seismic test will be part of CPE’s full technical review of the play’s prospectivity.

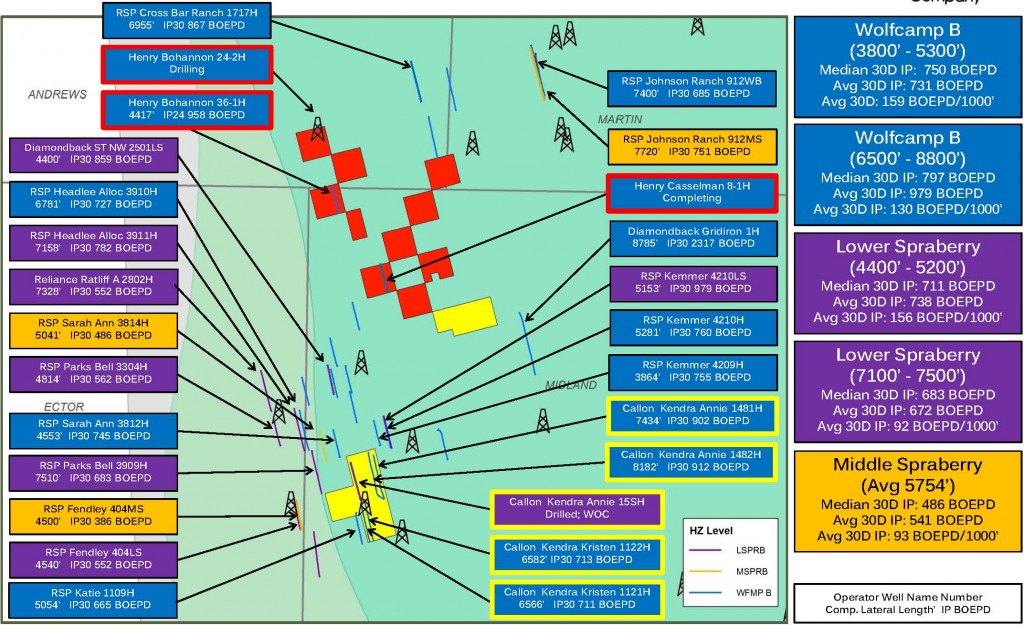

The acreage holds an estimated 440 gross horizontal drilling locations (273 net), with 188 gross locations (117 net) targeting the Wolfcamp B, Lower Spraberry and Middle Spraberry – formations that are currently producing in CPE’s nearby acreage. All targeted zones are held by production and Callon holds a 62% average working interest along with 46.5% net revenue interest.

Joe Gatto, Chief Financial Officer of Callon Petroleum, said, “We see this as some of the best potential we have in our portfolio. Part of our initial plans is to dedicate a rig to this area and most likely add a vertical rig in addition to the horizontal in order to accelerate its development.”

Callon Petroleum announced on August 19, 2014 at EnerCom’s The Oil & Gas Conference® 19 in Denver that it was planning to accelerate its drilling pace by adding a third horizontal rig starting in Q4’14 to drill and complete 40 gross horizontal wells in 2015. The company believes it has 14 years of drilling inventory based on its current three-rig campaign, however, inventory will double if all seven formations in the Midland Basin prove to be feasible across all of CPE’s acreage, pro forma for the acquisition.

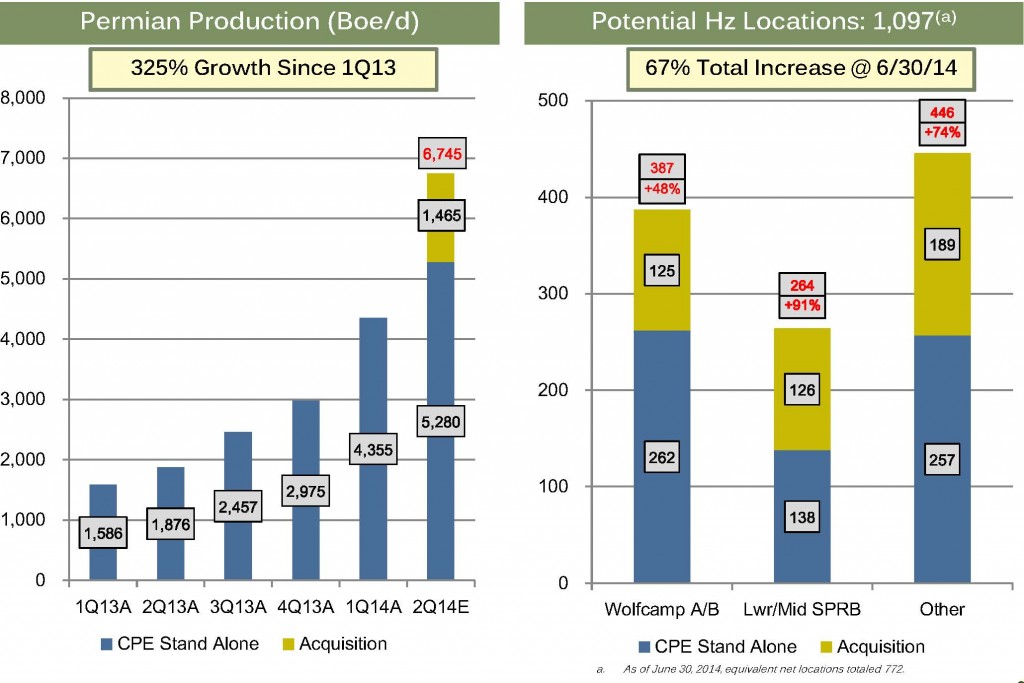

Callon’s most significant increase pertains to its inventory. On a metrics scale, Callon paid $53.15 per net BOE of PDP reserves and approximately $55,000 per net acre. On a production-adjusted scale assuming $80,000 per flowing BOE, Callon paid $24,695 per net acre. The company will now hold 1,097 gross potential horizontal drilling locations (772 net), representing an increase of 67% compared to its inventory before the transaction.

Acreage Performance

Callon, along with neighboring E&Ps like RSP Permian (ticker: RSPP) and Diamondback Energy (ticker: FANG), have existing operations nearby its new properties. CPE views its 188 gross locations in the Wolfcamp B, Lower Spraberry and Middle Spraberry formations to be “de-risked” due to industry delineation. The previous operator completed one horizontal well on the acreage, resulting in a peak 24-hour rate of 958 BOEPD. Currently, two more horizontal wells are in the completion stage.

In Callon’s nearby Carpe Diem and Pecan Acres properties, four Wolfcamp B wells completed by Callon returned an average 30-day IP rate of 809 BOEPD. Similar Wolfcamp B wells drilled by neighbors produced a 30-day average of 979 BOEPD, and Lower Spraberry wells have returned average 30-day rates of 705 BOEPD.

“The similar rates on shorter and longer wells are indicative that the difference in EURs is a simple adjustment based on length,” said Newberry.

The company plans to develop its acreage using 5,000 foot laterals with forecasted drilling and completion cost between $6.4 million to $6.5 million apiece. The wells are expected to yield EURs ranging between 419 MBOE and 474 MBOE with oil content of 83% to 88%. Based on Callon’s models, these wells are expected to generate internal rates of return greater than 10% even at a realized oil price of $60.00 per barrel.

Permian Operations Charging Forward

2014 is Callon’s first full year as a Permian pure play following the divesture of its Gulf of Mexico assets late in 2013. The Permian is North America’s greatest producing region by volume and its production continues to rise, with contributions made by Callon’s growth on a quarter-over-quarter basis. The acquired assets are nearly equal to CPE’s total production volume in Q1’13.

Pro forma for its latest acquisition, along with another pending purchase of 577 net acres, Callon’s production on a Q2’14 basis equals 6,745 BOEPD (80% oil) on 100,092 net effective acres. The pro forma production rate represents a 28% increase in comparison to Q2’14 totals – the same quarter when the company set a new production record of 5,280 BOEPD (21% higher than Q1’14). Assuming the closing of the transaction, CPE has 37 producing horizontal wells and 274 producing vertical wells as of August 26, 2014.

Current Operations

Its 2015 exit rate target is 10,000 BOEPD – 48% above its pro forma production. Callon management said the addition of a fourth horizontal rig is possible. Newberry said there is work to be done on an infrastructure standpoint, particularly since the previous operator was working with a single rig. “I expect the infrastructure to be ready by the middle of next year,” he said. “We’ve done this for some time now, and we know what it takes. It’s important we do this in a measured way, but we also need to be very aggressive.”

Callon, as previously mentioned, will fund the acquisition with cash and has secured an increase in its borrowing base post-acquisition to $250 million, and currently has approximately $142 million drawn. An additional $275 million is available from committed debt financing as part of an agreement with JP Morgan.

The company’s debt to EBITDA ratio will be 2.6x following the transaction, but the company has long term goals to maintain a EBITDA to debt ratio of 2.0x to 2.5x. Gatto said, “Although we are above our ratio for a short period of time, we expect it to drop within our range once we implement our three rig program.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

Johnson Rice & Co. Note (9.2.14)

Transaction details – Callon is acquiring 6,230 gross (3,862 net; 62% w.i.; 100% HBP) acres, located in Midland, Andrews, Martin and Ector Counties for $212.6 million. The properties are located near its existing Carpe Diem and Pecan Acres properties and offset significant industry activity (see page 3). Production from the properties averaged 1,465 boe/d (68% oil) during 2Q:14, virtually all of which comes from legacy vertical Wolfberry wells (only one Wolfcamp B horizontal producing) and the properties have 4 mmboe of PDP reserves (no PUDs estimated at this time) with an associated PDP PV-10 of ~$100 million. Adjusting the acquisition price for the acquired production (assuming $80k per daily flowing boe, given the nature of the vertical producers), the adjusted acreage price is ~$25,000 per acre (~$32,000/acre assuming $60k per daily flowing boe), which is in-line with a number of transactions announced in the past few weeks. The shallow decline of the acquired properties can be clearly seen on page 3 of this report, which shows the production level of the acquired properties since January 2012. Callon will assume operatorship of the properties upon closing of the transaction, which is expected on October 1.

Adds critical mass to drilling inventory - This transaction increases its acreage in the southern and central Midland Basin to 18,062 net acres (up from 14,200 net acres) adds 440 gross (273 net) locations with an average lateral length of ~6,325' to its inventory across all of the prospective zones, increasing its total inventory in the Midland Basin to 1,097 gross (772 net) locations.