Kase Lawal, Chairman and Chief Executive Officer of CAMAC Energy (ticker: CAK), first said 2015 will be the company’s most profitable year in history in its Q1’14 conference call. Since then, interest around the industry is building in anticipation of the completion of Oyo-7 and Oyo-8 – two “high impact” wells located offshore Nigeria in exploration blocks OML 120 and OML 121.

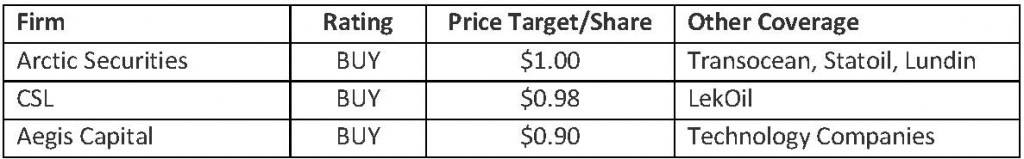

A third security firm initiated coverage on CAMAC on September 23, 2014. Aegis Capital Corporation joined Arctic Securities and CSL as the trio covering developments of CAK, and all have announced their coverage since April 2014.

Click here for Aegis Capital’s full report on CAMAC Energy.

CAMAC Primer

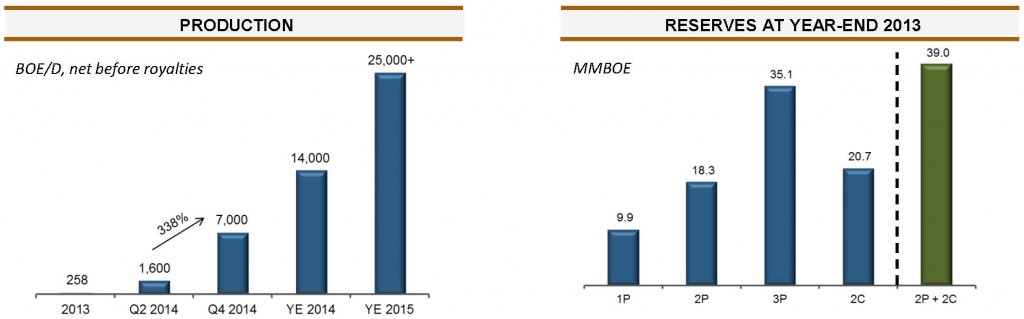

CAK is currently producing roughly 2 MBOEPD from the Oyo-5 and Oyo-6 wells offshore Nigeria, and is in the process of completing the Oyo-7 and Oyo-8 wells. The company anticipates production of 7 MBOEPD per well, and another three targets have already been identified for the Oyo-9, 10 and 11. The Oyo-9 is expected to be completed in 2015, meaning CAK could exit the year at more than 25 MBOEPD. Currently, all wells are targeting the Pliocene formation, but tests have confirmed the existence of the deeper Miocene formation, which “could elevate the firm’s value significantly,” says the report.

CAK also has properties in Gambia, Ghana and Kenya, and is currently testing the quality of the assets through seismic shoots and geological surveys.

Source: CAK August 2014 Presentation

Analyst Valuation

Aegis Capital did not include CAK’s non-producing properties in its valuation, but did estimate the value of OML 120 and OML 121 at more than $1.5 billion ($600 million and $940 million, respectively). Proved reserves of its Oyo fields is 9.9 MMBOE, and CAK believes its prospects may yield more than one million additional barrels. Total estimated value is $1.7 billion including free cash flow, leading to its valuation of $1.00 per share due to 1.7 billion shares outstanding.

The company also holds 100% ownership of these properties and secured drilling, storage and transportation contracts to execute its plan. With the addition of new wells, Aegis Capital believes CAK could exit 2016 producing more than 25 MBOEPD.

The report concludes: “We believe that the company is well positioned to deliver predictable and repeatable oil production growth at Brent pricing, high-margin oil projects, and advanced frontier exploration in West and East Africa. The company is likely to continue to add attractive exploration assets to its portfolio, in our view. In Nigeria, OML 120/121 is a prolific oil producing region with ExxonMobil, Shell and Chevron operating producing fields in the surrounding areas.”

CAMAC does not provide guidance on revenue totals, but Aegis believes the company will produce $47.7 million and $503.5 million in revenue for 2014 and 2015, respectively. The company will be operating at a net profit by 2015 in the forecasts, with an estimated $317 million in cash on hand equivalents by the end of the year. Aegis estimates the company had less than $1 million cash on hand at year-end 2013.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.