CAMAC Energy Inc. (ticker: CAK) is a Houston-based oil and gas company engaged in the exploration of offshore oil and gas leases in deep water Nigeria. The company is completing two separate wells in the Oyo Field and expects to generate a total of 14 MBOPD.

CAMAC’s Growth

CAK has methodically built up its position offshore Nigeria over the past fiscal year through equipment acquisition and boosting its stake in the projects. Since the announcement of its Q2’13 results on August 13, 2013, the company spud two offshore development wells with one reaching total depth of 6,059 feet. Along the way, CAK secured a rig contract in addition to a floating, production, storage and offloading (FPSO) vessel by the end of fiscal 2013.

The company was awarded a total of $270 million in financing from the Public Investment Corporation Ltd. of South Africa upon a successful listing on the Johannesburg Stock Exchange. To date, the first tranche of $135 million has closed. An additional $100 million in financing from Zenith Bank plc was awarded to CAK’s subsidiary on September 8, 2014, designed to fund the ongoing development of the Oyo Field. Management believes the $100 million will satisfy all financial requirements through the end of the current fiscal year.

Payoff Approaching

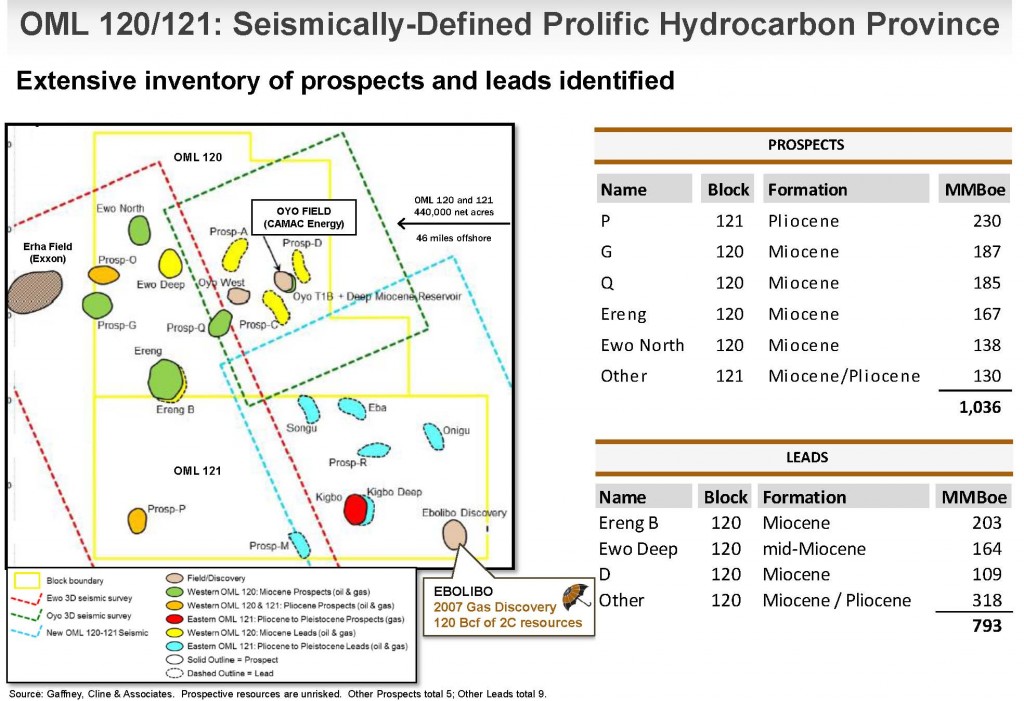

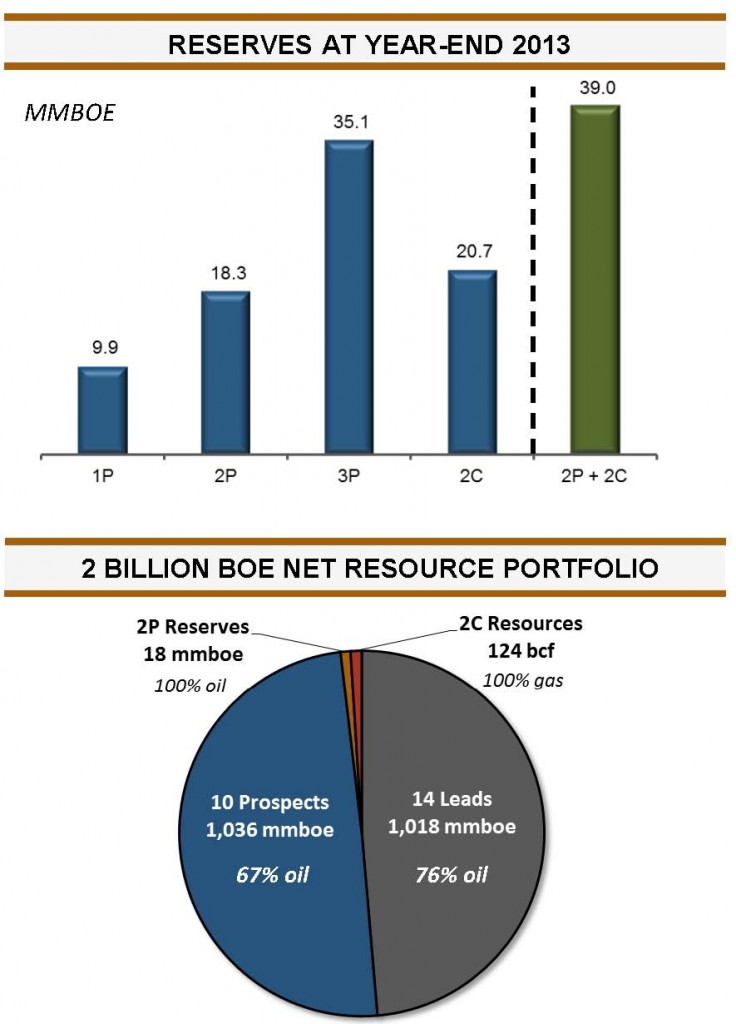

CAMAC’s Oyo target area is Oil Mining Licenses (OML) 120 and 121, located two licenses north of Shell’s (ticker: RDS-B) Bonga field. The Bonga has produced approximately 450 MMBO since being brought online in 2005 and is producing from multiple formations, including the Miocene. CAK’s two wells, the Oyo-7 and Oyo-8, discovered new formations when they were drilled, including the Miocene in the Oyo-7. While presenting at EnerCom’s The Oil & Gas Conference® 19, Earl McNiel, Chief Financial Officer of CAMAC Energy, told investors and analysts that the company is updating its reserve base following the discovery of the new formations.

CAK upped its ante in its OML blocks by acquiring the remaining 57.2% stake from its majority stockholder in November 2013. The company now has 100% working interest in the area and owes a royalty of 12% to the Nigerian government. Each Oyo well is expected to return 7,000 BOEPD and both Oyo-7 and 8 are expected to be online within the fiscal year. Management has identified a break-even rate of 2 MBOEPD and enjoys a slight premium to Brent pricing due to the quality of Oyo’s hydrocarbons.

“In terms of a baseball game, we’re still in the first inning,” said McNiel. “We’ve got a long way to go in unlocking the value contained in this asset base.”

Source: CAK Presentation at TOGC 19

Initiating Coverage

Arctic Securities Research Analyst Christian Yggeseth was the first to initiate research coverage on CAMAC Energy. He gave the company a “Buy” rating. Other oil and gas companies covered by Arctic Securities include, but are not limited to, Transocean (ticker: NOK), Statoil (ticker: ESV), Lundin Petroleum (ticker: LUPE.ST), and CGG (ticker: CGG).

On September 9, 2014, Angus McPhail of CSL initiated coverage on CAK with a “Buy” rating and a target price of $0.98 per share.

Source: CAK Presentation at TOGC 19

Upcoming Catalysts

Other than the Oyo-7 and Oyo-8, CAK anticipates drilling three more wells offshore Nigeria in 2015. 2014’s exit rate is already projected to reach 14 MBOEPD, with 2015’s exit rate forecasted at more than 25 MBOEPD.

Operations will ramp up considerably in 2016. CAK’s Oyo field is currently its bell cow, but the company also has properties in Kenya, Gambia and Ghana. Evaluation of those areas is currently underway through 2D and 3D seismic tests, and a total of five wells are slated to begin drilling in 2016. Management says drilling in Ghana may begin as early as 2015 if exploration tests are successful.

In its Q2’14 conference call, management also mentioned it “Always wants to share risk,” and has received interest from nearby operators in participating in a high impact exploration well. CAK wasn’t specific on the companies, but neighboring E&Ps include giants like ExxonMobil (ticker: XOM), Chevron (ticker: CVX) and Shell.

In the future, the company aims to boost the attractiveness of its stock by gaining more institutional ownership and analyst coverage – a route management believes may be accomplished through a reverse stock split, which was authorized by shareholders in May. In the meantime, CAK has kept its debt level low, which is a plan not followed by many small-cap companies. CAK’s current debt to market cap ratio is just 16% and compares favorably to its peers in EnerCom’s E&P Weekly database. Its debt to market cap ratio is well below both the industry median of 37% (consisting of 85 companies) and the small cap median of 67% (consisting of 21 companies).

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.