If Approved, New Export Capacity would Exceed 3.5 Bcf/d

Sempra Energy’s (ticker: SRE) Cameron LNG plant, located in Hackberry, Louisiana, is about to get bigger.

Representatives for the $10 billion LNG export plant applied for a facility expansion on February 24, 2015 – roughly four months after construction began. If approved, the expansion will provide an additional storage tank along with two liquefaction trains, increasing overall export capacity by 40%. Permission to expand the plant would make it the highest volume LNG exporter in the United States, based on information from the Federal Energy Regulatory Commission. Cameron LNG said its export capacity would be 3.53 Bcf/d in its release, which equates to nearly half of gas production from the Eagle Ford, according to February’s Drilling Productivity Report from the Energy Information Administration.

LNG Update

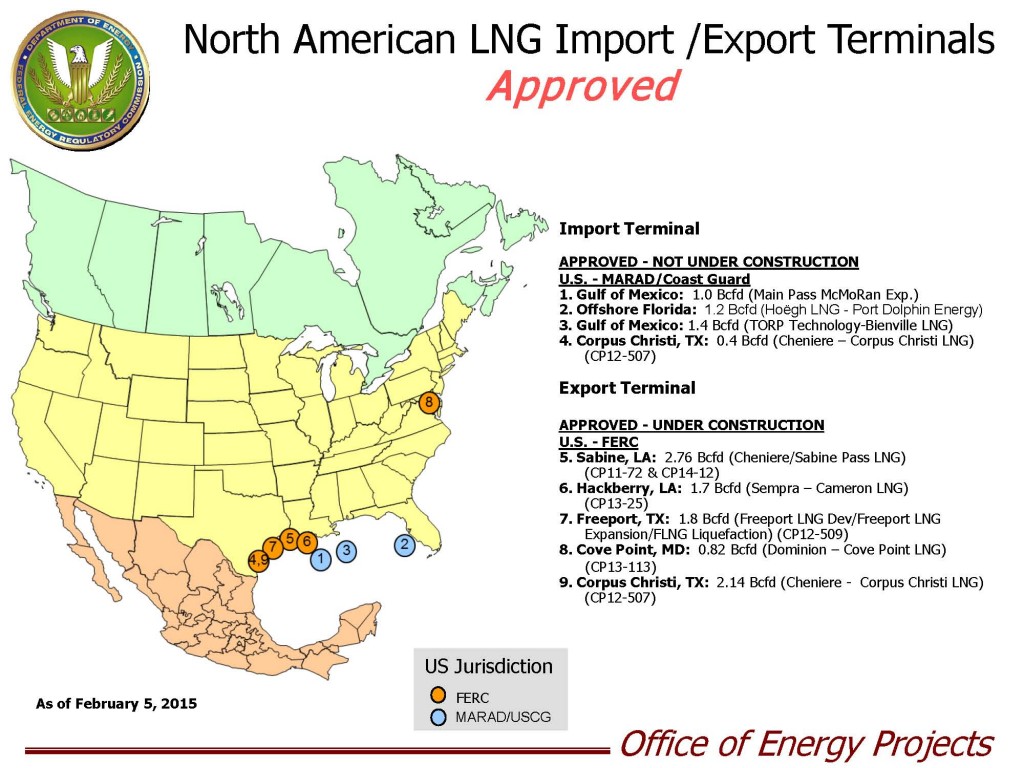

The Cameron LNG plant is scheduled to come online in 2018, but could be pushed back if the potential expansion is approved. The proposed facilities would be constructed within the existing LNG site. According to the FERC, five export facilities are currently being constructed in the U.S., and Cheniere’s (ticker: LNG) Sabine Pass is expected to come online in fiscal 2015.

An additional 14 export terminals have been proposed and are currently under review. Once the terminals are approved, their application is transferred to the Department of Energy (DOE), where a final decision is made after an environmental and economic review. The House of Representatives passed a bill in January (by a count of 277 to 133) that implements a 30-day deadline for the DOE to issue its decision.

Sempra’s partners on the Cameron LNG plant include GDF SUEZ S.A. (ticker: GSZ.PA), Mitsui & Co., Ltd. (ticker: TYO 8031) and Mitsubishi Corporation (ticker: TYO 8058), through a related company jointly established with Nippon Yusen Kabushiki Kaisha (ticker: TYO 9101). The plant is expected to create 3,000 construction jobs over the next four years and 200 full-time jobs in Texas and Louisiana, the company said in a news release.

The only other LNG plant scheduled to come online before Cameron is Dominion’s (ticker: D) Cove Point facility, located in Maryland. Freeport LNG in Texas is tentatively scheduled to be completed in late 2018, around the time Cameron’s first phase will be completed.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.