Russian President Vladimir Putin’s key role in brokering the OPEC agreement

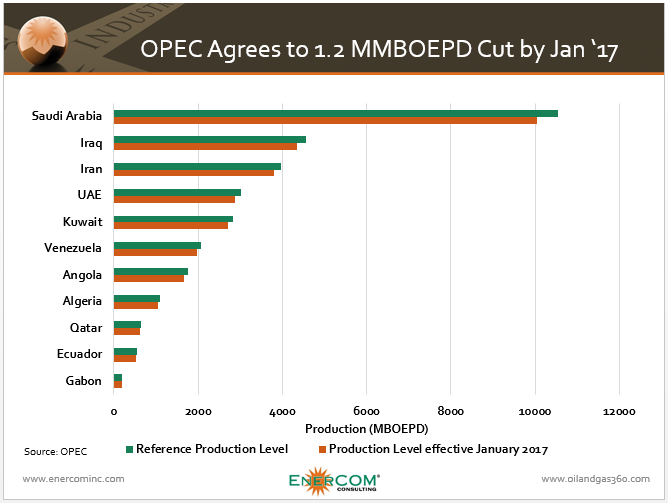

The price of crude oil continues to climb past $50 per barrel following OPEC’s deal to cut 1.2 MMBOPD of production Wednesday.

A number of non-OPEC producers will join the organization in lowering output, chiefly Russia, which has agreed to reduce its production 300 MBOPD from post-Soviet highs. Russian President Vladimir Putin appears to have played a key role both in Russia’s involvement in production cuts, and the success of the OPEC deal, which many feared would fall apart as regional rivals Saudi Arabia and Iran continued to butt heads.

Many market watchers were concerned that the deal may not materialize as Saudi Arabia continued to demand that Iran join in making production cuts, despite the Islamic Republic’s repeated instance on increasing production to pre-sanctions levels. In a compromise that took some by surprise, Saudi Arabia will take “a big hit” and cut its production by 486 MBOPD while Iran will increase its own slightly by 90 MBOPD.

Former Ambassador to Oman and CEO of Equilibrium International Consulting Gary Grappo told Oil & Gas 360® Saudi Arabia needed the political win, and both countries will benefit from higher prices, but it appears Putin also played a key role in Wednesday’s outcome.

Pivotal intermediary

Putin acted as a pivotal intermediary between Riyadh and Tehran, according to a report from Reuters. Ahead of Wednesday’s deal in Vienna, the Russian president established that the Saudis would shoulder the majority of OPEC’s cuts, as long as Iran agreed not frame the compromise as a victory over the kingdom. Putin discussed the agreement with Iranian President Rouhani who, along with Iranian Oil Minister Bijan Zanganeh, convinced Ayatollah Khamenei of the importance of accepting the deal and continuing political lobbying with Putin, reports Reuters.

Zanganeh kept a low profile at the meeting in Vienna, according to OPEC delegates. Afterwards, the normally combative minister avoided any comment that might be read as claiming victory over Riyadh.

“We were firm,” he told state television. “The call between Rouhani and Putin played a major role … After the call, Russia backed the cut.”

Now Putin’s authority faces a test in his own country

While many are relived with the outcome of this week’s OPEC meeting, it remains unclear how exactly Russia will cut 300 MBOPD of its own production. Following the OPEC announcement, Russian Energy Minister Alexander Novak said the country would “gradually” cut production in the first half of 2017.

“Russia is ready to join the agreement … Based on our active talks over the last couple of months with key OPEC members and non-OPEC countries, Russia will gradually cut its output by up to 300,000 barrels per day in the first half of 2017,” Novak told reporters.

He added that it was technologically challenging for Russia to cut production sharply.

“Our talks with non-OPEC countries allow us to expect some countries to join the deal, cumulatively contributing approximately up to 300,000 bpd,” Novak said. He did not elaborate.

So far, no Russian oil companies have explained how they will cut production, and “even if mandated by the Kremlin, [a production cut] would be akin to herding cats,” Macro Advisory Moscow Partner Chris Weafer told Bloomberg. Lukoil, Russia’s second-largest producer, supports OPEC’s moves to stabilize global oil markets, Pavel Zhdanov, the company’s director of capital markets and mergers and acquisitions, said during a conference call. It appears that majority of Russia’s cuts will fall on state-owned Rosneft, however.

“Rosneft looks like the number one company that should take the biggest share of the cut,” Ildar Davletshin, an oil analyst at Renaissance Capital, said by e-mail. It controls almost 50 percent of Russian oil output and it has one of the lowest shares of so-called greenfields, or new developments, in its production portfolio, he said.

Russia’s cuts are its decline curves

Cuts will likely be centered on aging and less economic fields, with companies like Rosneft allowing decline curves to take care of cuts for them, rather than halting the development of new projects. Moving forward with more greenfield projects allows Russia to protect its service industry as well, according to Mikhail Pshenitsyn, who has worked for more than 10 years in the country’s oil industry.

“The average production at new wells in Russia is around 50 tons a day, so Russia would need to decide against drilling around 800 new wells and leave some 100 drilling teams out of work,” Pshenitsyn said. “And where will we get them once we need them again?”

Cuts to Russian production, and the share of that burden that would likely fall to Rosneft, could put Putin at odds with his long-time ally, and CEO of the state-run oil giant, Igor Sechin. Leading up to the November 30 meeting, Sechin made no secret of the fact that he did not believe Rosneft should freeze production, much less reduce output.

Why should we do it?

“Why should we do it?” Sechin, known for his anti-OPEC position, said to Reuters in October. Sechin followed up with another question, asking if Iran, Saudi Arabia or Venezuela would cut their own production, implying the answer was likely “no.” Now that Saudi Arabia and Venezuela, which has been suffering more than most OPEC members, have both agreed to cuts, it remains to be seen if the head of Rosneft will fall in line with Putin’s plan.

“Putin wants the deal. Full stop. Russian companies will have to cut production,” a Russian energy source briefed on the discussions said to Reuters.

Venezuela needs higher oil prices, Putin got them

Stratfor reported today that the Venezuelan government expects social unrest to increase in 2017. “The country has prioritized making its foreign debt payments over using its oil revenue for imports,” according to Stratfor, “which has led the food supply to continue to tighten and inflation to climb. Control of food through a network of distribution networks, known as Local Supply and Production Committees, directly administered by the Venezuelan state under the direction of the Defense Ministry, could help the government keep a lid on security disruptions driven by worsening economic conditions. Widespread protests against the government may be less likely if people fear that those actions could disrupt their food supply, given that the state directly administers most of these networks,” according to the report.

Stratfor reported today that the Venezuelan government expects social unrest to increase in 2017. “The country has prioritized making its foreign debt payments over using its oil revenue for imports,” according to Stratfor, “which has led the food supply to continue to tighten and inflation to climb. Control of food through a network of distribution networks, known as Local Supply and Production Committees, directly administered by the Venezuelan state under the direction of the Defense Ministry, could help the government keep a lid on security disruptions driven by worsening economic conditions. Widespread protests against the government may be less likely if people fear that those actions could disrupt their food supply, given that the state directly administers most of these networks,” according to the report.

“The country is betting that the OPEC production cut finalized Nov. 30 will lead to sustained higher oil prices. If that is the case, Venezuela could have a greater ability to mitigate the potential for unrest and to avert a more disastrous outcome, such as a foreign debt default for state oil and natural gas company Petroleos de Venezuela.” PDVSA missed an interest payment in November.

Venezuela President Nicolas Maduro heaped praise on Putin at the sidelines of Fidel Castro’s funeral, according to Russian news agency TASS in a story published Tuesday. “Putin’s victories are our victories,” Maduro said, “We’re all looking towards Putin. For us, he is an emblem of fighting for independence and multipolar world.”