Permian, SCOOP/STACK in favor

Baird’s energy research team presented the results of the firm’s 3Q16 Energy Strategy Survey in a conference call today that was hosted by Denver-based senior analyst Ethan Bellamy and New York-based senior analyst Dan Katzenberg. This was the firm’s 14th energy survey since June of 2013.

The Q3 survey set a participation record with 182 respondents, including 87 energy industry executives, 91 buyside investors and 4 others.

Bellamy discussed responses to the question, “What could be the single biggest impediment to a recovery in crude oil prices?” The analyst said demand issues, not supply, dominated respondents’ fears about a potential oil price recovery—trumping supply, inventories, currency and the upcoming U.S. presidential election.

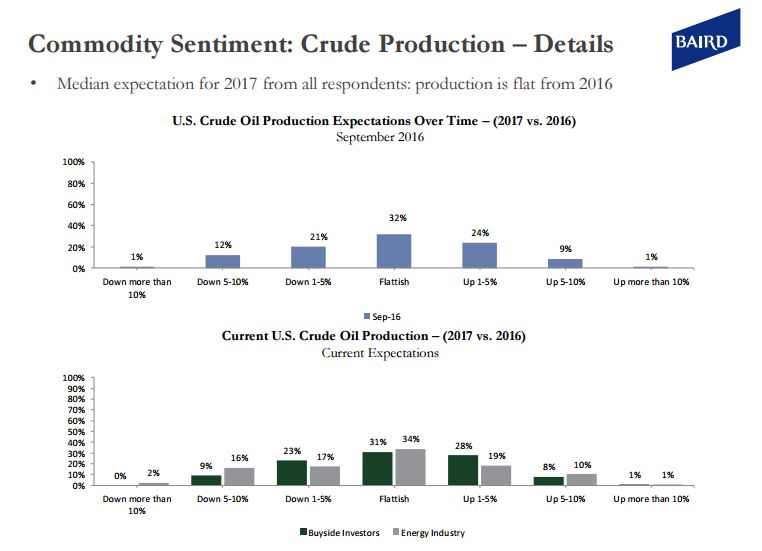

Bellamy said respondents are still bullish on oil plays—the Permian and Oklahoma’s SCOOP/STACK plays in particular. He said the buyside is more constructive on U.S. supply rolling over in 2016, with median expectations from all respondents calling for production to be flat in 2017.

On the natural gas side, Bellamy said respondents largely believe the gas rally, but they expect gas to trade between $2.50 and $3.50/MMBtu. Regarding the elections, Bellamy said Trump was viewed as being “bad for natural gas prices if he were to take the pressure off of coal.”

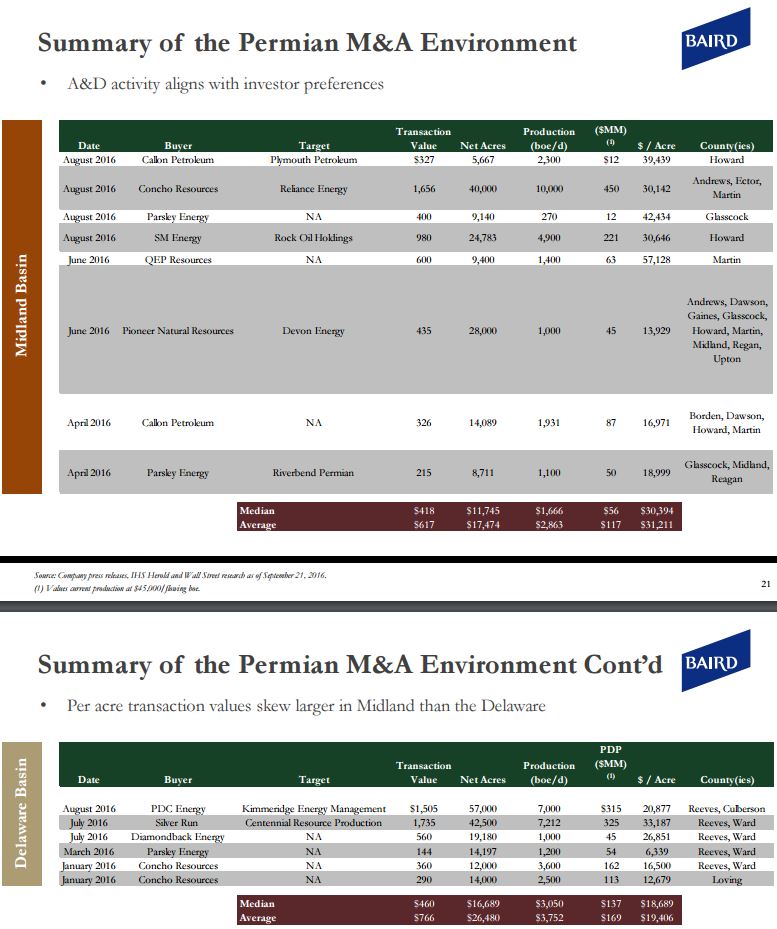

As for A&D activity, the per-acre transaction values skew larger in the Midland than the Delaware, Bellamy said. “How quickly valuations have increased in the past 12-24 months.”

Respondents expect to see M&A activity in the basin to be very robust thru ‘16 and into ’17, Bellamy said.

As for production, “more industry guys believe production might actually be up,” said Bellamy. “There is no consensus about where ’17 production will be.”

What’s hot, what’s not?

In the survey, respondents frowned on exploration, with a third of respondents expressing no interest in new plays. The economic assumptions by play said the Permian is largely in the money, SCOOP/STACK is in the money, Bakken and Barnett are out of the money, and the Marcellus and Utica gas plays are “solidly economic below $3.00.”

The analysts said that the Delaware and Midland continue to gain favor at the expense of all other basins. They said the responses put the Eagle Ford out of favor, which was somewhat of a surprise. “A bearish shift in the Eagle Ford, but interestingly it’s the industry moving more negative on this basin,” the analysts said in their presentation. “The buyside likes the Austin Chalk and the industry is saying it doesn’t care,” the analysts reported.

Operators raising capital in the most favored basins should receive little pushback from investors, the analysts said of the Permian and the two Oklahoma plays. The Haynesville may continue to attract capital due to bigger netbacks.

In the accompanying presentation some respondent comments were highlighted that added some color to the quantitative questions. Below are a few anonymous responses from some of the Baird survey respondents:

- “[The] Permian acquisition spree is totally ridiculous. Companies/investors paying $2-3 mm per potential location is both dumb and stupid. Add that to your D&C cost and then calculate the returns.”

- “Drilling efficiency is real. The marginal cost of a unit of production is moving down, but companies like CPE will pay more than $40,000/acre because investors keep giving them money looking for a 25% buy-out premium. Investors tell us every single day they do not believe in the industry’s IRRs. So why the open door with equity capital?”

- “Sure, the markets in general and the energy markets in particular (and US shale ranks at the top) are being propped up by central bank printing/excess global liquidity, and low interest rates. Mal-investment in the oil patch is rampant which is keeping zombie companies from going under and thereby allowing the sector to undergo the necessary and healthy cleansing process of taking out the weak players and consolidating quality assets in the hands of the financially strong and strategically prudent companies/managements.” –

- “How gullible speculators have been with regard to OPEC. Commentators seem to get it but bulls pour in like clockwork every time.”

“It’s very clear to us that capital is flowing to the low cost production areas,” the analysts said. “We’re cycling through bankruptcies quickly, and the cookie jar could remain open for an extended period of time–at least into 2017,” they said, in reference to the Fed interest rate policy.