More than $3.2 billion in capital raises were either announced or closed this week by three separate oil and gas companies. The largest raise comes from SandRidge Energy (ticker: SD) at a price of $1.25 billion of 8.75% senior notes, including the greenshoe announced on May 29, 2015. Other entities tapping the capital markets were MarkWest Energy Partners (ticker: MWE) with raisings of $1.2 billion of 4.875% senior notes and Cimarex Energy (ticker: XEC) with a $752 million raising in common stock.

Extending the Lifeline

SandRidge updated investors following the upsized raise, saying a portion of the proceeds are intended to pay down the $175 million drawn on its existing revolving credit facility. The amount authorized from the credit facility was also reduced to $500 million from the previous allotment of $900 million. SD management says the lowered credit facility will allow the company less restrictions with its debt covenants. SD now holds liquidity of $1.4 billion but possesses long term debt of nearly $5.0 billion, with the first of its senior notes set to mature in 2020. The latest notes offering is scheduled to mature in 2020 at an annual interest rate of 8.75%

Global Hunter Securities (GHS) said in a note that SD’s new capital provides “more running room as the fall borrowing base redetermination approaches, and the 2020 maturity gives SD additional time for oil prices to recover.” The running room comes at a price; GHS mentions the new notes carry an interest burden of roughly $100 million annually. Any excess liquidity could be used to pay down further debt, considering the $1.4 billion in current liquidity is twice the amount of projected 2015 capital expenditures.

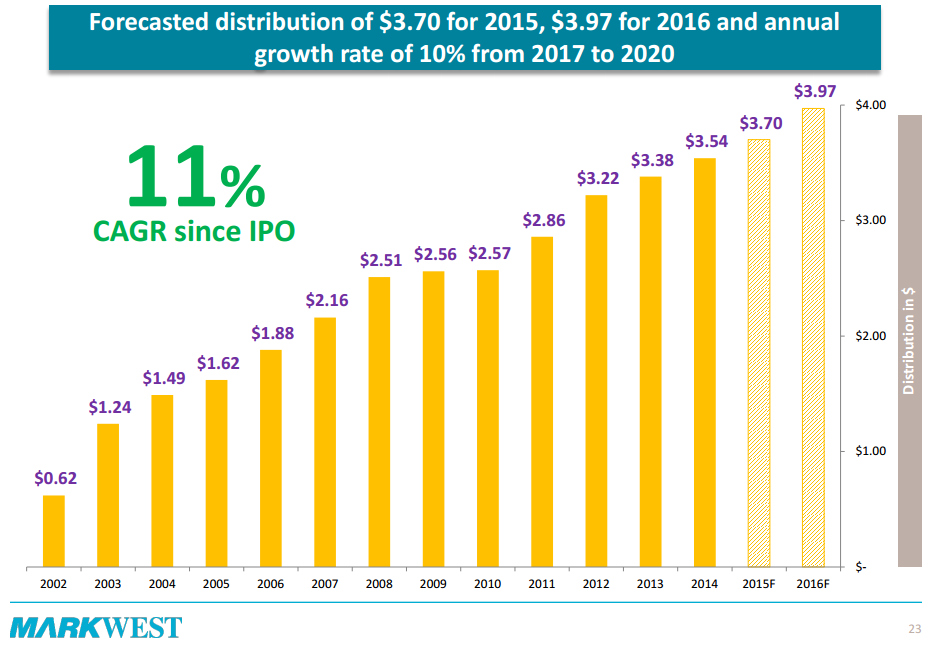

The move is similar to one executed by Whiting Petroleum (ticker: WLL) in March, providing the company with extra capital and an extended lifeline to exploit its drilling inventory. MarkWest Energy Partners is currently tendering offers for $1.2 billion in notes, with the first set to mature in 2020. MWE secured $1.15 billion from two offerings dating back to November and has historically funded its capital requirements through such long term debt and equity combinations. The Partnership anticipates an annual distribution growth rate of 10% from 2017 to 2020.

Private Equity has Its Hands Full

Private equity firms have been extremely active in the market downturn. NGP Capital Management launched its 11th fund in January with more than $5.3 billion at its disposal, with CEO Ken Hersh expressing confidence in his firm’s ability to navigate market downturns. EnCap Investments loaded up with a $6.5 billion private equity fund just last month.

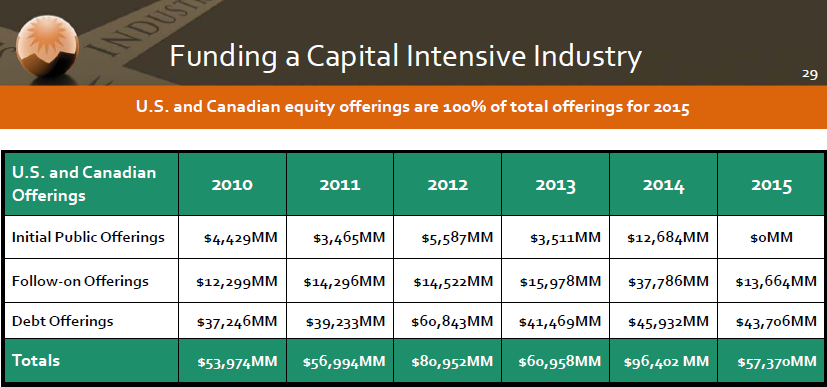

As indicated by the table below, 2015 debt offering amounts (which include the issuance of senior notes) are already in the top half in terms of amount spanning the previous six years. Many companies have been forced to raise capital through debt to provide short-term liquidity in the lower commodity environment, which has substantially increased leverage among the smaller players in the energy field. Larger, more well-positioned companies like Chevron (ticker: CVX), ExxonMobil (ticker: XOM), Noble Energy (ticker: NBL) and Plains All American (ticker: PAA) can more easily raise capital via a follow-on offering due to their stability and solid balance sheets. The four mentioned companies have raised the majority of the secondary raises in the table below.

Cimarex closed on its $752 million stock offering earlier this week, but the extra capital is not intended to pay down debt. Rather, the large cap company aims to “fund increased drilling and completion activity in the second half of 2015 and more significantly in 2016.” XEC is currently completely unhedged, raising the question if XEC management sees an oil price recovery on the horizon.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.