CARBO Ceramics Inc. (ticker: CRR) is the world’s largest supplier of ceramic proppant for fracturing oil and gas wells and a supplier of resin-coated sand (RCS) proppant; the provider of the industry’s most widely used fracture simulation software; and a provider of fracture design and consulting services. The company also provides a broad range of technologies for spill prevention, containment and countermeasures.

Q1’14 Earnings

CARBO Ceramics reported net income of $148.6 million ($0.80 per share) for Q1’14 in an earnings release on April 24, 2014. Quarterly revenue reached $148.6 million – 1% higher than Q1’13, despite the sales volumes being impacted from cold weather. Operating profit increased by $2 million (8%) trailing 12 months due to a rise in proppant sales. The Northern White Sand proppant increased its sales by 614% in the same time period.

The modest growth of the comparative quarters is attributed largely to operational difficulties experienced by CARBO’s clients. Several operators, particularly in the Bakken, experienced production drops and transportation issues due to the elements. OAG360 notes CARBO was successful in stabilizing its balance sheet despite a difficult quarter in what Gary Kolstad, President and Chief Executive Officer of CARBO, said, “Wells just weren’t getting completed.”

Source: CRR March 2014 Presentation

Sales are expected to increase in Q2’14 and Q3’14 to compensate for slower than expected Q1’14 levels.

In a conference call following the release, Kolstad added, “We believe that the potential for higher industry activity levels exists for the remainder of the year, driven by a continuing trend of more fracs per well and modest drilling and completion efficiency gains.”

Technology Review

CARBO’s ECONOPROP proppant, a low density ceramic, exceeded expectations when used by independent operators in the Bakken, Eagle Ford and Delaware Basin, respectively. Cumulative production in the Eagle Ford increased 20% ($800,000 net value to the operator) and the Delaware, when combined with CARBOLITE®, doubled the rates of nearby competitor wells. The Bakken operator has reordered proppants and another operator in the Permian enlisted a CRR subsidiary to provide consulting services on a 75-well project.

FRACPRO®, a version of stimulation software, was released in the quarter and uses several treatments, including real-time monitoring, pumping rates and friction calculation, to determine optimal operations. The company also plans on deploying SCALEGUARD, a reservoir management solvent, to its clients in upcoming quarters. The company is also expecting extra volumes of KRYPTOSPHERE by Q2’15 once an existing line is successfully retrofitted. The Gulf of Mexico has been identified as the primary target for the proppant, which specializes in deep wells. There have been no sales to date on KRYPTOSPHERE since it has not been produced commercially, but management placed importance on building inventory. Kolstad said, “I believe it can sell itself.”

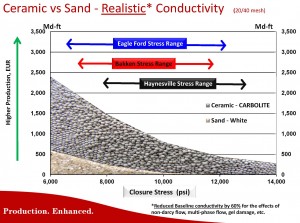

Source: CRR March 2014 Presentation

Moving Forward

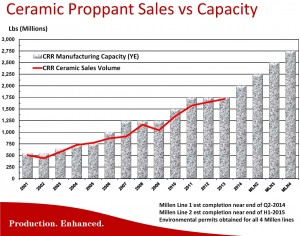

Millen Lines 1 and 2 will boost CARBO’s proppant capacity to 2.25 billion lbs. once both are online in Q2’15. Construction was not hindered by weather conditions. The company’s current capacity is 1.25 billion lbs., and each line will add 0.5 billion in overall capacity. A total of four Millen Lines are scheduled to be built and will bring total capacity to 3.25 billion lbs. once all are completed.

In the conference call, management said the amount of imported proppants, specifically from China, continue to fall. The import level has dropped “considerably” since 2011, and 2014 appears to be following the decreasing trend. CARBO says the use of Chinese proppants can damage wells and decrease estimated ultimate recovery. CARBO’s presentation says effectively stimulated wells can reduce the need for downspacing and ultimately reduce finding and development costs. WPX Energy (ticker: WPX), one of CRR’s clients, says the additional costs for high-grade proppants are offset by increased, reliable production rates.

Capital Intensity (%)

CARBO’s client base continues to grow and has now reached 178 companies – up from 119 in 2012 and 68 in 2011. The company also gives back to its shareholders through repurchases and dividends. Roughly 37,000 shares of common stock were repurchased in the quarter (roughly $4.06 million worth), and a total of 1.9 million shares have been repurchased since September 2008. Dividend amounts have increased every year since 2000 and have grown at an annual compound rate of 16% since 2006.

OAG360 notes CRR is backed by capital intensity historically below its peers. Capital intensity, one of the many valuation tools used in ECI’s database, provides an estimate of the investment needed to generate $1.00 in EBITDA. As seen in the graph above, CRR consistently ranks below its 31 peers in the oilservice industry. Although the ratio rose in Q4’13, OAG360 believes a drop will occur in the near future due to weather hampering the most recent quarter.

A key piece of CRR’s future is found on its balance sheet: CARBO operates with zero debt.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. A member of EnerCom, Inc. has a long-only position in WPX Energy.