In an effort to strengthen its balance sheet, Cenovus (ticker: CVE) has sold its royalty unit to Ontario Teachers’ Pension Plan (Teachers’) for gross cash proceeds of approximately $3.3 billion. The unit, named Heritage Royalty Limited Partnership (HRP), is a wholly owned subsidiary consisting of 4.8 million gross acres of royalties and mineral fee titles in Alberta, Manitoba and Saskatchewan.

Total volumes for HRP, considering royalties and working interests, totaled about 14.8 MBOEPD in Q1’15. CVE management said it considered an initial public offering, among other options, for HRP, but in the end believed an outright sale was the most beneficial for the company and its shareholders. The transaction metrics equated to $223,000 per flowing BOEPD, while the estimated cash flow of HRP is $30 million. Revenues in 2014 totaled about $320 million in fiscal 2014.

In the press release, Brian Ferguson, president and chief executive officer of Cenovus, said the proceeds will “strengthen our balance sheet and provide us with greater resilience during these uncertain times as well as the flexibility to invest in organic projects with strong returns.”

Background to the Deal

According to Reuters, royalty lands are privately held oil and gas properties that are not subject to the royalties that producers pay governments for operating on publicly owned lands. Instead, producers pay a mineral tax to governments and royalties to the owners of the properties.

Teachers’ is the largest single-profession pension plan in Canada and manages pensions for 311,000 working and retired teachers. The plan reported management of $154.5 billion in net assets as of year-end 2014 and created a Natural Resources Group in 2013. Ziad Hindo, Senior Vice President of the Natural Resources Group, said the HRP acquisition fits in with Teachers’ strategic shift of focusing more on “direct and diversified energy sector holdings.” The plan had $11.9 billion in energy investments before its latest deal.

Cenovus, Pro Forma

Cenovus is one of Canada’s largest oil and gas producers and is the third largest E&P by market cap on EnerCom’s International Benchmarking report, consisting of 54 companies.

The proceeds from the HRP sale will be used to pay down debt, which accounts for 35% of its market cap in the EnerCom report. Its cash position would have been $6.16 per share on a pro forma basis, relating to Q1’15 results. Consolidated production will only decrease by its 7.8 MBOEPD of third party volumes in the transaction. Production moving forward is 287.2 MBOEPD.

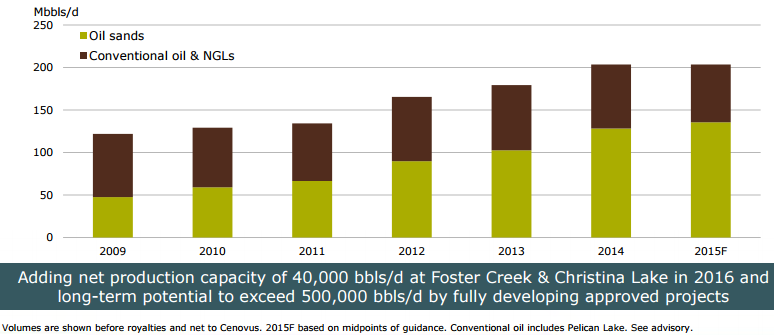

Cenovus has sharply cut down on investment costs in the new commodity environment – 2015 capital expenditures are down 38% compared to 2014’s investment of $3.1 billion. Its oil sands projects in Christina Lake and Foster Creek account for the bulk of production volumes and increased by 25% on a year-over-year basis in its fiscal 2014 earnings release. In its Q1’15 conference call, management discussed the sale of the royalty business at length but assured the audience that the proceeds will not be used on potential acquisitions. In an additional balance sheet-padding event, Cenovus issued $1.4 billion in a bought-deal offering in March.

“The decision to raise equity was based on an assessment of our three-year business plan and our organic investment opportunities,” said Ferguson in the quarterly call. We wanted to have the highest level of certainty if prices remained low… and we decided the minimum amount of equity that would give us the certainty to be able to continue to be able to invest in these higher-return, organic projects at Foster Creek and Christina Lake.”