During his introductory comments on the Noble Energy (ticker: NBL) Q2 earnings call today, Noble Chairman and CEO Charles Davidson said:

“I wanted to spend a couple of minutes discussing the regulatory environment for oil and gas development in Colorado, which is certainly gathering a lot of attention right now.

As many of you are aware, certain initiatives have been proposed for inclusion on the November general election ballot, which, if adopted by voters, would become amendments to the State of Colorado’s Constitution.

Over the past several months, we, along with a number of other companies, have worked with the governor’s office on a sensible legislative solution that would provide local communities a stronger regulatory voice and support responsible oil and natural gas development. Unfortunately, time for the legislative solution has passed.

So, while there’s still no assurance on what will or will not make its way to the November ballot, we remain focused on our original plan, which we have been implementing for well over a year. This includes working with others in the industry, Coloradans for Responsible Energy Development, and many non-industry stakeholders to ensure that voters understand the importance of these ballot measures. We are wholly committed to ensuring that Colorado voters are fully informed.

The potential amendments include a proposal for greater local regulation and oversight of oil and gas development as well as the measure for increased setbacks.

We support the input of local communities in the development of oil and gas but that must be balanced with an overall regulatory framework that supports responsible recovery of hydrocarbons partnering with local communities including surface and mineral owners, city and county authorities and other governmental bodies has been and will always be critical to our success in all of our locations worldwide.

We believe the ballot measure proposing a 2,000-foot setback is a step in the wrong direction for Colorado. Existing setback rules which require 500 to a 1,000-foot distance from occupied structures were just put into effect last year and they are some of the most aggressive regulations in the country.

The 2,000-foot setback while a fourfold increase in direct distance is a 16-fold increase in terms of total surface area affected. This would have a significant impact on development of oil and gas in certain areas of the state. Perhaps not a substantial in the near term as companies could shift their focus to an area that’s not affected. I know you’d like for us to provide a specific number of potential locations at risk. However, without clarity on how the ballot measure would be implemented including the potential for obtaining waivers, quantifying the impact would be pure speculation at this point.

This type of constitutional amendment could ultimately result in a loss of many jobs throughout the state, reduce revenues to surface and mineral owners, and obviously reduce tax revenue to many local and state jurisdictions as well.

This ballot initiative is not just about the oil and gas industry. As Governor Hickenlooper pointed out recently, these initiatives could harm all businesses due to its broad prohibitions. For that reason, there are many other business organizations that have joined us to defeat this proposal. So we’ll do everything we can in our power to provide the necessary information to voters to fully assess the impacts of these ballot measures with the ultimate intention of having them defeat it in November and I certainly believe we’ll be successful.”

During EnCana’s (ticker: ECA) second quarter earnings call this morning, EnCana President and CEO Douglas James Suttles responded to a question on the setback proposal as follows:

“… just for everyone’s background, there were a large number of ballot initiatives started for the November election here. That’s now been reduced to two. And there’s been a lot of development in this space over the last week or 10 days, which we see as positive. The biggest being that some of the most important and significant political leaders here in the state of Colorado have come out and openly opposed these initiatives, as well as almost the entire, if not the entire business community across the state.

People realize this is not an oil and gas issue. This is an economic issue for the State of Colorado.

And we’ll see how that develops over the year. … I think all of the businesses that operate in the State of Colorado realize this would be quite detrimental if implemented as stated in the initiative. The exact percentage is hard to tell and the implications, but it would have a significant impact to all the operators in the DJ Basin if these ballot initiatives came into force. But it’s hard to speculate on, one, whether that happens. And, two, how it would get implemented and what reaction people would have to it.”

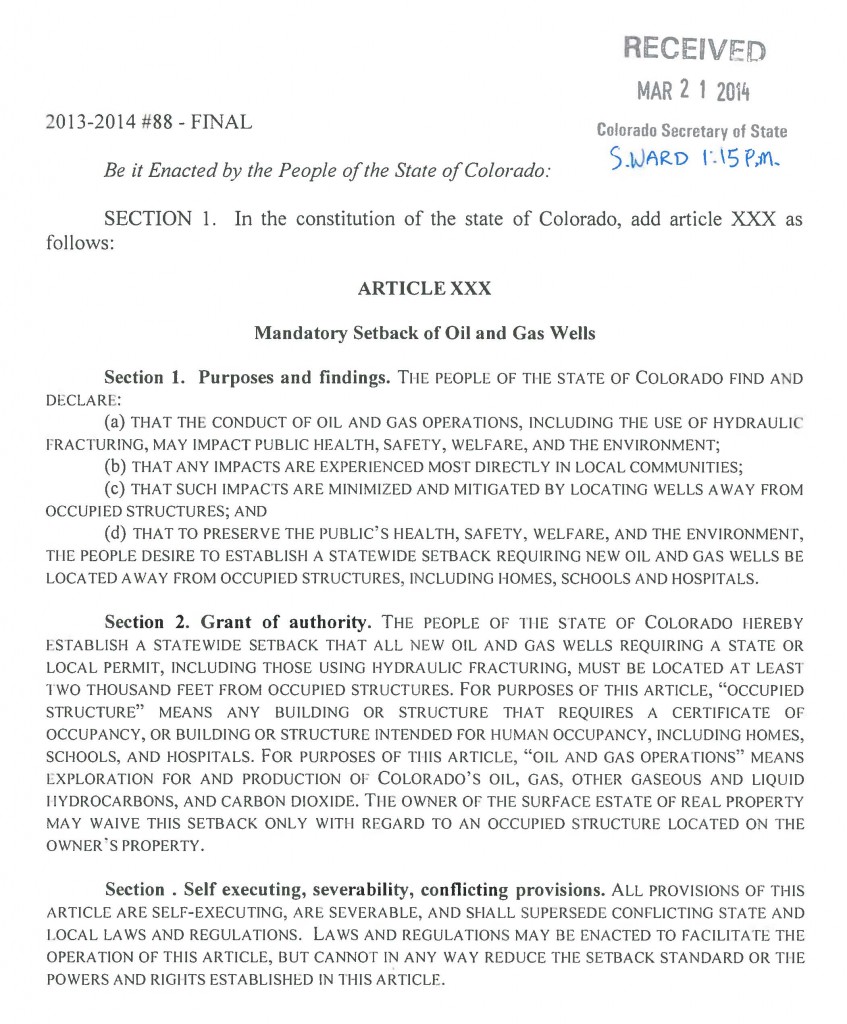

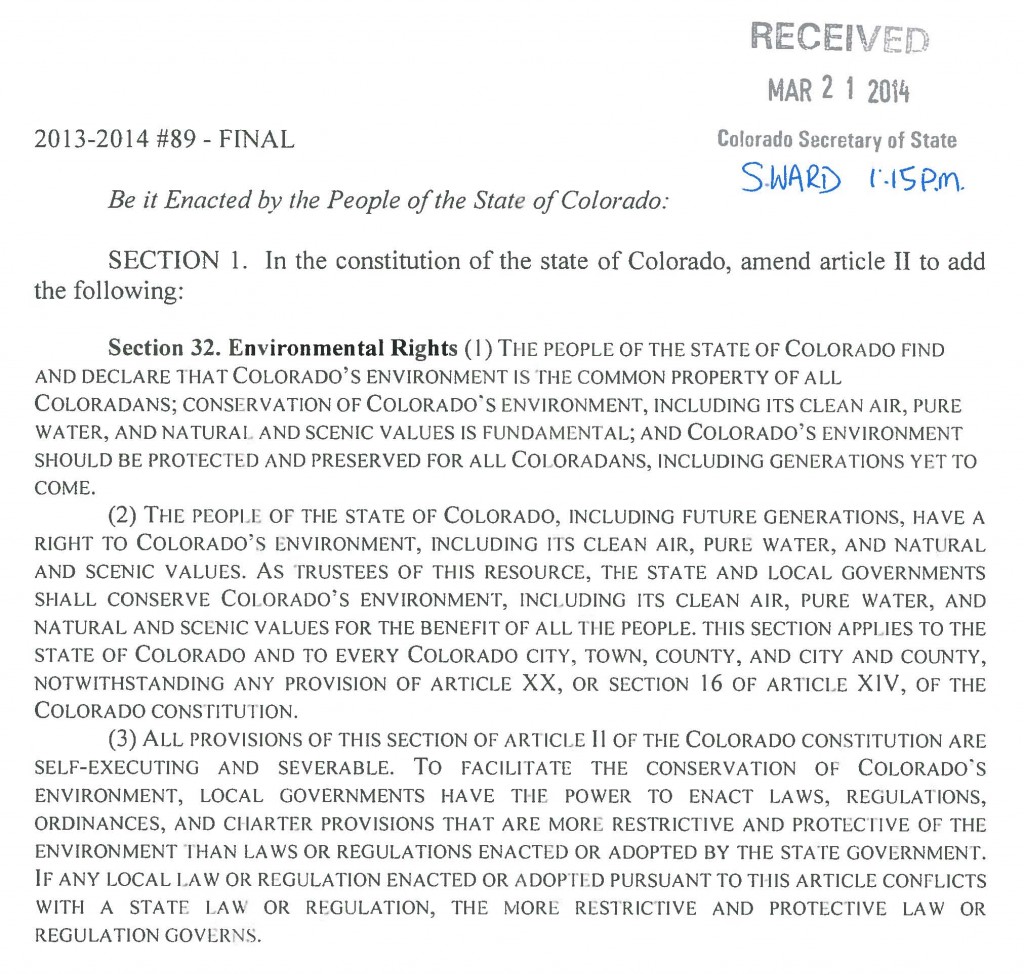

The two initiatives gathering signatures appear below:

Initiative 88 would increase the setback for new oil and gas wells to 2,000 feet from the current state-mandated 500 feet.

Initiative 89 would add an environmental bill of rights to the Colorado constitution and grant local governments the power to enact environmental regulations that are more restrictive than state laws.

OilandGas360® examined the economic boom in Weld County as a result of the increased Niobrara shale activity in the Wattenberg in a two part series earlier this week. Click here for Part One: Will Voters Kill Colorado’s Golden Goose? Click here for Part Two: Will Political Windstorm Bring Wattenberg Development to a Halt?

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.