Natural gas imports continue 8 year decline

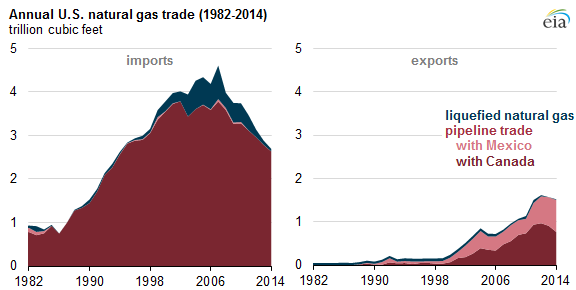

Net natural gas imports to the United States decreased 9% in 2014, continuing an eight-year decline, according to the Energy Information Administration (EIA). As U.S. dry natural gas production has reached record highs, lower domestic prices have helped to displace natural gas imports. Net natural gas imports totaled 1,171 Bcf in 2014, the lowest level since 1987, according to EIA data.

The decrease in imports was driven largely by lower amounts of natural gas shipped in to the U.S. from Canada. About 98% of U.S. natural gas imports come from Canada. The large quantities of natural gas imported from Canada represented 7% of total U.S. natural gas consumption in 2014, down from 11% in 2009.

U.S. natural gas exports also decreased in 2014, but at a slower rate than the decrease in imports, and were still 9% above the previous five-year average. Natural gas exports to Mexico, which account for nearly 50% of U.S. natural gas exports, increased 12% in 2014.

Net imports of liquefied natural gas (LNG) in 2014 totaled 43 Bcf, down 54% from 2013 and continuing a five-year decline. LNG exports increased from 2013 levels, but not enough to offset a nearly 40% decrease in total LNG imports in 2014.

Regional trends in natural gas in 2014 included:

- Inflows of natural gas from Canada were equivalent to 50%-80% of New York’s natural gas consumption as late as 2008. In 2014, however, outflows of U.S.-produced natural gas through pipelines that crossed into Canada through New York State exceeded inflows of Canadian gas, as increased production from the Marcellus region outpaced demand.

- Pipeline outflows of natural gas crossing into Canada through Michigan and Minnesota exceeded inflows of natural gas, but inflows increased and outflows decreased in 2014, likely because of increased demand during the winter months of 2014.

- Natural gas export to Mexico through pipelines crossing the international border in Texas, California and Arizona increased to a record 706 Bcf in 2014 to meet increasing demand from new natural gas-fueled power plants in Mexico. Higher production of natural gas from the U.S. Gulf Coast and the Eagle Ford Shale in southern Texas contributed to the increase in exports to Mexico.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.