U.S. energy intensity has declined by 13% since 2005

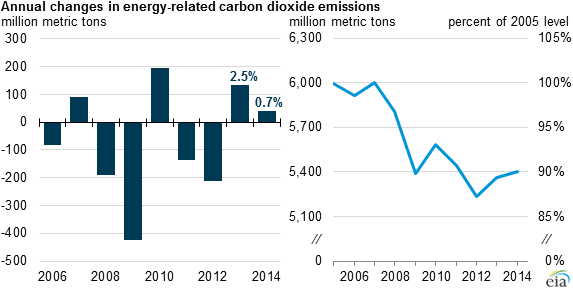

The Energy Information Administration (EIA) released annual statistics about carbon dioxide (CO2) emissions in the United States today. CO2 emissions in the U.S. increased for a second year in a row, but at a lower rate compared to GDP than in the past.

CO2 emissions remain the largest component of overall U.S. greenhouse gas emissions. President Obama set a goal of reducing these emissions by 17% below 2005 levels by 2025. In 2013, emissions and GDP grew at similar rates (2.5% and 2.2% respectively), but in 2014 CO2 increased by just 0.7% while GDP grew by 2.4%.

The U.S. population grew at an average annual rate of 0.7% from 2005 to 2014, while the U.S. economy, as measured by GDP, climbed 1.4% a year during the same time frame. The amount of energy consumed per unit of GDP, or the energy intensity of the U.S. economy, has declined by 13% since 2005 despite the growing population and GDP. In the EIA’s 2015 Annual Energy Outlook, the Administration expects energy efficiencies to result in a 0.4% annual reduction in energy use per capita from 2013 through 2040. The average decline in energy use per GDP will be around 2.0% annually for the same time frame.

There was a 0.7% bump in energy intensity in 2014 due to increased weather-related energy consumption, but energy intensity fell in 2014 by 1.2%

Carbon intensity, or the amount of CO2 emissions per unit of energy consumption, declined by 8% during the 2005 to 2014 time period, with an average decline of 0.9% per year. The EIA projects carbon intensity to drop by 2.3% annually through 2040, with the energy supply accounting for 0.2% of the yearly drop.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.