New Designs Deliver Big Results

The Powder River Basin of Wyoming has traditionally been exploited for its coal resources and coalbed methane gas opportunities. Increased knowledge and improved execution from the oil and gas industry has changed that perception.

The region has more than doubled its oil output since 2009, and the handful of E&Ps in the region have been rather secretive of their trials and errors from the play. The Powder River Basin and other formations in the Rocky Mountain Region, including the Niobrara, Codell, San Juan, Piceance and Denver Julesburg, are receiving extra attention from improved drilling and well completion methods but their consistency is still an issue.

Core Laboratories (ticker: CLB) is commissioning operators to submit rock results in order to conduct a regional study. “This unconventional oil and gas reservoir has proved to be challenging in terms of reservoir characterization, predicting producibility potential, estimating ultimate recovery, and optimizing fracture stimulation techniques,” says the report from Core Lab. “Many companies either do not have or have limited rock property data that are crucial for understanding these reservoirs.”

Two large E&Ps updated their respective Powder River Basin results in recent conference calls.

Chesapeake Rolls Out Results

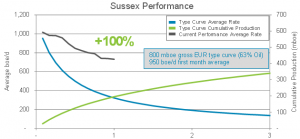

Chesapeake Energy (ticker: CHK) increased its Powder River Basin type curves by 20% compared to its Analyst Day last year. A type curve for the Sussex formation was also released for the first time, and the results are significant: CHK expects 800 MBOE of estimated ultimate recovery from the Sussex wells.

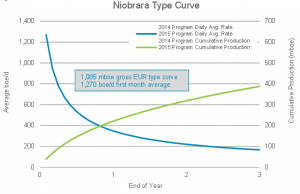

“That historical performance was fully 100% over our type curve, and increases are expected Sussex rate of returns from 20% at the type to 50% at $3.25 and $65,” said Chris Doyle, Executive Vice President of Chesapeake’s Northern Division, in a conference call. CHK brought 11 Niobrara wells online in the quarter with average peak production rates of 1,594 BOEPD.

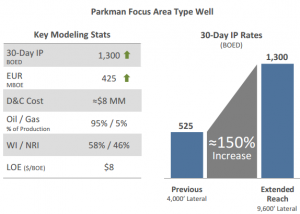

Devon Boosts Type Curve

Devon Energy (ticker: DVN) increased its Powder River type curves due to an enhanced well design. The new curve is aided by extended reach laterals of 9,600 feet and experts to yield EURs of 425 MBOE (95% oil). The 30-day rates for wells in the Parkman formation are 150% higher than the previous design. Just like CHK, DVN brought online 11 wells in the quarter and averaged 30-day rates of 1,300 BOEPD apiece.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.