Despite the weight the Marcellus/Utica region carries on the oil and gas industry, E&Ps continue to de-risk and explore parts of the play in an attempt to find the elusive “sweet spot.”

Chesapeake Energy (ticker: CHK), one of the play’s pioneer companies, sold its southern Marcellus acreage last week to Southwestern Energy (ticker: SWN) for a price tag of $5.4 billion. Industry analysts widely agreed SWN paid a hefty sum for the properties, as OAG360 covered in a feature article following the announcement. The larger than realized price is an indication of regional popularity moving to the south, which has been aided by the emergence of the Utica Shale. Sell side analysts placed per-acre values in the transaction at anywhere from $8,000 to $9,625.

Southern Stronghold: Magnum Hunter Resources

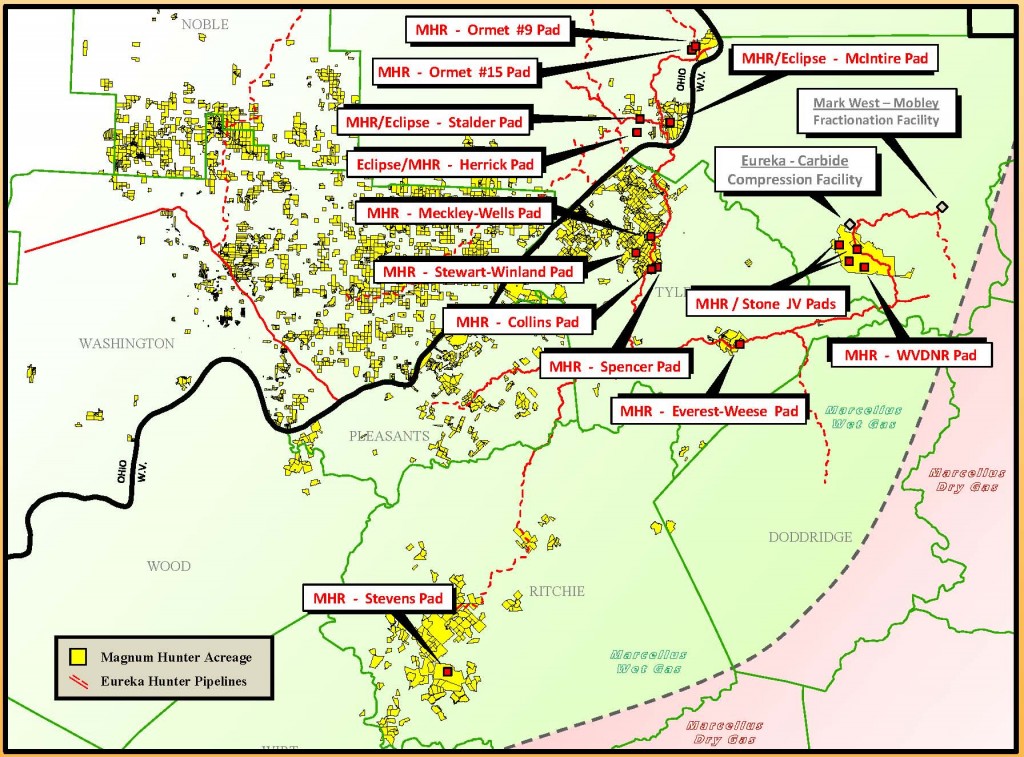

Source: MHR October Presentation

Positioned on the south side of the play is Magnum Hunter Resources (ticker: MHR). Gary Evans, Chairman and Chief Executive Officer of MHR, has often referred to the company’s position as “unique,” and its early entry into the area allowed MHR to build out infrastructure and secure takeaway capacity. MHR had a banner month of September, setting a record in takeaway capacity through Eureka Hunter, its pipeline subsidiary, and drilling a record Utica well in Tyler County, West Virginia. The Stewart Winland 1300U’s initial production rate reached 46.5 MMcf/d, and is not only the first Utica well to be drilled in West Virginia, but is the southernmost Utica well drilled to date.

Valuation Perspective

Sell side analysts from numerous security groups viewed the CHK sale as a positive for MHR, due to the acreage value. SunTrust Robinson Humphrey said the value per acre was nearly double the price of prior sales. Capital One Securities said, “We value MHR’s acreage in the area at ~$14K/acre, but the stock is not pricing in that level.”

Gabriele Sorbara of Topeka Capital Markets described MHR’s acreage as “superior” in a note on October 16, 2014. “Based on our calculation, the assets were acquired for $13,015 per flowing Mcfe/d and $8,947 per acre (adjust for acquired production),” the note says. “An average of these transaction metrics on Magnum Hunter’s production and acreage implies upside of 39.2%… By early next year, we believe management will have transitioned to a pure-play Appalachia company with an improved balance sheet/capitalization and greater transparency on its Utica potential. Further, with its scale in the core Marcellus/Utica shale, we believe Magnum Hunter makes for an attractive takeout over the next 12 months.”

Indeed, MHR does plan on transitioning to a pure-play Appalachia company. Evans told OAG360 in an exclusive interview that Magnum Hunter could potentially divest all of its Bakken assets by the end of the year, bringing in an additional $400 million of asset sales at its midpoint. More than $200 million in the area has already been sold to date. “That will completely change up our balance sheet and we think that’s the right move at this time in our life cycle,” said Evans.

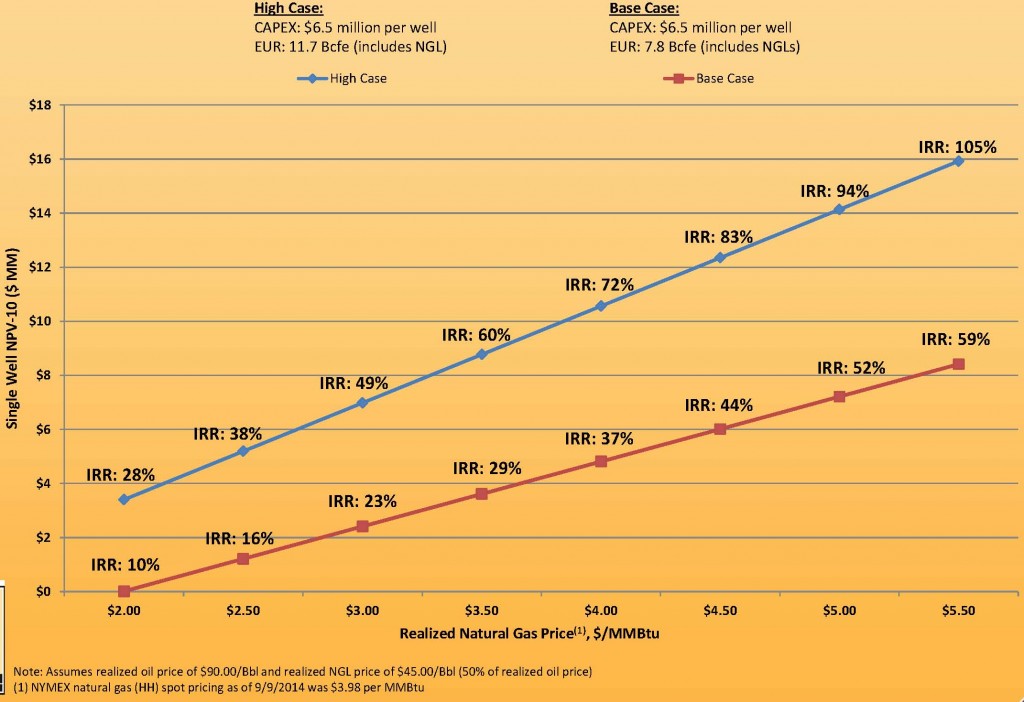

Source: MHR October Presentation

MHR announced production rates of 19 MBOEPD in August, but has not provided an pro forma update with any of its new wells. The current production rate, in relation to enterprise value of $2,352 million, yields a rate of $123,789/flowing BOEPD. If production hits the forecasted year-end 2014 volume of 32.5 MBOEPD, multiples imply the company’s value would increase to $4,023 million (not accounting for increase in debt).

MHR Operational Update

Magnum Hunter Resources further proved the value of its acreage in a news release on October 22, 2014. The Stewart Winland 1300U was completed as a four-well pad, with the other three wells targeting the Marcellus. The Marcellus wells ranged in depth from 6,147 feet to 6,155 feet, received 27 to 29 hydraulic fracture stages and included horizontal laterals ranging from 5,676 feet to 5,762 feet. The wells tested at peak rates ranging from 16.8 to 17.1 MMcfe/d on adjustable chokes.

Total results from the Stewart Winland pad combined for a flow of 97.4 MMcfe/d, the company’s highest production test rates to date. Evans said the results are a “testimony to the quality of the rock underlying the company’s lease acreage.” Evans told OAG360 that he believes MHR’s acreage is in the core of the Marcellus/Utica and the rates of return are two to three times greater than the company’s returns in the Bakken.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom, Inc. has a long-only position in Magnum Hunter.