CVX Expects Spending to Wind Down through 2018

The oil and gas industry is not expecting Q4’15 earnings season to be pretty, but not many expected Chevron (ticker: CVX, chevron.com), one of the world’s largest integrated oil companies, to post a loss of $558 million.

Typically, integrated companies are somewhat shielded from commodity downturns, as the profits increase in the downstream sector to offset losses from the upstream side. Chevron had previously credited its downstream division to generating positive returns, such as Q2’15, when downstream revenue more than quadrupled on a year-over-year basis.

But this quarter was different. In an earnings release issued on January 29, 2016, Chevron’s profit streak of 52 consecutive quarters ended. The last time, Chevron posted a quarterly loss (back in 2002), the Houston Texans had not played an NFL game and stamps cost $0.37 apiece. The company still reported earnings in excess of $4.5 billion for fiscal 2015, but the year-over-year earnings fell by more than a staggering 75%.

“Despite the strong operating results, an oversupplied market led to prices fall to levels not seen since 2014,” said John Watson, Chairman and Chief Executive Officer of Chevron, in a conference call following the release. “As expected, our financial results suffered. Across the corporation, we are responding to this low-price environment.”

Maintains Dividend Priority

Plans may be changing within the corporation, but one element will remain untouched.

Chevron has repeatedly pledged to keep its dividend intact, saying the incentive is its “top priority.” However, maintaining the dividend that may involve some additional cost cutting on the expenditure side. “They are one of the few companies with the credit rating and the balance sheet to tolerate these prices for the short term and still pay a dividend,” said Brian Youngberg, analyst at Edward Jones & Co., in an interview with Bloomberg.

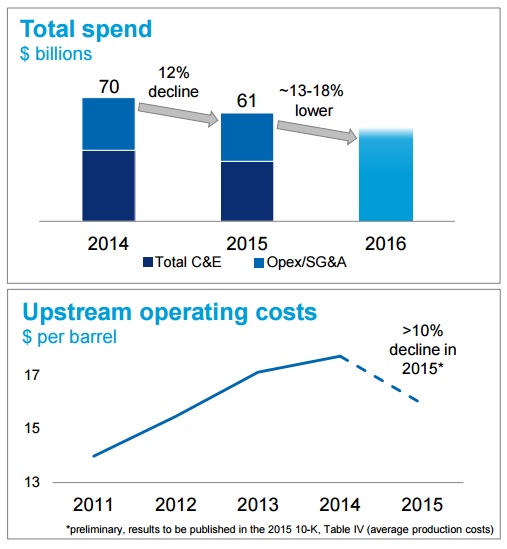

Chevron itself acknowledges that issue, and projects 2016 spending to decline by 24% to $26.6 billion. An additional $4 billion is projected to be saved once its Angola, Gorgon and Wheatstone projects are complete ($2 billion down from $6 billion).

“Since the [announcement of our 2016 guidance], market conditions have deteriorated and we will be responsive,” said Watson. “Flexibility in our capital program allows discretion in our spend with a likely outcome for 2016 being near the bottom of our guidance range. Looking beyond 2016, our flexibility will continue to increase and we expect further reductions in our capital program.”

Chevron speculates cutting approximately 20% in capex for 2017 and 2018, but analysts like Roger Read of Wells Fargo Securities believes more pullback is required. “At this spending level, we forecast a 2016-17 organic FCF deficit (after the divi[dend]) of $13bn and $5bn, respectively, assuming the current futures strip,” he said in a note to clients, adding the deficit follows 2015’s free cash flow shortfall of $17.7 billion.

William Featherston, Managing Director of UBS, had the same projections in his forecast. Chevron, on the other hand, told investors and analysts that cash costs will naturally fall in the near-term due to the finalizing of some massive projects, like the $54 billion Gorgon LNG venture in Australia. “However, we’d note CVX’s actual growth will depend on asset sales (not included in guidance), PSC effects, project ramp-up timing, & Partitioned Zone restart (we assume a 2017 re-start and 70 MBoed contribution),” said Featherston in his note.

William Featherston, Managing Director of UBS, had the same projections in his forecast. Chevron, on the other hand, told investors and analysts that cash costs will naturally fall in the near-term due to the finalizing of some massive projects, like the $54 billion Gorgon LNG venture in Australia. “However, we’d note CVX’s actual growth will depend on asset sales (not included in guidance), PSC effects, project ramp-up timing, & Partitioned Zone restart (we assume a 2017 re-start and 70 MBoed contribution),” said Featherston in his note.

CVX management intends on selling $5 to $10 billion in assets by year-end 2017.

How will the Banks React?

When asked if Chevron may be in line for a downgrade, Patricia Yarrington, Vice President and Chief Financial Officer of Chevron, implied a change was likely. “The rating agencies have conservative oil price scenarios out there and I think that’s understandable… If a downgrade does occur, and I think they’re moving in that direction, we would not be the only one that that would happen to,” she said, adding that the company’s balance sheet and low debt profile (20% debt ratio) should be taken into consideration. “I don’t see [a downgrade] materially impacting our cost of funds or materially impacting our ability to secure financing.”