Size and timing of production rollover will depend on OPEC output

The Canadian Imperial Bank of Commerce (CIBC) released its Oil View today, making some changes to its price forecasts from its previous release in August. CIBC’s new call on WTI for 2015/2016 is $51.75/$61.25, down from $54.00/$62.50 in its previous report. CIBC also lowered its price forecast for European crude benchmark Brent to $57.25/$67.25 from $61.00/$70.50 for this year and next, respectively.

CIBC said the purpose of the revisions was “mainly narrowing our forecasted WTI-Brent spread, reflecting that U.S. oil production has slowed faster than we were expecting, but other non-OPEC production has been more resilient so far.” CIBC views the current WTI-Brent spread of $2.60 as unsustainably narrow, “particularly in light of the fact that stock builds have been so disproportionate in the U.S. relative to other regions.”

In its report, CIBC sees the market moving from a surplus to a deficit sometime in 2016, a movement that should be accompanied by draws on crude oil storage. Yesterday, the Department of Energy released data showing a build of 2.85 MMBO to crude oil inventories, bringing the total to 482.8 MMBO in storage, well above the five-year historical average.

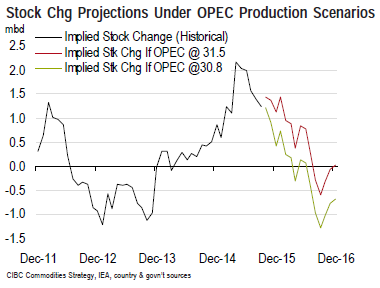

CIBC included two scenarios in its report, one which assumed OPEC crude production of 30.8 MMBOPD from now through the end of 2016, and a second which assumed OPEC production of 31.5 MMBOPD over the same time period. The lower production case is below what the group produces now, but is in line with average OPEC production over the last 12 months. The second scenario reflects the likelihood of Iranian production returning to the market.

In the lower production model, CIBC anticipates that crude oil stocks would start to see draws in June-July averaging 500 MBOPD through the end of 2016. In the scenario that includes Iran’s likely production, draws would be delayed for an additional one to two months, and average just 200 MBOPD for 2016.

CIBC expects the draws to come as production continues to taper off in non-OPEC countries. In the U.S., CIBC believes that the majority of the high-grading possible through increased efficiencies has already taken place, with production from U.S. producers slowing down through 2016, continuing a trend seen already in the U.S.

Despite the slowing production from the U.S., CIBC said that it is surprising that there has yet to be any sort of industry-wide liquidity crunch on the scale that could be expected a year into a price rout. “Liquidity from regulated banks is not likely to increase under the circumstances — especially in light of increased federal regulatory scrutiny — but with the exception of certain companies and certain banks, the “crunch” that one might have expected in this price environment has yet to turn dire. Just as important, the capital available from non-regulated entities, like private equity, seems ample,” CIBC said in its report.

David Preng, founder and president of Preng & Associates, told Oil & Gas 360® that private equity was one of the largest differences between today’s downturn and the one seen in the 1980’s.

David Preng, founder and president of Preng & Associates, told Oil & Gas 360® that private equity was one of the largest differences between today’s downturn and the one seen in the 1980’s.

The difference between 1986-‘87 and today, there was no private equity back then,” Preng said. “Today there is $80+ billion in unlevered cash sitting in private equity’s coffers looking to be invested. Right now, we’re working for three different PE groups who’ve asked us to find leadership teams.”