Looking at Increasing Drilling and Completions in 2015 and 2016

Cimarex Energy (ticker: XEC) is offering six million shares of common stock at a price of $109 per share, the company announced on May 20, 2015. Including the greenshoe offering of 0.9 million shares, Cimarex will generate total proceeds of $752.1 million, not including underwriting fees.

According to the company release, “Net proceeds from the offering are expected to be used for general corporate purposes and to fund increased drilling and completion activity in the second half of 2015 and more significantly in 2016.”

The offering is expected to close on or about May 26, 2015.

A Puzzling Move

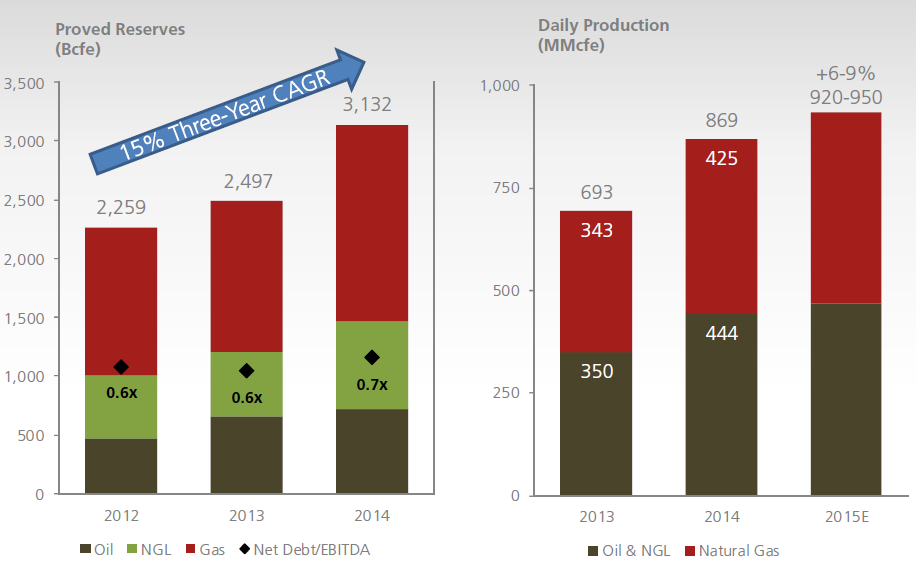

Considering XEC is equipped with a very solid balance sheet (15% debt to market cap) and stable cash flows (its net debt to trailing 12 month EBITDA is 1.1x), the announcement was generally unexpected by the market.

“We’re a bit surprised to see XEC pull the trigger on an equity deal,” said a note from Global Hunter Securities.

Raymond James Equity Research raised eyebrows as to what is on the horizon, saying the offering “gives rise to the temptation to speculate on potential acquisitions; whether this would be of a whole company or just assets is another question. “

Placing any acquisitions aside, analyst firms outlined potential plans for the extra cash in regards to ramping up drilling activity. Stifel believes XEC will add three rigs in late 2015 and outproduce its production guidance by 0.5%, leading to year-over-year production growth of 12%. With the extra capital in tow, Stifel believes the net debt to trailing 12 month EBITDA multiple will drop to 0.6x – well below the median of 2.4x in 88 companies listed in EnerCom’s E&P Benchmarking Report.

Another possibility: XEC is currently unhedged, leaving it completely exposed to commodity swings. The belief of accelerating activity in late 2015 could serve as a vote of confidence to the oil price recovery. Global Hunter Securities complimented Cimarex’s assets, saying “With more than 50% project IRRs in both the Mid-Continent and Permian we endorse management’s decision to accelerate activity as it’s clearly justified, in our opinion.”

Cimarex Position

The equity raise will more than fund the company’s cost of its 2015 drilling and completion program, which was slated at about $685 million. Total 2015 guidance is in the range of $900 to $1,100 million.

Since the raise was met with surprise from the market, questions regarding the company’s balance sheet were few and far between in a conference call addressing its Q1’15 results. Thomas Jorden, Chief Executive Officer of Cimarex, was imperative that the company would leave 2015 within cash flow and had no intention of adding debt. “We view debt as a long-term commitment and we’re hesitant to make long-term commitments in this volatile environment,” he said.

XEC management was conservative in its approach and had at least guided to making additional plans following the OPEC meeting in June, based on if cuts were on the horizon. “We’d like to…at least get some kind of a directional confirmation of oil prices,” Jorden added.

“Every increase is a big positive to our cash flow and our outlook. So, we’ve said in the past that our current capital program is a snapshot in time and we’ll be reevaluating that come midsummer and make our best determination. We are absolutely getting ready to accelerate, if indeed it’s prudent.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.