A boost for clean coal from the Trump administration, more expensive natural gas, or both – what’s coming coal’s way in 2017?

A few minutes after President Trump’s inauguration last Friday, the White House posted a memo that outlined the new president’s intentions as to the direction his administration would take regarding energy policy. The new administration’s energy memo called for lifting climate-driven restrictions, developing $50 trillion in oil and gas resources, opening up federal lands and developing clean coal.

That White House memo was in stark contrast to the policies of the departing president who had declared early on that he intended to bankrupt the coal industry.

During the fall run-up to the election, a story in The Daily Caller recapped President Obama’s efforts as follows: “A 2015 study found the coal industry lost 50,000 jobs from 2008 to 2012 during Obama’s first term. During Obama’s second term, the industry employment in coal mining has fallen by another 33,300 jobs, 10,900 of which occurred in the last year alone, according to federal data. … Much of the blame for the job losses is targeted at federal regulations aimed at preventing global warming, which caused coal power plants to go bankrupt, resulting in a sharp decline in the price of coal.”

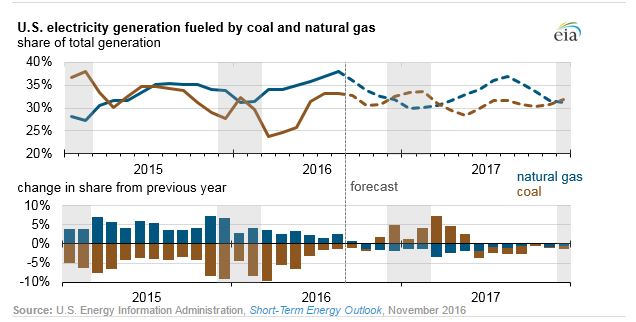

EIA sees coal possibly topping gas again.

There is pushback from energy analysts to that theory, however. Most support the idea that cheap natural gas as fuel for electricity generation combined with the advent of affordable, highly efficient twin-turbine natural gas power plants that emit about half the carbon dioxide of coal-burning power plants had as much to do with coal’s demise as federal climate and emissions policies (the CPP and MATS). Regardless, it’s fair to say that eight years’ worth of anti-coal policy and anti-coal government regulations initiated a knockout punch for coal while the advent of economic shale gas provided the follow through by delivering big supplies of natural gas and lower gas prices.

Last Friday’s White House memo said that “the Trump Administration is also committed to clean coal technology, and to reviving America’s coal industry, which has been hurting for too long.” The question from many sources today, though, asks if the new administration can actually reverse the fate of coal or will attempts to do so make it worse?

The Institute for Energy Economics and Financial Analysis quoted analysts telling their clients that “Donald Trump will not be able to revive the U.S. coal industry absent a sharp spike in natural gas prices, as he loosens environmental regulations on oil and gas pipelines.

“Trump’s plan to loosen environmental regulations and speed pipeline permitting will hasten the demise of coal for power generation, Sanford C. Bernstein & Co. LLC midstream analyst Jean Salisbury said.

“Cheap natural gas is the true chief culprit in coal’s decline, and if Trump’s other campaign promises regarding expanding gas infrastructure are to be believed, gas supply may grow even more quickly than it would have under [Hillary] Clinton,” Salisbury said in a Nov. 9 note, according to IEEFA.

Platts senior quantitative analyst Bob Yu said he believes coal will gain some market share in the U.S. power sector in 2017 because of a tempered reversal of coal-to-gas switching, but Yu said renewable energy sources will remain a headwind for both fossil fuels.

Yu said gas demand for power generation will weaken in 2017 with higher natural gas prices.

“A $3.30/MMBtu average price for Henry Hub gas in 2017, above an average of $2.40/MMBtu in 2016, would cut gas power demand by about 2.5 Bcf/d next year,” Platts reported. “ ‘Coal would take some of the generation lost by gas via economic fuel switching, but that shift ‘really isn’t one for one’ between the fuels, … primarily because of renewable sources’ growth,’ Yu said.

“Yu said he sees gas prices rising but said he doesn’t think the Henry Hub price would peak above $4.50/MMBtu. If pricing nears that mark, producers are more “nimble” than in the past and able to add more working rigs rapidly, he said. That ability to put new production online quickly would swiftly add to gas storage and likely push down prices.”

Forbes sourced an SNL Energy report that it was the combination of gas and renewables [that] helped topple coal a decade early, but that “because of higher natural gas prices this winter, coal is ‘showing signs of a slight bounce back’. In fact, EIA expects coal to resume its status as top fuel in 2017,” Forbes said.

“The SNL analysis shows that the U.S. generated 1,348 Gigawatt hours of electricity from natural gas in 2015, compared to 1,326 for coal,” Forbes said. “As it turns out,” writes SNL’s Annalee Grant, “the power industry has significantly reduced coal-fired generation as of 2015, according to data from SNL Energy. That achievement is due, at least in part, to low natural gas prices and increasingly inexpensive renewable generation technologies.”

How natural gas affects coal

A Wall Street Journal story published today reported that natural gas bounced off of lows Monday from “the same type of speculation that had helped make gas one of the market’s biggest gainers of the past year, analysts and a trader said.

“Bargain buyers swooped in as prices fell below $3.15 a million British thermal units for just the third time since the week after Thanksgiving. Many are still betting that demand from power plants and international buyers is growing so quickly that it eventually could expose a supply shortfall caused by last year’s cutbacks from U.S. production companies.

“Prices fell quickly from a two-year high in late December and have settled between about $3.10/mmBtu and $3.40/mmBtu for three weeks. That stretch of calm comes just after a month in which volatility peaked at its highest point in more than a year and prices rose all the way to $4/mmBtu,” the report said.

An EIA report published today said that in 2016, the annual average Henry Hub natural gas price was the lowest since 1999 as a result of a very mild winter that left natural gas inventories at a record high for the end of March. However, high natural gas use for electricity generation during the summer and declining production contributed to Henry Hub natural gas prices rising from an average of $2.00/MMBtu in the first quarter of 2016 to an average of $2.88/MMBtu in the third quarter of 2016.

“Cold weather across much of the northern United States in mid-December led to an increase in demand for space heating (much of which is provided by natural gas), contributing to natural gas inventories ending the month below the five-year average. As a result, Henry Hub spot prices increased to a monthly average of $3.59/MMBtu in December, the first month in which prices averaged above $3.00/MMBtu since December 2014.

“In 2017, Henry Hub prices are expected to remain near the levels in December 2016, leaving annual average prices in 2017 higher than those in 2016. Prices are expected to be higher again in 2018. The higher prices are the result of forecasted consumption and exports exceeding forecasted production and imports, which implies that the difference will be supplied from inventories.” The agency warned of disparity in weather forecasting affecting its gas demand and pricing predictions.

So what exactly comprises “clean coal technology” and, apart from the forces of supply and demand pushing up the price of natural gas relative to coal, what administration policies would bring back coal demand and reverse the loss of coal mining jobs? Oil & Gas 360© will look at clean coal and possible administration actions to boost the coal industry in part two of the story.