ConocoPhillips announces delivery of first oil at Surmont 2

ConocoPhillips (ticker: COP) announced today that it had produced first oil from its Surmont 2 oil sands facility, located in Alberta, Canada. Construction on the project, which is the largest single-phase steam-assisted gravity drainage (SAGD) project ever undertaken, began in 2010.

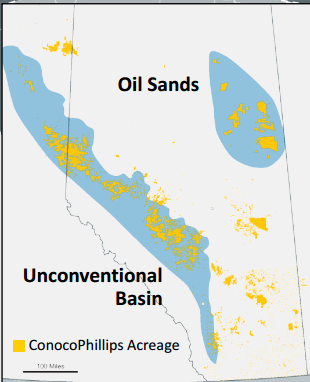

The Surmont project is located in the Athabasca Region of northeastern Alberta, approximately 35 miles southeast of Fort McMurray. Surmont is operated by COP under a 50/50 joint venture agreement with Total E&P Canada (ticker: TOT).

Production at Surmont 2 will ramp up through 2017, adding approximately 118 MBOPD gross capacity. Total gross capacity for both Surmont 1 and 2 is expected to reach 150 MBOPD, according to a COP press release.

“The oil sands are an important part of our portfolio,” said Ryan Lance, chairman and CEO. “We’re pleased to see a magnitude move from the capital phase to the production phase, knowing that it will produce for decades to come.”

Long-life production

Many oil sands projects have continued developing despite the drastic drop in oil prices over the last year. The capital intensive process of developing an oil sands project, combined with their long production life, has kept them off the chopping block for companies looking to lower capital expenditures.

According to ConocoPhillips’ investor presentation, the company expects the project to have greater than 30 years of flat production, working out to approximately $20 per BOE full-cycle F&D costs.

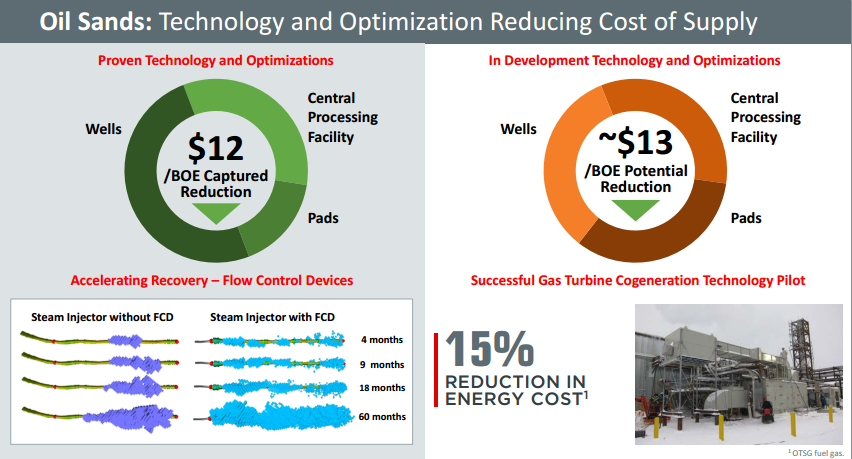

COP’s main focus with its oil sands projects has been the reduction of costs, according to the company. The company has already realized a $12 per BOE reduction in production costs, and is targeting an additional $13 per BOE in savings through lowering costs at the well, pads and central processing facility.