ConocoPhillips: we can manage cycles without chasing them

ConocoPhillips (ticker: COP) held an analyst and investor meeting Thursday outlining the company’s goals moving into 2017 and beyond. COP – the 13th largest oil and gas company in the world by enterprise value – is now gearing its business to manage the cyclicality of oil and gas without chasing trends in the market, the company indicated in its presentation today.

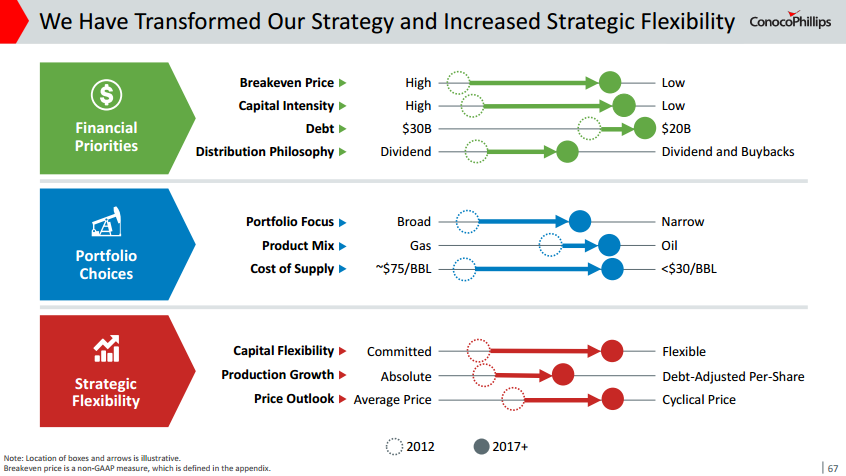

The strategies the company intends to pursue to that end include lowering its breakeven price to $50 per barrel Brent or lower, reducing debt to $20 billion, and divesting $8 billion in natural gas assets as the company focuses on oily assets.

“During the past two years, we have significantly transformed ConocoPhillips to succeed in a lower, more volatile price environment. We’ve lowered the capital intensity and breakeven price of the company, lowered the cost of supply of our investment portfolio, and created strategic flexibility for future price cycles,” said Ryan Lance, chairman and chief executive officer, in a press release Thursday.

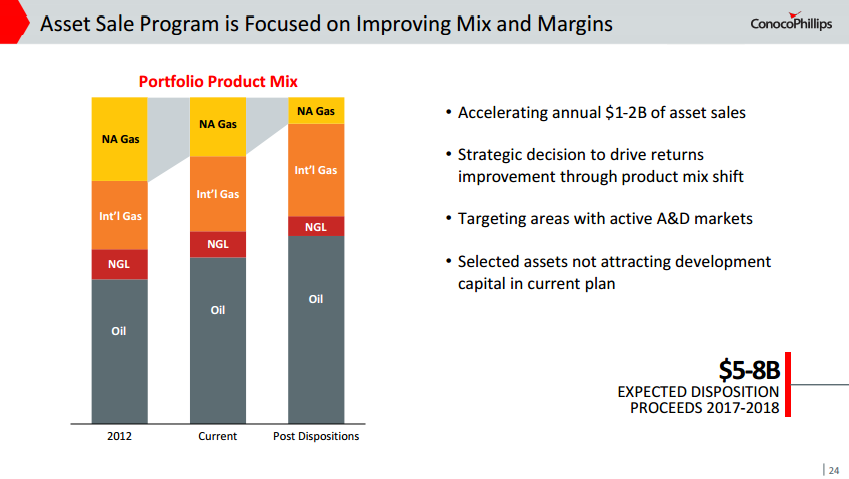

ConocoPhillips narrows focus – targets $5-$8 billion in natural gas asset sales in 2017 and 2018

A major focus for the company as it looks to build a “disciplined and resilient, yet flexible” business is to pay down the company’s debt from $27 billion now to approximately $20 billion at year-end 2019. In order to achieve that goal, ConocoPhillips is narrowing its asset base and divesting primarily North American natural gas assets. COP is looking to sell $5-$8 billion from 2017-2018, continuing a pattern of increasing the amount of oily assets in its portfolio.

The size of the divestiture is impressive. Chesapeake Energy Corp. (ticker: CHK), the second-largest U.S. natural gas producer, has a market cap of $4.69 billion, putting its entire business below the low-end of Conoco’s planned divestitures.

Capital will target low-decline conventional assets, but unconventionals will lead production

As ConocoPhillips moves toward more oil production, the company expects to deploy the majority of its capital into conventional assets, a somewhat unusual strategy given the prominence of hydraulic fracturing in recent years. COP’s 2017 capital budget guidance is set at $5 billion, down 4% from 2016 and more than 50% below 2015 capex, with the majority of the budget going toward low-risk, low-decline assets.

The company believes it needs approximately $4.5 billion for flat production, with $3 billion of that targeting conventional projects in Europe, Asia Pacific and Alaska.

ConocoPhillips plans to spend approximately $600 million on exploration, which the company said will be used primarily on unconventionals, appraisal of the Barossa discovery, and closeout of deepwater Gulf of Mexico and Nova Scotia drilling obligations.

The company expects flat to 2% growth in 2017 compared to 2016, including production guidance of 1.56 MMBOPD at its midpoint.

“Growth is expected to come primarily from ramp up at APLNG in Australia, Surmont 2 in Canada and Kebabangan in Malaysia, as well as increased activity in the Lower 48 unconventionals, partly offset by normal field decline. The company’s production outlook excludes Libya,” it said in its press release.

ConocoPhillips believes that this plan will offer the company the flexibility to maintain production while stilling increasing the payout to its shareholders in a $50 Brent scenario. The upside of course is that when prices recover beyond that point, COP will have an even greater ability to grow.