New tech requires fewer unplanned shutdowns, allowing for more production

Carigali-PTTEPI Operating Company (CPOC) announced this week that new chemical treatment and cooling technology that was installed on its

development platform in the Gulf of Thailand saved the company approximately $52 million per year. The tech, which was provided by General Electric (ticker: GE), reduced chemical consumption by 9.5 tons and decreased shutdown time and production loss, according to a press release.

“Our Muda Field platform was losing a significant amount of money per year due to unplanned shutdowns,” said Shahzada M. Nisar, head of operations for CPOC.

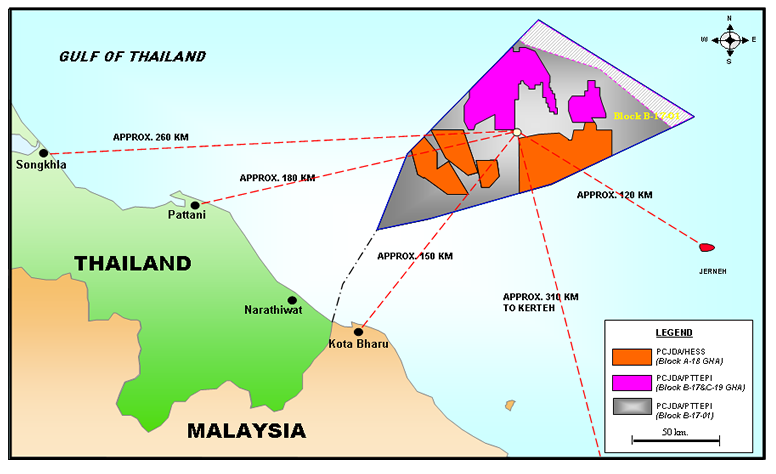

CPOC’s platform in the Muda Field is located approximately 150 km (93 miles) northeast of Kota Bharu in Malaysia, 250 km (155 miles) east of the Songkhla province in Thailand, in about 55-65 meters (180-213 feet) of water. It was using a cooling medium to cool off gas from compressors for gas processing and gas export, but the system failed to run as designed and was shut down frequently for maintenance.

The platform is capable of producing 269 MMsf/d, or gross production of worth $8.7 million per day, according to the company. On average, the facility was shut down for six unplanned days per year for cleaning, says CPOC, resulting in $52.2 million of lost production.