Crescent Point will maintain dividend despite 28% CapEx cut

Two companies this week, Crescent Point Energy Corp. (ticker: CPG) and Concho Resources Inc. (ticker: CXO), released forward looking statements projecting increased production in 2015, regardless of commodity prices.

Crescent Point, which is based in Calgary, Alberta, said in its announcement that the company has set a capital expenditures budget of $1.45 billion for 2015. With that budget, CPG expects to generate average daily production of 152.5 MBOEPD, a 9% increase over 2014 guidance.

For 2015, the company expects to spend $1.27 billion(88%) of the budget on drilling and completions, including the drilling of 616 net wells. The remaining $180 million of the budget is expected to be allocated to investments in infrastructure, undeveloped land and seismic across all the company’s core areas.

Of the 88% of the 2015 budget being spent on drilling and completions, the main focus (30%) will be on CPG’s Viewfield assets, according to the company’s investor presentation. After Viewfield, Shaunavon will be receiving 21% of the budget, followed by Flat Lake with 13% and Uinta with 10%. The remaining 26% will be spent on the company’s other various assets.

The 2015 budget represents a 28% decrease from the company’s 2014 capital expenditure budget, which was set at $1.75 billion. CPG says it lowered its capital expenditures for 2015 in order to protect its dividend and balance sheet, and to remain flexible in the face of low oil prices. The annualized dividend of $2.76 per share will go untouched despite the reduced expenditures – a testament to CPG’s balance sheet.

The company has one of the best positions among its peers in EnerCom’s International E&P Weekly, which includes 25 Canadian companies in addition to CPG. Crescent Point’s enterprise value is the second highest in the peer group at $14.73 billion while its debt to market cap of 21% sits well below the peer group average of 62%. Crescent Point also has a significantly lower asset intensity of only 46%, compared to the group average of 91%.

This low asset intensity means that the company only has to spend 46% of its profits to maintain production. CPG’s low asset intensity, when combined with the relatively low breakeven in most of the company’s plays, gives it more flexibility in the current lower price environment.

The company says that it maintains a number of levers to protect its balance sheet and dividend, even if lower oil prices persist throughout the year, including:

- Inventory depth

- Flexibility to further reduce capital expenditures in the second half of the year; and

- The option to shift more capital to its re-frac inventory.

Scott Saxberg, the company’s president and CEO, also said that the company is using its hedges to help maintain its strong position. “We have increased our 2015 oil hedges to greater than 50% at prices averaging above CDN$90 (about USD$76) per barrel,” he said. In its press release, CPG said 53% of its natural gas production is hedged at an average price of CDN$3.60/GJ (USD$3.05/GJ). Crescent Point’s oil and natural gas hedges are in place until mid-2017 and early 2018, respectively.

The company said it expects to increase capital spending if oil prices rebound.

Down in Texas, Concho pursues a similar strategy

Concho Resources, a Texas-based E&P company announced a revised 2015 capital expenditure budget after releasing an initial capital budget for 2015 with its Q3’14 filings. CXO revised its budget for next year down to $2 billion from $3 billion, representing a 33% cut.

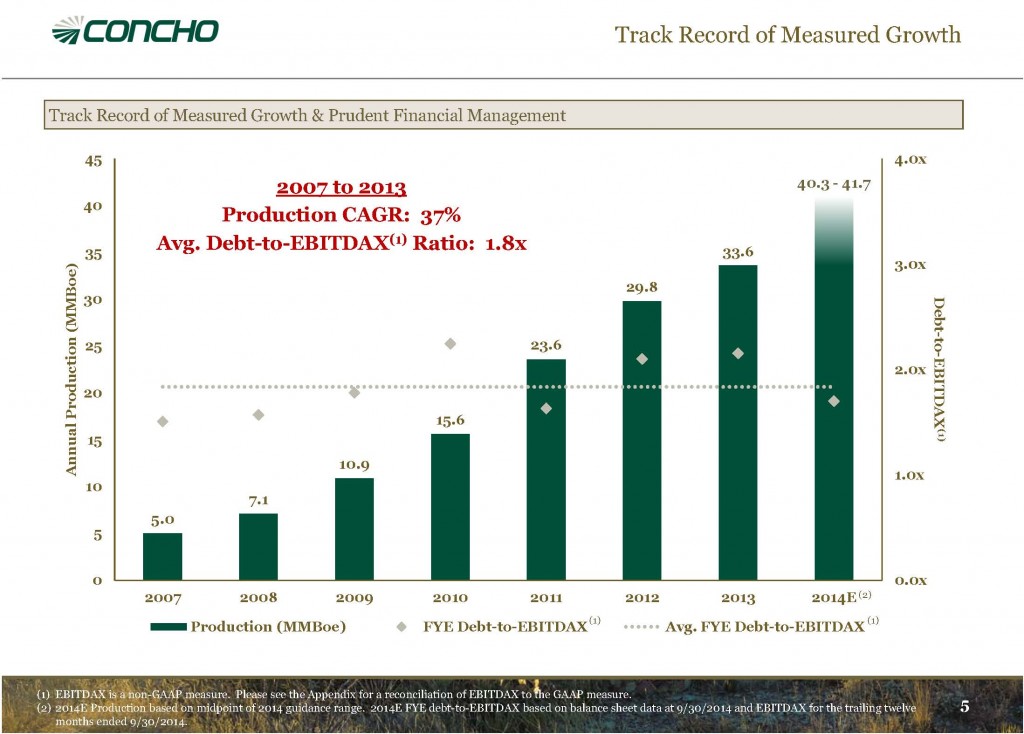

Despite this significant drop in capital expenditures for next year, Concho still expects to see substantially increased production. In its announcement about it revised 2015 budget, Concho says it expects to generate 16% to 20% year-over-year production growth in 2015, continuing its pattern of increasing production year-over-year. In its Q3’14 earnings release, CXO was expecting average 2014 production of approximately 112 MBOEPD based on Q4’14 guidance rates.

The company’s 2015 capital program includes approximately $1.8 billion for drilling and completion activities and $200 million for facilities, midstream and other capital. Concho expects to allocate $1.3 billion for drilling and completions in the Delaware Basin, $300 million in the Texas Permian and another $200 million in the New Mexico Shelf.

Concho is currently running 36 drilling rigs and expects to average approximately 30 rigs in the first quarter of 2015 and approximately 25 rigs beginning in Q2’15 through year end.

Tim Leach, Chairman, CEO and President of CXO commented, “Reducing the capital program while delivering growth reflects our commitment to a strong balance sheet. In the current environment, we intended to retain significant flexibility to scale our activity level up or down depending on service costs and commodity prices.”

Based off EnerCom’s E&P Weekly, Concho’s asset intensity is only 47%, much lower than the group average of 106%. The company also boasts a slightly higher than average trailing twelve month capital efficiency of 226%.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

BMO Capital Markets Group:

2015 Budget Ramps Down; Disciplined on Growth

Event

Concho announced updated production and capital spending guidance for 2015 (it had indicated lower activity on its 3Q call beginning in 1Q15 if oil prices remained weak), in which production growth is expected to be 16-20% (vs. 28-32%) with capex of $2Bn (vs. $3Bn). While this is a meaningful cut to growth, the updated budget does imply a modest improvement in capital efficiency ($38,000 per Boe/d vs. $45,000 per Boe/d), which we think is more due to high-grading than assumed service cost reductions (new presentation showed historical well costs in IRRs). While total capex was reduced by one-third, the Delaware Basin saw only a 25% cut, while the Midland and New Mexico Shelf were reduced by 50%. Rig count is expected to drop from 36 currently to 25 by midyear, a level which will be held through year-end 2015. No substantial changes were made to the hedge portfolio in the updated presentation, while nat gas realizations are expected to be weaker on lower NGL prices. Current income taxes are now expected to be $40-50mm (vs. 15-25% of total), which appears high, although it’s unclear what price deck is assumed or how much of a lag is involved.

Impact & Analysis

Similar to other oily peers, we estimate Concho plans to reduce capex to maintenance levels, and this should result in flat Q/Q production in 2H15 with ~$100mm per quarter CF outspending at NYMEX. For the full year, we estimate a manageable ~$600mm of CF outspending and debt/EBITDAX at 2.4x by year-end 2015 (NYMEX). Assuming a flat ($2Bn) budget in 2016 (where the bigger reduction in our estimates was), we estimate production growth of 7% on ~$500mm CF outspending and leverage at 2.6x by year-end (NYMEX). While leverage is above historical averages, we expect it to remain stable in 2016+, with Concho able to deliver good growth near cash flow at the strip, in addition to remaining one of the best-positioned E&Ps to accelerate if prices improve.

Valuation & Recommendation

We rate Concho shares Outperform with a $100 target price.