Devon Energy divests $1 billion in non-core assets with potentially another $1 billion on the way with the sale of its Access Pipeline interest

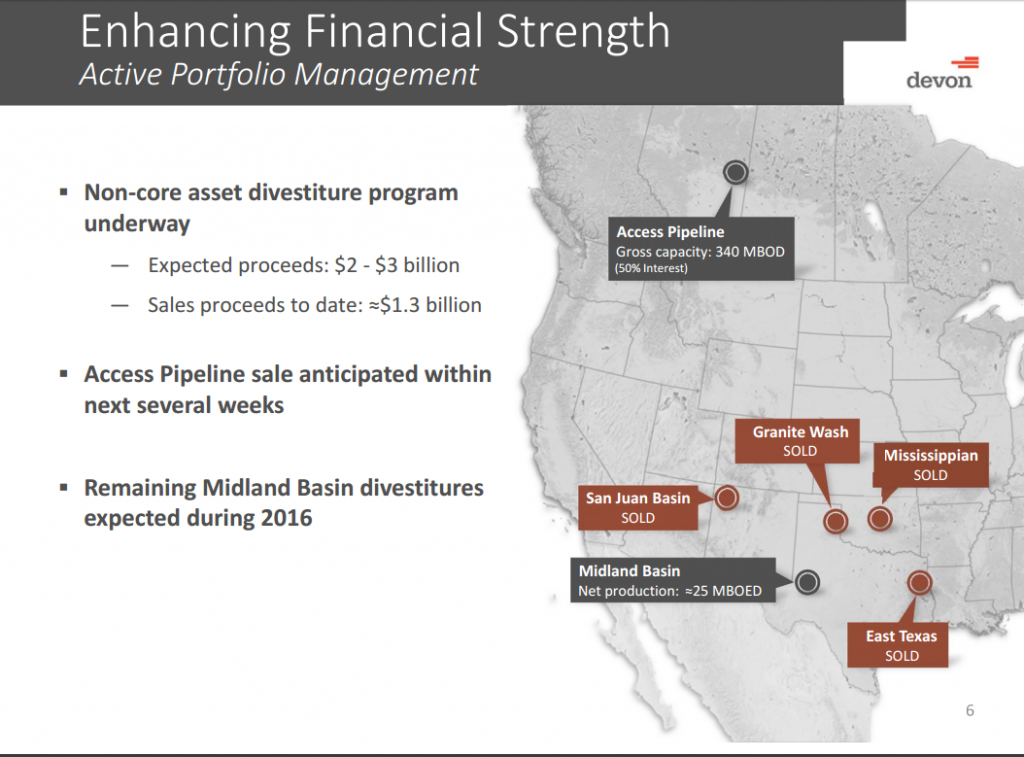

Devon Energy (ticker: DVN) announced roughly $1 billion in asset sales today as the company works towards a goal of $2-$3 billion in total divestitures this year. The sale included producing assets in East Texas, the Anadarko Basin Granite Wash, and an overriding royalty interest in the northern Midland Basin, according to the company’s press release.

Devon’s East Texas assets, which sold to an unnamed buyer, consisted of 22 MBOEPD (70% gas, 25% NGLs, 5% oil), and sold for $525 million, meaning DVN received $23,864 on a flowing BOE basis. The Anadarko Basin assets, which sold for $310 million, included 14 MBOEPD of production (50% gas, 37% NGLs, 13% oil), working out to $22,143 per flowing BOE. The overriding royalty interest in the Midland sold for $139 million, covering roughly 11,000 net acres.

First quarter cash flow from the properties was around $16 million, or $64 million annualized, according to an analysts note from Wells Fargo this morning. The company expects to incur “minimal taxes” with the transaction.

Along with the announced sales today, Devon added in its press release that it continues to market its upstream assets in the Midland Basin, as well as its 50% interest in the Canadian Access Pipeline. A note from KLR Group today estimated Devon will realize roughly $20,000 per acre of undeveloped land in Martin County (about 15,000 acres), and the same per flowing BOE on producing assets in the Midland, equating to net proceeds of $800 million. DVN is “in advanced negotiations” regarding the sale of its interest in Access, and KLR expects the company to announce an additional $1 billion in divestitures from the midstream interest in the coming weeks.

Devon continues working toward $2-$3 billion in divestitures as the company pays down debt

“Combined with other recent asset sales, we have now announced $1.3 billion of gas-focused upstream divestitures,” said DVN President and CEO Dave Hager. “Proceeds from these … transactions will be utilized to further strengthen our investment-grade financial position,” he said in the company’s press release.

Devon’s TTM net debt-to-EBITDA for 2015 of 2.6x is favorable compared to the wider group in EnerCom’s E&P weekly for the week ended May 27, 2016. The group of 74 U.S. E&P companies have a median TTM net debt-to-EBITDA of 3.4x.

KLR Group estimates 2016 net debt pro forma today’s asset sales of 4.5x, compared to 4.9x previously. Wells Fargo’s note expected Devon’s 2017 net debt-to-EBITDAX to be the second-lowest among its large cap peers, suggesting the steps the company is taking to defend its balance sheet will pay off in the future.

Devon intends to use a third of the sale proceeds from today’s divestitures to bolster this year’s capital spending and pay down debt with the rest, Hager said last month. The company would need to make progress on asset sales before considering an increase in production, according to Bloomberg Intelligence analysts.