U.S. weekly crude oil output at 9.6 MMBOPD

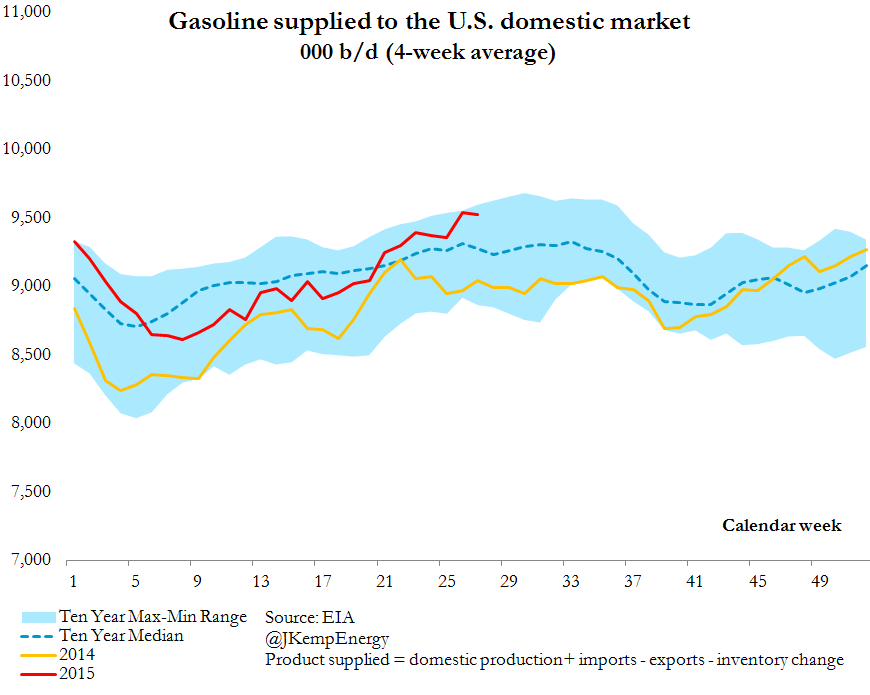

Demand for automotive-grade gasoline (mogas) increased to 9.17 MMBOPD, a year-over-year increase of 7.1%, according to a note from Global Hunter Securities using data from the Energy Information Administration (EIA). Based on GHS’ assessment, this marks some of the highest demand for mogas since 2010, sending more bullish signals to the market.

Consumption is up about 480 MBOPD from this time last year and 250 MBOPD higher than the 10-year seasonal average, according to analysis from John Kemp with Reuters. “Gasoline demand [is roaring] back to life,” says Kemp.

Gasoline consumption peaked in the summer of 2007 at almost 9.7 MMBOPD, according to information from the Energy Information Administration (EIA). But demand could not be sustained as the economic crash and high gas prices sent demand down to 9.2 MMBOPD by the summer of 2009.

“Demand only began growing again in 2013 and 2014 when prices stabilized and the economy started to recover,” says Kemp. “In 2015, demand appears to be accelerating as the expansion matures and fuel prices remain 25% lower than a year ago.”

Data from the U.S. Federal Highway Administration show Americans drove a record 988 billion miles during the first four months of 2015. Motor gasoline consumption, which rose by 80,000 b/d in 2014, will increase by a projected 170,000 b/d (1.9%) in 2015 as the effects of employment growth and lower gasoline prices outweigh increases in vehicle fleet efficiency

Lower prices along with higher rates of road traffic and more demand for larger vehicles continue to push gas consumption higher, according to Kemp’s assessment. Higher demand for gasoline has kept refineries near peak capacity as well.

U.S. refineries are processing about 16.5 MMBOPD of crude oil, 1 MMBOPD higher than seasonal averages, and a level exceeded only briefly in 2014. As refiners continue to produce at a near-record pace, U.S. gasoline stockpiles decline, according to Kemp. Gasoline stockpiles are down 10%, or roughly 25 MMBO, since February, leaving them 4 MMBO over 2014 levels and 5 MMBO above a ten-year average.