Iraq may owe international oil companies compensation for lost production

Less than a week into the new year, many oil market experts are beginning to wonder if OPEC will be able to follow through with its production cuts.

Already Iraq, the group’s second-largest producer, appears to be facing problems in implementing cuts as the cash-strapped country looks to lower output without triggering contractual obligations to pay international oil companies (IOCs), and without the cooperation of the semi-autonomous Kurdistan region.

Iraq agreed to reduce its output by approximately 210 MBOPD as part of the OPEC agreement in November that sent crude oil prices above $50 as markets began to hope for balance. The country has limited options in upholding its end of the bargain, however.

“Of the Middle East producers that agreed to the cuts, it’s probably the one that has the most [international oil company]-operated production,” Jessica Brewer, principal analyst for Middle East and North Africa upstream oil and gas at energy consultancy Wood Mackenzie. “There are a lot more parties involved, which makes it more complex.”

The oil contracts used in Iraq include a provision that requires the government to compensate IOCs when production is cut for reasons beyond the control of the driller. Government-imposed production cuts could trigger those provisions, according to Brewer, putting Iraq in a difficult financial position.

Iraq opposed cutting its own production during initial negotiations among OPEC members, arguing that it needed the funds from oil in order to pay for its war against the Islamic State. Two years of low oil prices and the conflict with IS militants have left the country’s coffers depleted.

Brewer went on to note that there are no indications Iraq, which is OPEC’s second biggest producer, has reached a deal to reduce production with companies such as BP (ticker: BP), ExxonMobil (ticker: XOM), and Royal Dutch Shell (ticker: RDSA) – which is a significant concern because an OPEC compliance panel is meeting in Vienna to assess reductions made by the cartel’s members on January 21.

Kurdistan is unwilling to cooperate with the central government on production cuts

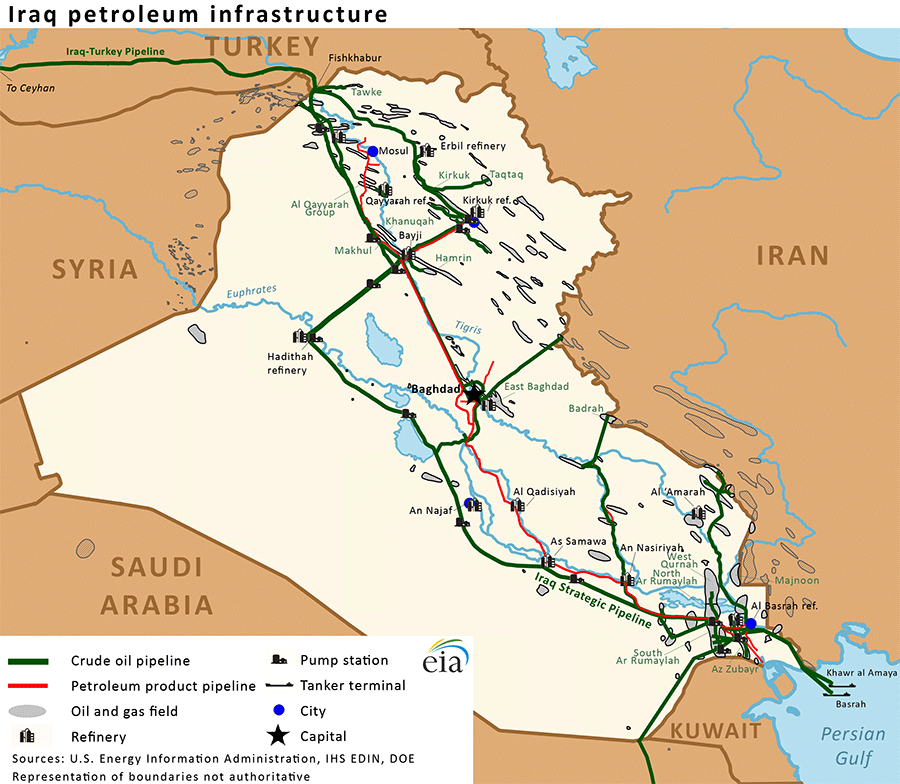

Many of the IOCs operating in Iraq help the country with its southern oil and gas fields, but the OPEC member may not find it any easier to cut production in the north.

The semi-autonomous Kurdistan Regional Government (KRG) took control of the city of Kirkuk after the central government forces failed to defend it from the Islamic State in 2014. The Kurdish government now controls some of the production in the north, and has said that Baghdad will have to shoulder the cuts alone.

“The Kurdistan Region will continue its oil exports as before and has not decided to abide by the OPEC accord to reduce the exportation of oil,” Dilshad Shaaban, deputy head of the energy and natural resources committee in the Kurdistan Parliament, said on December 26, 2016.

Iraq’s prime minister also said Tuesday that the Kurds are exporting more than their share of oil. Under the terms of the 2017 budget, the KRG are allocated 250 MBOPD of exports from fields under their control, which does not included the disputed Kirkuk fields, which Kurdish forces control, but are run by Iraq’s North Oil Company (NOC), reports Reuters.

Iraqi minister affirms Iraq’s commitment to OPEC deal

Despite concerns that Iraq may not be able to cut its production by more than 200 MBOPD, Iraq Oil Minister Jabar Ali al-Luaibi said Thursday that the country still stands behind the OPEC deal.

“Iraq affirms its commitment to the OPEC decision which was taken in the last meeting in Vienna by putting in place a studied plan to reduce production from the country’s fields from the start of the new year,” Luaibi said in a statement.

Luaibi also said his ministry was in discussions with IOCs about implementing cuts in the country’s southern fields during scheduled maintenance.