EarthStone Energy plans to grow production 200% to 400% on acquired Midland assets in 2017

With 2016 in the books and many companies reporting their year-end numbers, markets are beginning to look forward to the year ahead. A stable oil price and greatly improved drilling efficiencies have led many to have a more optimistic attitude about 2017, particularly about companies in the Permian, where low breakeven costs and high EURs have operators excited.

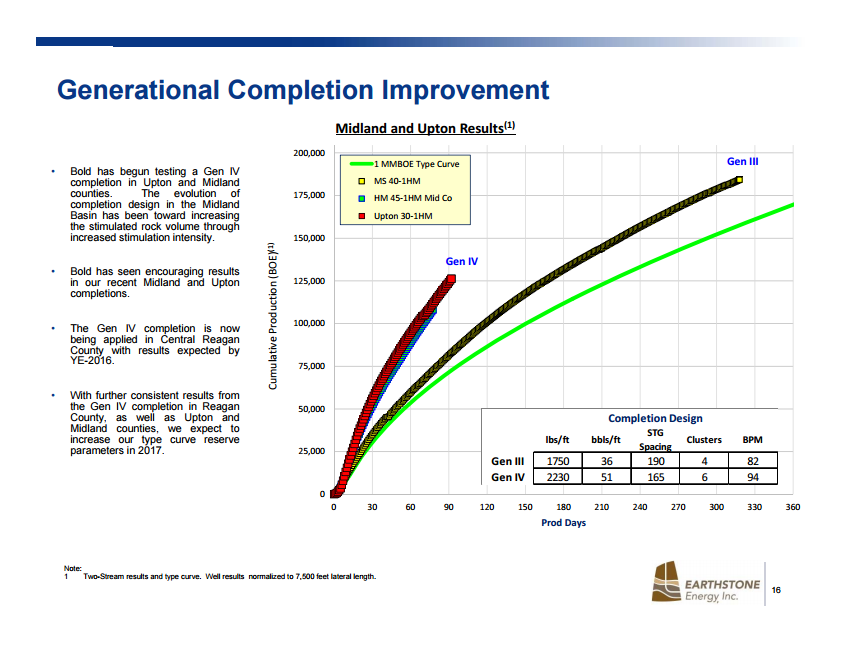

The main focus of the dash to the Permian has been on the Delaware, but opportunities exist throughout the region, including in the nearby Midland basin, where EarthStone Energy (ticker: ESTE) acquired Bold Energy in November, 2016. The deal, which will close later this year, includes 20,900 net surface acres in the core of the Midland, and EarthStone plans to increase production from the assets 200% to 400% over the course of the year, according to a company presentation.

“We’re looking forward to closing on our announced acquisition of Bold Energy in April and becoming a sizable operator in the Permian,” EarthStone President and CEO Frank Lodzinski told Oil & Gas 360®. “You’ll see things getting better and better where Bold was, and we think there’s a lot of opportunity there,” Lodzinski said.

EarthStone plans to run one rig on the acquired Bold assets this year. Two wells are currently flowing back, with one well being completed and six more wells drilled and waiting completion. The company reported year-end production of 2.6 MBOEPD from the Midland acreage it acquired from Bold, and said it plans to reach 7.1 MBOPD with a single rig, and potentially add a second rig, bringing net production to 11.6 MBOEPD by year-end 2017.

Surviving the downturn

The Bold acquisition was a transformational purchase for EarthStone, Lodzinski said, and it took place during one of the most difficult times in the industry in recent memory. The crash in oil prices in 2015 put a major dent in M&A activity as buyers and sellers were unable to agree on a price for assets, and many companies declared bankruptcy.

“This is our fourth public company,” Lodzinski said. “We’ve survived every downturn and gone on to prosper. EarthStone is run by a team that has a heck of a track record.”

EarthStone Energy presenting at EnerCom Dallas

EarthStone will be presenting its story at the Tower Club Downtown Dallas on Wednesday, March 1, as part of EnerCom Dallas, an investor conference which is modeled after EnerCom’s The Oil & Gas Conference® in Denver.

The Dallas conference is designed to offer investment professionals a unique opportunity to listen to a wide variety of oil and gas company senior management teams update investors on their operational and financial strategies and learn how the leading independent energy companies are building value in 2017.

The event also provides energy industry professionals a venue to learn about important energy topics affecting the global oil and gas industry. The forum offers healthy dialogue and informal networking opportunities for attendees.

To sign up for EnerCom Dallas and hear Raging River present, or to find out more information about presenting companies at EnerCom Dallas, click here to visit the conference website.