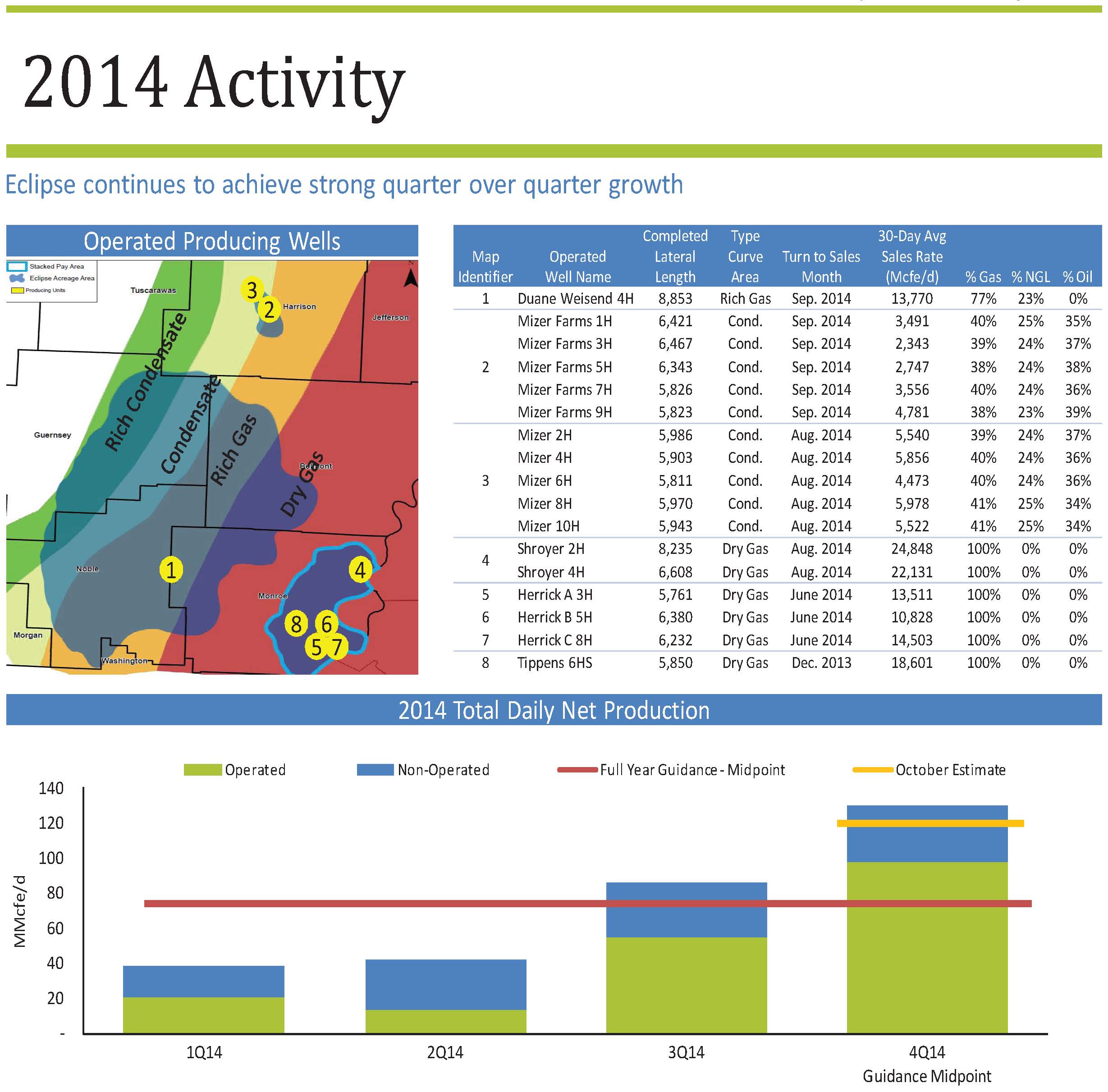

Eclipse Resources (ticker: ECR) provided an operational update on its recent production and drilling activities. From September 30 (the end of the third quarter 2014) to November 30th, the company brought six new operated wells online in the Condensate type curve area of its Utica Shale acreage. Initial results from the wells, using the company’s restricted choke methodology, are in-line with the company’s type curve expectations. Reported production from ten other wells drilled in the condensate window averaged a 30-day sales rate of 4,428 Mcfe/d, with lateral lengths ranging from 5,811 to 6,467 feet.

Eclipse’s initial production estimate for the month of November 2014 was approximately 130 MMcfe/d, representing a 52% increase over its average daily production in Q3’14. Current production is estimated at approximately 148 MMcfe/d, representing 72% increase from its average daily production in Q3’14.

Commenting on the update, Benjamin Hulburt, Chairman and Chief Executive Officer, said, “Eclipse is continuing to methodically execute on our plan. Our team is efficiently developing our acreage and meeting our timeline, cost and production objectives. We continue to be pleased with the initial performance of our liquids/condensate type area wells using our restricted choke production method, and we are very encouraged with our Utica dry gas acreage where we are continuing to monitor the long term performance of our two Shroyer wells that continue to produce at a combined rate of approximately 41 MMcf/d after 100 days online. During the month of December, we expect to bring an additional five net wells online and continue to believe our average daily production in the fourth quarter will trend towards the high end of our previously issued guidance. As we look forward to 2015, given our acreage position spanning across both the core liquids and core dry gas areas of the Utica play, I believe we are in a unique position to adjust our drilling plans to maximize returns in this volatile commodity price environment.”

In the company’s Q3’14 report, Mr. Hulburt said, “Eclipse Resources has now drilled 51 operated wells to total depth. Since spudding our first operated Utica well, we have reduced our drilling times from an average of 49 days per well for our first 10 wells, to an average of just 16 days per well for our last 30 wells. Additionally, since commencing our operated drilling and completion program, we have reduced the total drilling and completion cost per foot of lateral from an average of approximately $2,400 per foot for our first 10 wells, to an average of approximately $1,640 per foot for our last 30 wells despite testing tighter stage completions than originally planned on these wells. We plan to continue to constantly work to optimize our drilling and completion methods and believe we can continue to reduce costs even further in the coming year.”

The company also said in its Q3’14 release that as of September 30, 2014, total net proved reserves increased by 32% during the quarter to 245.5 Bcfe, of which approximately 75% were natural gas, 14% were NGL and 11% was oil.

In an interview with Oil & Gas 360® at The Oil & Gas Conference™ 19, Mr. Hulburt said Eclipse was on track to drill 100 or more wells in the second half of 2014, and “is looking to double that pace in 2015.” He also said the projected compound annual production growth rate would be greater than 200% over the next three years.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.